Buying cheap trusts on a bigger discount than normal can be a lucrative way to make money over the long-term. Similarly selling trusts that have been bid up can help avoid losses if they eventually downgrade again.

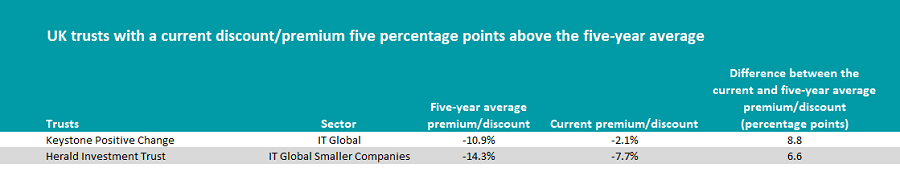

As such, Trustnet asked QuotedData to look at the trusts which have diverged at least 5 percentage points off their five-year average premium or discount in the IT Global Smaller Companies, IT Global and IT Global Equity Income sectors.

Source: QuotedData

Only two trusts were running at least 5 percentage points narrower than their five-year average premium/discount across all three sectors: Keystone Positive Change and Herald Investment Trust.

Part of the IT Global sector, Baillie Gifford’s Keystone Positive Change trust had one of the biggest shifts in discount relative to its history, now 8.8 percentage points tighter than its five-year average, 2.1% today versus 10.9% historically.

Baillie Gifford took over management of the trust from Invesco earlier this year and is now run under the same process and leadership as the Baillie Gifford Positive Change fund.

James Carthew, head of investment companies at QuotedData, said that this narrowing discount reflected the dramatic change in sentiment investors had towards the fund since Baillie Gifford took over.

The fund has done well over the past year since the takeover, coming out as the third-best performer in the sector (42.8%) but this was not enough to make it a buy option for Chris Salih, investment trust research analyst at FundCalibre.

That the fund is still on a lingering discount could be down to Baillie Gifford’s house style of concentrated growth being out of favour over the past year during the value rally, he said, but noted that it was not a “screaming buy” at its current levels.

Herald Investment Trust was the only member of the IT Global Smaller Companies sector in the study, a buck in trend from the UK study where small-caps had the most trusts diverging from the five-year average.

Herald investment trust is the oldest in the sector and currently on a discount 6.6 percentage points wider than usual. Over three years it has made the third-most in the sector (97.5%), able to generate returns at a time when UK equities were severely shunned by the global market.

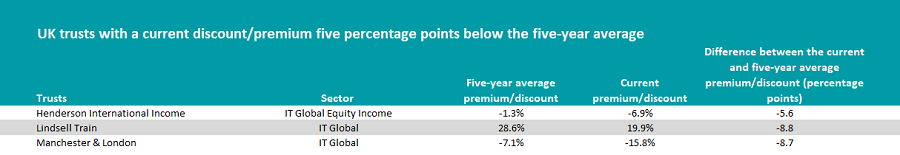

Source: QuotedData

At the other end of the spectrum Lindsell Train was also 8.8 percentage points off its five-year average, but going the other way. It is now on a 9.9% premium, downgraded from 28.6%.

Run by FE fundinfo Alpha Manager Nick Train the trust made the best returns in the sector over 10 years (51.3%) but has come off the boil since the Covid vaccine was announced, dropping to the fourth quartile of the sector in recent months.

Carthew said that when the Covid pandemic began, investors sought refuge in the well-known, globally recognised consumer brands like such as those held in Train’s trust, but now that economies are recovering “they are waking up and realising that the growth prospects of these businesses are a bit dull.”

Manchester & London was just behind with an 8.7 percentage-point swing between its current and five-year average discount.

Long-term it has performed well, making the sector’s third-best returns over three years (129.1%) but near term has also struggled and was the worst performer over the past year, netting a loss of 7.9%.

This underperformance is mainly down to the high allocations to the technology sector and China, two areas that have faced big headwinds in 2021: for the former rising inflation expectations cutting valuations, while the latter was hit by the Chinese government’s crackdown on the education and technology sectors.

Earlier in the year, Alan Brierley, an Investec analyst, recommended investors sell out of the trust due to its poor disclosure, debating whether investors actually had enough information to know what they were buying.

Next was the IT Global Equity Income sector and the Henderson International Income Trust (HINT).

The trust is 5.6 basis points wider than its average discount, now at 1.3%. The trust’s performance has flitted between the second and third quartile since it launched 20 years ago and in 2020 it struggled immensely, ranking second-worst among its peers and losing 8.1%.

Winterflood analysts said this underperformance was driven by the underweight positioning in non-dividend paying growth names, but added that manager Ben Lofthouse has acted to change this, taking advantage of the equities sell-off last year to increase exposure to growth stocks.

This could act as a complimentary holding to UK equity income funds as part of a wider portfolio, they said.

It was the only fund on the list for the IT UK Equity Income sector, although Murray International was just under the cap at 4.9 basis points.

Kepler analysts were positive on the trust, noting that it had a high yield with healthy revenue reserves, which helped maintain a narrow dividend.

Due to its significant overweights in Latin America and Asia ex China, the analysts said it could act as a good diversifying option against other global equity income trusts.

It is worth noting that premiums/discounts are influenced by investors’ sentiment, which is not an exact science. A trust may be highly valued or out of favour with investors for a number of reasons.

Salih said investors should consider performance ahead of the share price as “discounts are not solely tied to performance”.