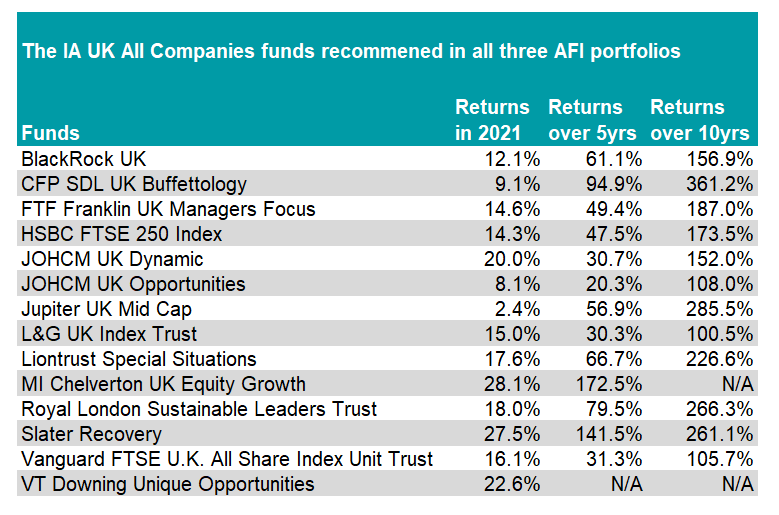

Liontrust Special Situations, CFP SDL UK Buffettology and Royal London Sustainable Leaders Trust are among the UK equity funds that are suitable for investors of all risk types, according to the Adviser Fund Index (AFI).

The adviser group is made up of fund pickers from 20 investment firms who select funds for investors of different risk profiles. These are then put into three portfolios with the mindset of cautious, balanced and aggressive investors.

Having previously looked at the investment trusts that appear in all three lists, this week Trustnet focuses on UK funds.

One option for investors is to buy a passive fund as a ‘core’ holding, while adding ‘satellite’ active funds around it. In this way, investors get the market return as a base, with smaller holdings in funds that have the potential to beat it over the long term.

For those that like this approach, the HSBC FTSE 250 Index, L&G UK Index Trust and Vanguard FTSE U.K. All Share Index Unit Trust were tipped as the building blocks for any portfolio, according to the panel.

This is then supplemented by a number of strategies that would work well as complements to broad market tracker.

From the IA UK All Companies sector, both Liontrust Special Situations and CFP SDL UK Buffettology are all-cap portfolios that take advantage of companies in the mid- and small-cap end of the market.

Source: FE Analytics

The former invests in companies that it believes have a competitive advantage, such as high barriers to entry or irreplicable intellectual property, while the latter invests with in the same way as renowned US investor Warren Buffett, picking long-term compounders at a reasonable price and letting them accrue over time.

For those with an ethical mindset, Royal London Sustainable Leaders Trust is another on the list. The managers invest in a wide range of companies that tackle ESG issues, with a main goal of transitioning to a more sustainable economy.

Meanwhile, investors that want a ‘value’ fund – those that buy cheap stocks in the hope they can rebound – might consider JOHCM UK Opportunities.

The fund has struggled over the past five years, making fourth-quartile returns over one, three and five years, but it has matched the market over 10 years despite its style of investing being out of favour for much of the past decade.

With interest rates potentially on the rise after inflation hit 4.2% in October, some may wish to add this as an option should value funds come back into fashion.

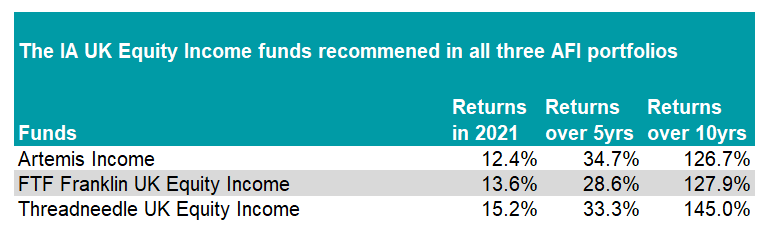

Away from the IA UK All Companies sector, there were three income funds that made the list – Artemis Income, FTF Franklin UK Equity Income and Threadneedle UK Equity Income.

Although these funds are synonymous with people in retirement, or those that are naturally more cautious with their money and want a regular stream of income rather than the volatility of growth shares, they have a place in all three AFI portfolios.

Source: FE Analytics

All are above-average over the past decade, with Threadneedle UK Equity Income the pick of the bunch, returning 168.9%. The large-cap, value strategy has been managed by Richard Colwell since 2010 and fits well with the others on the list.

At the other end of the spectrum, smaller companies are viewed as high-risk options for investors, but have a place in even the most cautious portfolio – albeit at a lower allocation.

TB Amati UK Smaller Companies has been one of the best performers in the IA UK Smaller Companies sector over the past decade, returning 361.4%.

The fund invests in companies with strong balance sheets and predominantly invests in stocks that are larger than £500m although it can invest in smaller businesses as required.

Its largest weightings are to healthcare, consumer discretionary and financials, with technology also a double-digit allocation. This complements well with the Artemis UK Smaller Companies fund, which has lagged over the past decade as its value approach has suffered.

Total return of funds vs sector over 10yrs

Source: FE Analytics

Indeed, its highest allocation is to industrials (37%) followed by consumer discretionary and financials. Technology and healthcare – two of the fastest-growing parts of the market – make up less than 15% of the portfolio.

The fund had a disastrous 2020 as these names performed well, losing 16.6% – the worst in the sector. However, this year it has made 27.1% as it has rebounded during the value rally.