BlackRock Asset Management has shorted popular investment trust Hipgnosis Songs, according to data from the Financial Conduct Authority (FCA).

The fund group has taken a 0.58% short position on the investment trust, the joint-largest short position ever taken against the company and only the second time an asset manager has bet against the firm.

At the current share price, it means BlackRock has an £8.9m bet against the £1.5bn investment trust.

Indeed, the only other time shares in the investment trust had been lent out by short sellers was in late 2019 and early 2020, when Qube Research &Technologies Ltd also took out a 0.58% position.

Rob Morgan, chief analyst at Charles Stanley Direct, said that it might not be a straight “naked trade” but could be a pairs trade, where BlackRock have backed the other investment trust in the IT Royalties sector, Round Hill Music.

Hipgnosis Songs was the first investment trust of its kind when it launched in 2018, investing in the associated intellectual property rights of music.

The trusts manager and founder Merck Mercuriadis, has had a wealth of experience in the music industry, managing artists such as Elton John, Mary J Blige and Guns N’ Roses among others.

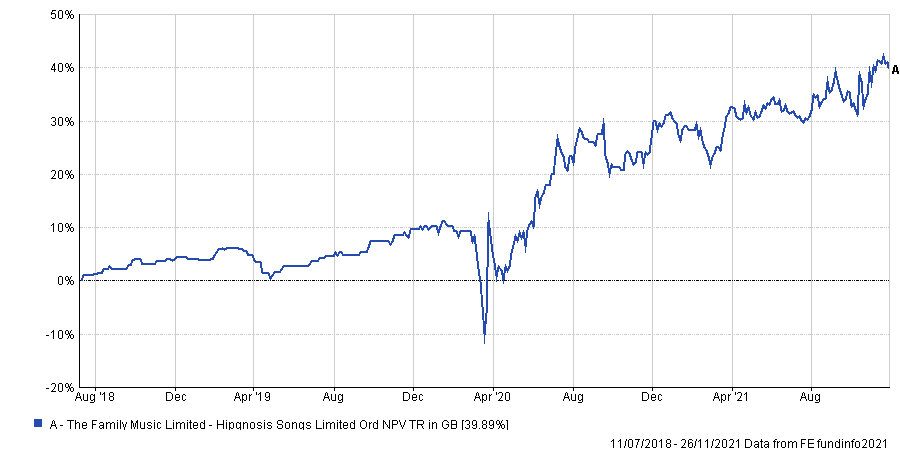

Its popularity was evident recently when its share price hit an all-time high on the London Stock Exchange of 128.4p, a 4.4% rise in share price from the start of the year. It is also running on a 7% premium to the value of its underlying holdings, yet since its launch in 2018 it has made a total return of 39.9%.

Performance of trust since launch

Source: FE Analytics

Hipgnosis’ popularity has taken a dip recently after concerns were raised about how much time Mercuriadis would have to run the portfolio after private equity firm The BlackStone Group bankrolled a new £1bn portfolio pf songs, recorded music and royalties, which is to be managed by Hipgnosis Song Management.

Morgan said that the BlackStone announcement had pros and cons for the trust. On the plus side he said it could provide more “firepower” for the trust and increase its ability to diversify and add new artists to its vast catalogue. But it could be a disadvantage as the manager may not be able to “cherry pick”, the best options.

Yet it is undeniable that the trust remains popular. Morgan said it is potentially “a true diversifier” to markets while also offering a “rising income stream”.

He added that it also fits into a lot of pre-existing themes, such as changing demographics and digitalization.

“The whole monetization of the music catalogue is a is a hugely potentially lucrative business,” he said.

However, he warned that it remains an untested asset class and one that investors can do little historical research on. He added that there could still be some cyclicality to the asset that has not been fully identified yet.

Another point of concern is that investors generally do not understand how an asset like songs work, particularly on the legal side.

“The events recently with Taylor Swift and her battle over owning her masters got me thinking because her re-released versions have had more downloads than the originals,” Morgan said.

These are not risks a day-to-day investor will be well versed in but is something that could impact the profitability of a song. The advice to investors is to invest in what they understand or have faith that the manager has a “pretty robust view on it”.

A spokesperson for Hignosis said that the short position had been in place for some months and appeared to be “the work of a computer and associated with their [BlackRock’s] index trading business.”

BlackRock declined to comment.