The move to a carbon-neutral global economy is expected to be one of the most powerful themes of the next decade, but the problem with any megatrend with this sort of potential is that you won’t be the first person to have spotted it.

As a result, many of the young upstart stocks offering a product or service that can help the fight against climate change tend to have a valuation that relies more on potential and less on reality, leaving themselves open to a severe rerating if sales disappoint.

However, Rob Burnett (pictured), manager of the LF Lightman European fund, claimed that the transition to a low-carbon economy would be more pertinent to traditional value sectors over the next decade than blue-sky growth areas – and the good news is that as established, cash-generative industries, these are easier to analyse and a much safer bet for investors.

He said the electric vehicle market was the perfect example: “How is it that Tesla is valued at $1.5m (£1.1m) per car sold this year and Volkswagen is valued at $15,000?

“That is 100x the price, even though Volkswagen is at half Tesla’s EV (electric vehicle) sales, even though it started later, and is set to eclipse it within about 18 months. So how has that happened?

“It is because narratives matter. And today in European equities we have what is the preeminent narrative of this decade. It is not tech. It's the clean energy transition.”

Performance of stocks over 5yrs

Source: Google Finance

One of the reasons why companies such as Volkswagen are on lowly valuations is that they score poorly on environmental, social and governance (ESG) metrics, meaning they are shunned by the growing number of funds with a strict set of sustainability criteria.

While the company has slowly regained the trust of investors following a high-profile fraud case in 2015, and intends to be net carbon neutral by 2050, its cars are still responsible for about 1% of global emissions.

However, Burnett said that for investors with a long-term view, this presents an opportunity to get into a company before the ESG money, allowing them to benefit from an eventual rerating.

The manager named Swedish steel producer SSAB as an example of a similar opportunity: it plans to produce the world’s first fossil-free steel by 2026 and go completely fossil free by 2045.

“SSAB is responsible for 10% of Sweden’s CO2 emissions and 7% of Finland's emissions,” he said.

“But it's going 100% fossil-free, so it's going to single-handedly cut its nation state's emissions by 10%.

“Now it's a steel company, it's a heavy polluter. But every ESG fund in the world is eventually going to buy this stock.”

However, another value manager claimed this strategy might not be so straightforward. Simon Murphy, manager of the VT Tyndall Real Income fund, said that although Burnett’s premise was sound, the cost involved in putting such heavy polluters on a sustainable footing meant that this transformation wouldn’t automatically result in a decent result for shareholders.

Instead, Murphy said there could be better opportunities for investors in the stocks that could help to bridge the transition to renewable energy.

To start with, he pointed to Drax, which used to be one of the Europe's largest coal-fired power stations, but now uses biomass pellets.

“What’s interesting about Drax is it’s in the process of developing what is potentially the largest carbon capture and storage project in the world,” he said.

“It won't come to fruition until 2027 or 2028, but the potential exists for Drax to effectively capture 16m tonnes of CO2, which it will then effectively store under the North Sea, and it becomes carbon negative.

“What I like about Drax is you've got a perfectly interesting business right now which is steady but underpriced, generating good cash flows, earnings and dividends, yet you've got this really exciting potential technology going forwards as well.”

Not everyone is convinced about Drax’s sustainable credentials, with S&P removing it from its Global Clean Energy index in October. However, Murphy said that most important from an investment point of view was that it had the backing of the UK and European authorities as a sustainable solution.

His other choice was Rolls-Royce. The stock has yet to recover from the pandemic – it is down by about two-thirds since its 2018 high – but aside from the rebound potential, Murphy was excited about the opportunities in building small modular nuclear reactors, for which it secured £210m of funding in November.

Performance of stock over 5yrs

Source: FE Analytics

“I believe nuclear power will have a reasonable role to play in getting us to net zero, but the problem historically has been the scale of the projects and how much they cost,” Murphy continued.

“Rolls-Royce and its partners are developing small modular nuclear reactors, which are based off the technology that they used to power nuclear submarines for 30 or 40 years.

“It’s still another five to seven years away, but the beauty of it is you'll be able to effectively pre-manufacture these reactors off site and then just bring all the components together on site and put them together relatively quickly.”

Data from FE Analytics shows that LF Lightman European has underperformed its sector and index since launch in March 2019, although former Neptune Investment Management fund manager Burnett has significantly outperformed his peer group composite over the course of his career.

Performance of fund manager vs peers over career

Source: FE Analytics

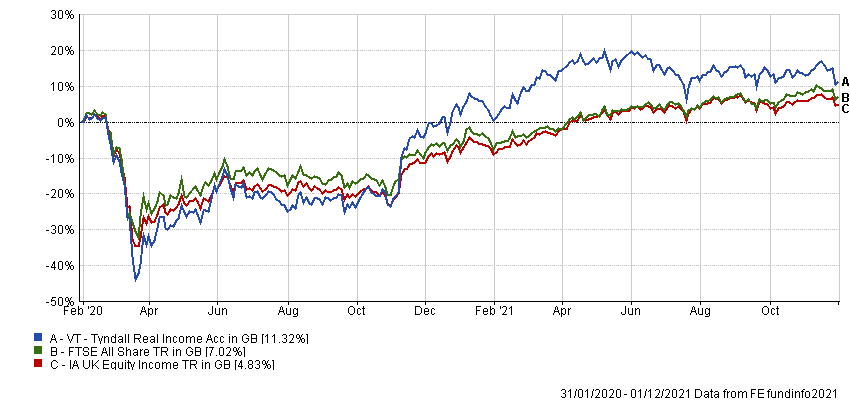

VT Tyndall Real Income has made 11.3% since Murphy took charge in January 2020, compared with 7% from the FTSE All Share and 4.8% from the IA UK Equity Income sector.

Performance of fund vs sector and index under manager

Source: FE Analytics

The £10.3m fund is yielding 3.3% and has ongoing charges of 0.78%.