Donald Trump’s indecision on everything from tariffs to whether he is going to fire Federeal Reserve chair Jerome Powell is giving investors whiplash, causing volatility and uncertainty. Some investors have responded by pulling back and favouring more cautious assets such as gold or bonds.

But this is not the case for everyone. While some have become more risk averse, Alex Watts, senior analyst at interactive investor, said other investors are doubling down, believing that there are opportunities to be found due to weaker valuations.

Below, experts identify the high-risk investment trusts and funds that might suit investors who believe now is the time to be more adventurous.

Redwheel Global Intrinsic Value

Ben Yearsley, director at Fairview Investing, turned to the Redwheel Global Intrinsic Value fund, managed by Ian Lance and Nick Purves.

Yearsley explained: “There has been a lot written about US and tech over the past few years to the extent that it has seemed the only story in town. Breaking news, it isn’t.”

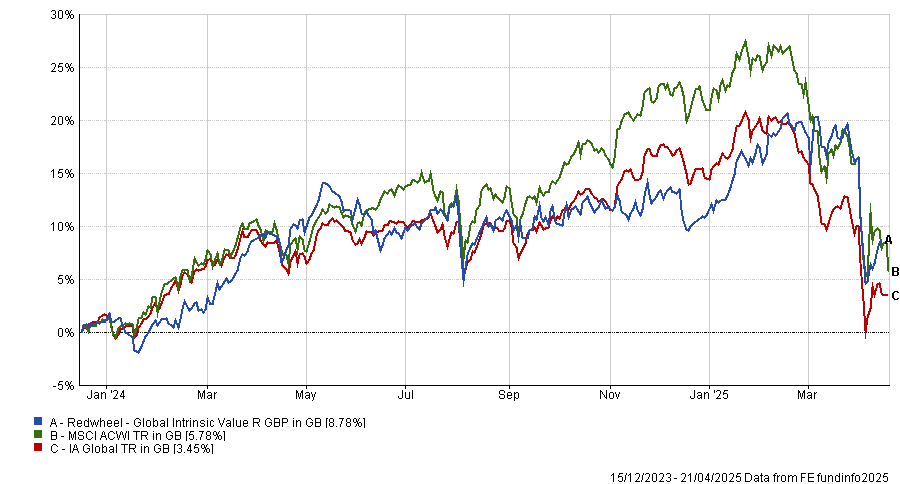

Since its inception in December 2023, the fund has been up 8.7%, beating the average sector and the MSCI ACWI. While it was also a victim of the Liberation Day sell-off, sliding by 6.6% since 2 April, it performed better than the US-dominated MSCI ACWI, which tanked 9.2%.

Recent volatility has demonstrated the challenges with large overweights towards US and growth stocks. Areas such as the UK or Europe that have been viewed as out of favour are exactly what investors might need to rebalance their portfolio, Yearsley said.

Performance of fund vs the sector and benchmark since inception

Source: FE Analytics

He added: "I think price still has an important part to play – surely the starting price you pay impacts your long-term total return? The yield on offer also gives you a massive head start on your total return,” Yearsley said.

With a yield of around 5%, as well as Lance and Purves’ years of experience managing successful value strategies such as Temple Bar Investment Trust, Yearsley said the Redwheel strategy had the necessary components of a great fund, despite the emphasis on out-of-favour markets.

Guinness Asian Equity Income

Watts pointed to the Guinness Asian Equity Income fund, led by Edmund Hariss and Mark Hammonds, as a compelling high-risk investment.

Its high conviction, low turnover approach and 30% allocation to China have been risky recently as the trade war between China and the US has escalated. Nevertheless, the macro environment of the Asia Pacific ex-Japan market means the portfolio is positioned to ride this out, Watts explained.

He said Asia Pacific markets emphasise domestic consumption and intra-regional trade, with China trading more than "$960bn worth of goods with ASEAN (Association of Southeast Asian Nations) countries in 2024".

Instead of backing down to the US, China is deepening its trade with other Asian countries, Watts said. Harris and Hammonds have taken advantage of this by favouring domestic companies, with just 11% of portfolio company revenues derived from the US, according to Watts.

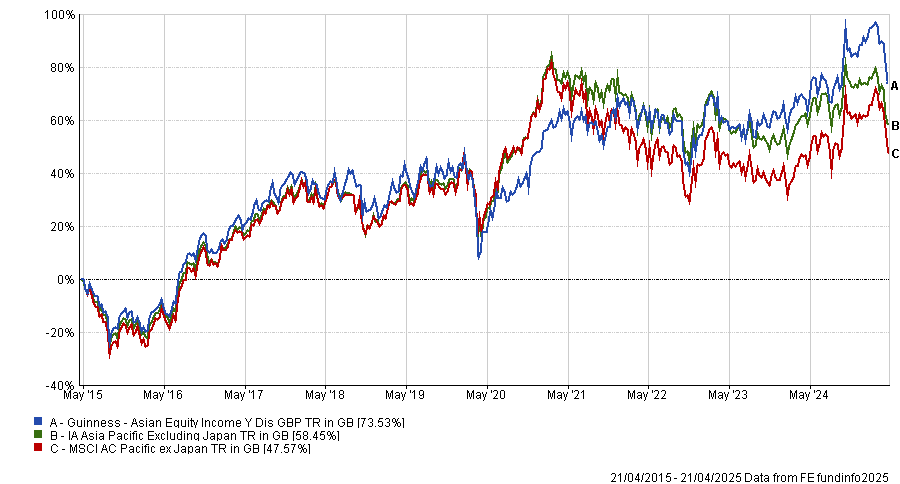

The fund is up 73.5% over the past 10 years and Watts noted that the managers’ successful navigation of “Trump’s tariff-heavy first term” was another point in their favour.

Performance of fund vs sector and benchmark over the past 10yrs

Source: FE Analytics

“The fund offers a prudently managed and time-tested approach to tapping into long-term headwinds and diversifying your portfolio”, very suitable for investors who have regained some of their risk appetite, Watts concluded.

Vietnam Holding

Meanwhile, Matthew Read, senior analyst at Quoted Data, pointed to Vietnam Holding Limited. Despite Vietnamese equities experiencing a “short dislocation” following the announcement of tariffs, Vietnam still has “one of the most attractive macro backdrops in emerging markets”, that the trust is positioned to take advantage of, Read said.

In response to the recent wave of tariffs and “short-term dislocation in Vietnamese equities”, it has remained nimble. Since Liberation Day, it has trimmed its exposure to exports and increased its focus on domestic companies, banks and retail, which are less susceptible to global market volatility, Read said.

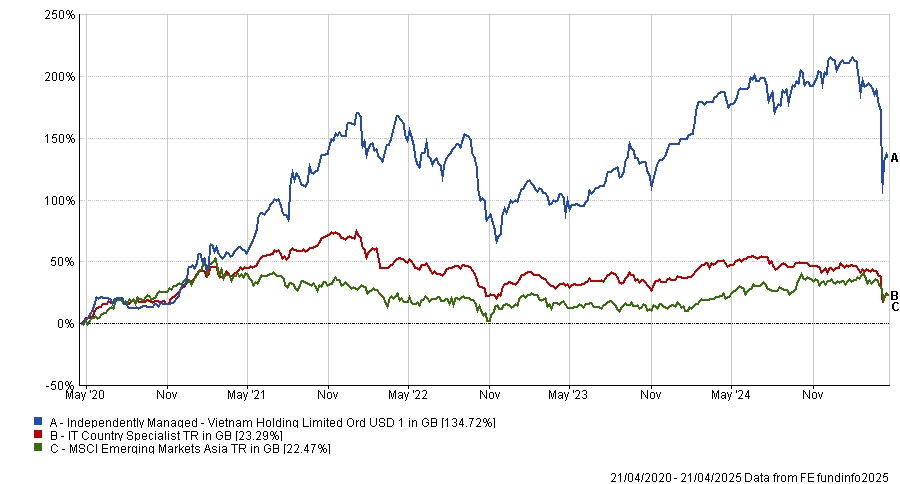

These domestic businesses benefit from Vietnam’s macro tailwinds and “already high growth story”, such as ongoing infrastructure reforms, ambitious GDP targets and a young and dynamic population. The strategy has done very well over the past five years, beating the MSCI Emerging Markets Asia index by 110 percentage points.

Performance of trust vs sector and benchmark over the past 5yrs

Source: FE Analytics

Finally, the potential for Trump to rethink his trade policies or the possibility of a better trade deal means that, if the market calms down, Vietnam Holding can benefit, Read said.

However, if volatility continues to rise, Vietnam will be “less correlated to more developed markets, with valuations significantly below global peers” – something even more cautious investors could be underestimating.