News of a new, highly contagious strain of coronavirus could be bad news for investors, but the BlackRock Investment Institute has warned against selling out of stock markets just yet.

Stocks around the world fell at the end of last week as some countries imposed new restrictions to combat ‘Omicron’ – the name of the latest strain.

However, today shares have bounced back, with the FTSE 100 index up 1.3% while markets in America and Europe were also positive.

Jean Boivin, who heads the BlackRock Investment Institute, said he still favoured equities, despite the latest news, but would be quick to change his stance if vaccines proved ineffective.

He noted that the news had affected risk sentiment, with investors reappraising those companies that are dependent on the economic environment, but said that the broader macroeconomic picture was unchanged.

“Vaccine campaigns so far have proved effective and versatile. It would be a game changer if the new strain were to significantly compromise vaccine effectiveness and question the restart, but there is no evidence of this yet,” he said.

Although there were concerns that government restrictions, such as more lockdowns, could have an impact, he said that these will be “lighter” than they have been in the past, and added that their impact on the economy had waned as the world has adapted to the new atmosphere.

“Omicron could trigger growth downgrades, worsen risk sentiment and hit services sectors, especially in the near term. It could even question the restart if vaccines or treatments were to prove ineffective,” said Boivin.

“If they are effective, the new strain only delays the restart, and we don’t see it changing the otherwise solid picture for equities: a powerful restart and the prospect of continued low real rates. We are leaning against Covid-related stock pullbacks for now as a result.”

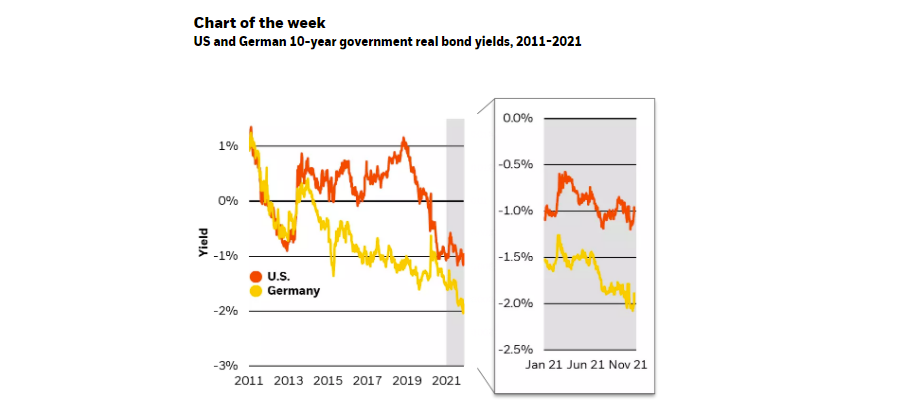

He argued that it was more important that negative real, or inflation-adjusted, yields supported equities, which had initially edged up earlier this month but had fallen back to near-record lows.

Source: BlackRock Investment Institute

“The reason is a more muted response to inflation, thanks to fiscal-monetary coordination to bridge the virus shock and central bank policies of letting inflation run a bit hot,” Boivin said.

“We expect real yields to rise from here, but stay at historically low levels for the inflationary environment. This makes equity valuations look better than they otherwise would, and challenges cash and nominal bonds.”

He expected the Federal Reserve to start gradually raising rates in 2022, assuming the new strain does not derail the economic restart, which would push yields higher.

While this would also impact stocks, he said they offer “higher risk-adjusted returns” and a “potential buffer” to inflation risks, especially if rates are not raised to the same levels as in previous cycles.

However, should inflation expectations spiral upward or, conversely, central banks tighten prematurely – both of which would suggest higher policy rates than currently expected – Boivin said the firm would turn “neutral” on equities.

He said this was unlikely, as it would “require the Fed to abandon or completely reinterpret its new policy framework”.

Of more importance was the sum total of the economic growth and interest rate rises, rather than the pace of either, he said. “This applies to both Covid-related risks that slow the restart and to the Fed’s rate trajectory.”