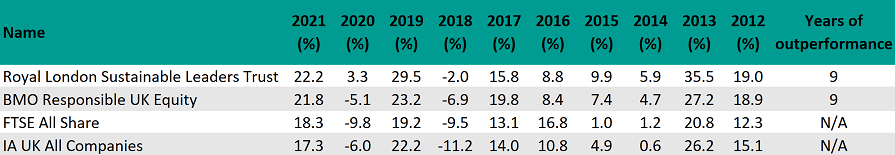

Two strategies with a focus on sustainability have topped the list of most consistent IA UK All Companies funds of the decade, beating the FTSE All Share – the most common benchmark in the sector – in nine of the past 10 calendar years.

The funds – Royal London Sustainable Leaders Trust and BMO Responsible UK Equity – also beat the sector average in the same number of years.

Of the 205 funds with a track record long enough to be included in the study, another four – Liontrust Special Situations, Liontrust UK Growth, Allianz UK Listed Opportunities and TB Evenlode Income – also beat the FTSE All Share in nine of the past 10 years, but didn’t perform as consistently well against their peers: Liontrust Special Situations and TB Evenlode Income beat the sector in eight of the past 10 calendar years, while Liontrust UK Growth and Allianz UK Listed Opportunities only managed it in six.

Performance of funds vs sector and index

Source: FE Analytics

The £3.4bn Royal London Sustainable Leaders Trust is headed up by Mike Fox, George Crowdy and Sebastien Beguelin, who screen for firms with strong environmental, social and governance (ESG) qualities, while excluding those that are exposed to controversial activities.

They also look for companies that offer potential for growth and are relatively undervalued by the market. Once the managers have identified potential candidates, they score them on financial and sustainability factors.

The FE Investments team, which includes the fund on its Approved List, said this is to “identify best-in-class companies that actively seek to contribute to a more sustainable society and that actively manage the business exposure to ESG risks”.

The managers prefer larger companies, and exposure to foreign firms for which there are no suitable UK alternatives, particularly tech stocks.

FE Investments added that the fund is differentiated from many ethical peers, which focus predominantly on negative screening.

“This team goes a step further and screens companies to isolate those that are contributing to the transition to a sustainable world,” it said.

“As such, it is a very good candidate for investors who specifically want exposure to companies that are making a positive impact for society or operating in a sustainable manner.”

In a recent note to investors, Fox said that while sustainable investing did better than expected in 2021, it may struggle this year, as the “low-hanging fruit” has already been snapped up and many valuations look stretched. In the long term, however, he said it was still the place to be.

“Most people don’t realise how early we still are in the adoption of sustainable investing,” he said.

“While investors may feel that the sustainable ship has sailed and that they don’t want to be last to the party, this is not the case. I remain firmly convinced that sustainable investing offers the best potential of doing good for society, while deriving reasonable investment returns.”

Royal London Sustainable Leaders Trust made 278.8% over the 10-year period in question, compared with 131.6% from its sector and 110.7% from the FTSE All Share. It has ongoing charges of 0.76%.

Performance of funds vs sector and index over 10yrs

Source: FE Analytics

BMO Responsible UK Equity aims to provide capital growth by investing in attractively priced, high-quality businesses with proven management teams, strong financials and competitive advantages, while screening out companies with damaging or unsustainable practices.

Manager Catherine Stanley also looks for companies that make positive social and environmental contributions and use their influence to encourage better practices.

FE Investments said the fund has a well-established team behind it with three of the five sector specialists having worked together for more than 15 years.

“They have built an attractive track record and have managed risk well versus peers, despite a relatively limited investment universe,” it said. “They are well supported by the Responsible Investment Team, which conducts screening and some company engagement, and the Advisory Council, which oversees the integrity of the ESG integration process.”

It said this gives the investment team more time to focus on stockpicking through analysis of balance sheets, competitive advantages and management quality, and improving its process.

“This separation creates good structure and a thorough due diligence process and helps to ensure the fund remains loyal to its responsible mandate,” FE Investments added.

Stanley said investors should be aware that most responsible options in the UK tend to be found towards the small- and mid-cap area of the market. Fortunately, she claimed this was an area of expertise for the responsible investment team, which has been “invaluable to the management of this fund”.

“The key here is finding compounders and avoiding profit warnings, hence our strong focus on risk,” she explained.

“Risk is considered at all stages of the process. There are also things to avoid, such as binary outcomes and speculative businesses. We don't chase short-term performance, but look for long-term consistent success.”

BMO Responsible UK Equity has made 192.9% over the 10-year period in question. The £583m fund has ongoing charges of 0.79%.