Appealing valuations, UK technology stocks, inflation and US fiscal policy are all topics on the minds of 2021’s top performing UK managers.

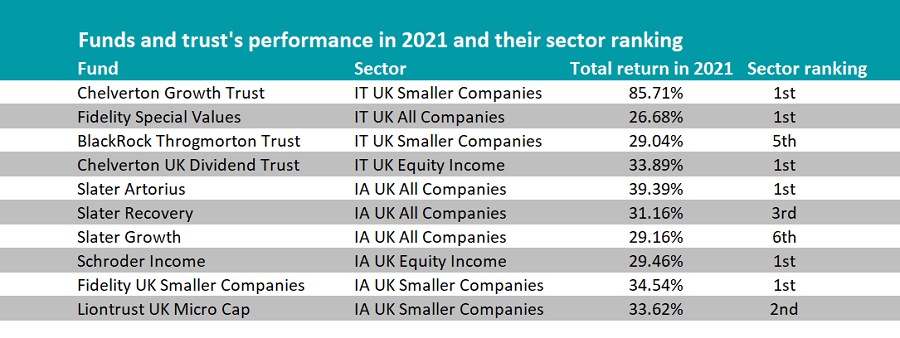

In this series Trustnet asked fund managers that topped their sectors in 2021 what the future might hold for the coming year.

Compared with the start of last year, the UK is in a much better and stronger position, according to Jonathan Winton, manager of Fidelity UK Smaller Companies, 2021’s best IA UK Smaller Companies fund.

He said that the domestic market had shaken off a lot of the “baggage” that had been “dragging it down” for so many years: chiefly Brexit concerns and Covid-19.

When Brexit occurred in 2016 it caused an immediate, negative reaction from overseas investors, who chose to divest away from the UK rather than gamble on the unknown geopolitical outcome.

Then Covid came along, with new issues such as the continuous struggle to get a handle on cases, which forced the UK economy to a halt.

But with a successful vaccine rollout, the UK has entered the new year with a much rosier picture, he said.

Dan Whitestone, manager of the BlackRock Throgmorton trust, agreed, adding that the pandemic “has driven an acceleration of profound seismic market share shifts intra-industry, which we think of as ‘Corporate Darwinism’.”

He said that well-capitalised companies were reaping the benefits of changing consumer and corporate behaviour, while they also gained from “weakened peers exiting the market”.

David Horner of the Chelverton UK Dividend Trust, seconded this progression of change in the UK markets, but said it had been going on for much longer then Covid.

He said it has been a story of little, unnoticed improvements going on since Brexit occurred, but when these were added up they “lead to significant growth”.

For many of the managers, UK valuations were one of the most positive characteristics overall. Kevin Murphy, manager of Schroder Income – the best IA UK Equity Income fund last year – said valuation was a “guiding light or a North Star”.

He added that, at the moment, the UK market is one of the cheapest global developed markets in the world, on a relative basis. A statement his peers agreed with.

Source: FE Analytics

FE fundinfo Alpha Manager Alex Wright, of the Fidelity Special Values trust, added that the UK market has actually been cheap over the past five years but the key difference now was that “fundamentals on the ground have been strong”.

He said the removal of the macroeconomic headwinds and successful vaccine rollout have contributed to the improved outlook and changed the game for the UK.

There is also a pretty rare event going on in UK value at the moment, which Winton said was significant for value investors globally.

In the past, Winton said those buying cheap companies in the hope they rebound have had to sacrifice on the quality of the businesses, but that this was not the case currently.

“There are businesses with 10 times earnings growth and good return prospects medium term all with low levels of debt. If you look back in history, it's quite rare to find attractive valuations for businesses that I would regard as sort of fairly high quality,” he said.

It is not just UK-only investors that should be taking note, however, as Murphy noted that his pan-European value funds and global value funds were also overweight the UK market.

Although the sun might be shining a little brighter for the UK it does not mean that the sky is totally blue, as all the managers noted several grey clouds they were keeping an eye on.

Valuations may be cheap overall, but there is still polarisation between the cheapest and most expensive stocks that investors need to keep an eye on, Murphy said.

For example, US technology stocks have been repeatedly criticised for being too pricey “and there's an element of truth to that, but UK technology shares are even more expensive, we just don’t have many of them,” he said.

One of the biggest problems facing the UK was inflation, which Mark Slater of the Slater Artorius, Slater Recovery and Slater Growth funds, was monitoring.

He said: “Investors and companies alike are not used to dealing with inflation and interest rate rises are likely to be a headwind.”

The current UK rate of inflation is at 5.1%, well above the central bank’s 2% target. By now, companies that can should have already begun offsetting the cost to their customers, said Matthew Tonge, manager of the Liontrust UK Micro Cap fund.

“Those that haven't been able to had to issue profit warnings at the back end of last year and there will definitely be more this year for the same reason,” he said.

Another is what the US will do regarding its own fiscal policies. Horner, said that “whatever the US does impacts us”, due to the global reach of its market.

“We’re concerned about their massive fiscal expansion and the inflation that they are creating, which is huge. But there’s nothing we can do and frankly there is nothing that my companies can do about it. We need to just be aware that it is a problem.”

Overall the managers were positive heading into this year despite the challenges facing global markets and economies.

Murphy said: “Given the run of bad news the UK has had we should be able to do more than simply cross our fingers. The UK market deserves some time in the sun.”

| Fund/trust | Sector | Fund Size(m) | Fund Manager | Yield | OCF | IT Net Gearing |

| BlackRock Throgmorton Trust | IT UK Smaller Companies | 1001.5 | Dan Whitestone | 1.12% | 0.60% | 0.00% |

| Chelverton UK Dividend Trust | IT UK Equity Income | 67.7 | David Horner, Oliver Knott | 3.88% | 2.33% | 35.25% |

| Fidelity UK Smaller Companies | IA UK Smaller Companies | 430 | Jonathan Winton, Jac Jones | 0.34% | 0.91% | |

| Fidelity Special Values | IT UK All Companies | 982.4 | Alex Wright | 2.14% | 0.72% | 0.00% |

| Liontrust UK Micro Cap | IA UK Smaller Companies | 212.5 | Anthony Cross, Julian Fosh, Matthew Tonge, Victoria Stevens, Alex Wedge | 0.00% | 1.35% | |

| Schroder Income | IA UK Equity Income | 1864.6 | Nick Kirrage, Kevin Murphy | 2.71% | 0.89% | |

| Slater Artorius | IA UK All Companies | 32.3 | Mark Slater | 0.00% | 1.07% | |

| Slater Growth | IA UK All Companies | 1655.7 | Mark Slater | 0.00% | 0.81% | |

| Slater Recovery | IA UK All Companies | 451.4 | Mark Slater | 0.00% | 0.81% |