Environmental, social and governance (ESG) funds face an extended period of underperformance as numerous tailwinds that have driven returns over the past decade begin to work against them.

Enormous amounts of money have flooded into ESG funds as the trend for responsible investing has gathered pace. Global assets under management (AUM) are expected to exceed $40trn (£30trn) this year, according to data from Bloomberg, up from $22.8trn in 2016.

However, Ian Lance, manager of the Temple Bar Investment Trust, said that in many cases ESG funds were just a proxy for growth funds, which was where their problems began.

“Often the top-10 of growth and ESG funds are nearly identical,” he explained. “We think that a change in the macro backdrop from low inflation and low interest rates to high inflation and higher interest rates will cause a regime change from growth to value and hence ESG funds are likely to do poorly from that point of view.”

Correlation between growth and ESG funds over 3yrs

Source: Redwheel

James Penny, chief investment officer at TAM Asset Management, agreed with him.

“Many ESG companies have a lot of future forward earnings, which is all about tomorrow: COP26 was all about what we need to do, not what we've done,” he said.

“Companies whose valuations are based on projected earnings are going to come under pressure now inflation is at its highest in 30 or 40 years.”

However, he pointed out that their unsuitability for an environment of rising inflation and interest rates was not entirely down to their ESG tilt, and this won’t be the only area of the market likely to struggle in the coming months and years.

“There's been this underlying trend of people being forced to own growth stocks over the past 10 years when they thought they owned a diversified portfolio, because that’s been the only place to survive,” he said.

“ESG is no different. Even unconstrained global managers who could go anywhere had to own growth stocks if they wanted to outperform the market.

“If you invested in value stocks over the past 10 years, you’d be lucky to still have a job.”

Lance said that the tilt to growth was not the only reason why ESG funds were likely to struggle in the near term. He noted that mounting pressure on oil & gas companies to diversify away from fossil fuel production has led to underinvestment in this sector, “leaving these industries unable to meet current levels of demand, which has led to a rise in commodity prices”.

“We believe these are the areas that will perform in the coming years,” he added.

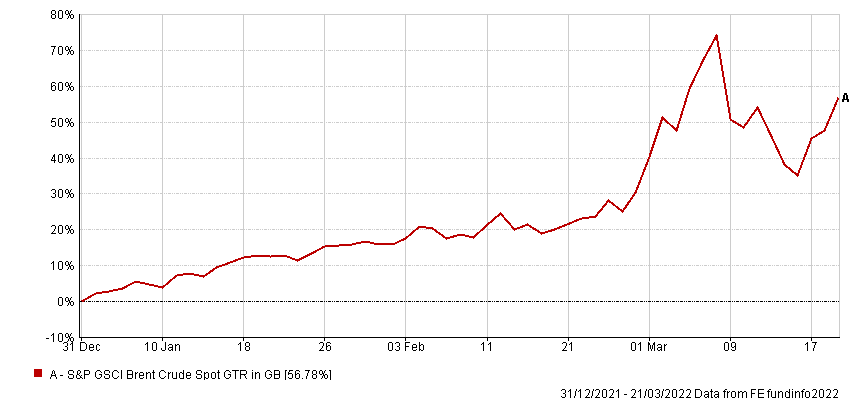

Data from FE Analytics shows the oil price is already up 56.8% this year, spiking after Russia’s invasion of Ukraine. Most ESG funds avoid this sector.

Performance of index in 2022

Source: FE Analytics

Yet it was not all bad news. There were worries that investors in ESG funds were just chasing the latest fad and would run for the exit as soon as performance began to falter, exacerbating any falls.

If anything, the opposite is true. Data from Calastone shows that while inflows into equity funds fell to a net figure of just £42m in February – 96% lower than the average monthly inflow over the preceding 12 months – a net £641m was added to ESG equity strategies.

In a recent Trustnet article, Jacob de Tush-Lec, manager of the Artemis Global Income fund, said the trend towards sustainable investing meant oil & gas companies would be unlikely to trade on the sort of multiples seen in the past when the price of these commodities has spiked.

Jake Moeller, senior investment consultant at Square Mile Investment Consulting & Research, looked at it from a different point of view. He said that the growth tilt of many ESG funds would begin to self-correct as oil & gas companies reinvented themselves as renewable energy producers, meriting their inclusion in these strategies.

“A rising tide of change will mitigate some of those compositional biases,” he said.

He also pointed out that most investors in ESG funds aren’t just looking for financial returns, but want their money to have a positive impact on society. From this perspective, James Clark, senior fund analyst at Hawksmoor, said the elevated oil price should play into the hands of the renewable energy industry.

“What greater incentive does the world need to fully embrace our abundant resources of wind, solar, hydro, tidal and geothermal energy?” He asked.

“Furthermore, as governments, companies and consumers look to mitigate and adapt to the effects of ‘black gold’ being quite so costly, energy efficiency measures will be more important than ever.”

He added: “On this note, the long-term drivers of sustainable investment aren’t going away – if anything, they’re getting stronger.

“Sustainable investment may be facing a bump in the road in 2022, but it’s not one which would send a car (electric, of course) skidding off track.”