Oil and gas prices and commodities were some of the near-term themes investors sought passive exposure to in the first quarter of 2022, data from Hargreaves Lansdown (HL) finds, although there were still some long-term options that remained popular.

The DIY investment platform looked at which exchange-traded funds (ETFs) investors had been allocating to over the quarter.

Below, Emma Wall, head of investment analysis at research at HL, details the five most popular ETF buys with investors recently.

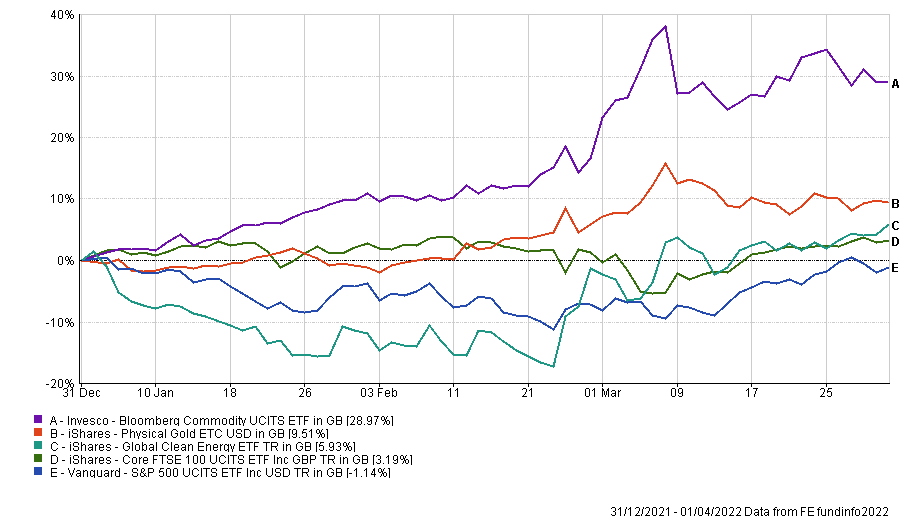

Performance of ETFs YTD

Source: FE Analytics

Vanguard Funds S&P 500 UCITS ETF

First up was the $37.5bn (£28.6bn) Vanguard Funds S&P 500 UCITS ETF, which, as its name states, tracks the main US index.

This part of the equity market has struggled in the opening months of 2022, with the S&P 500 losing 1.4% year-to-date. In contrast, the FTSE 100 made 3.2%, the only major equity market – among developed and emerging – to generate a positive result so far this year.

This negative return was in direct contrast to the decade prior when the S&P 500 led equity markets by some margin, making close to 300% total returns in that time, threefold the FTSE 100 (91.3%).

But the rally has stalled because of the rising levels of interest rates and inflation, factors which negatively impact the growth style companies that dominate the S&P 500. This growth bias helped the market to outperform when these factors were limited, but it has hampered it recently.

Indeed, Wall said that “the US market has gone from darling to dud” in terms of performance but, investors have not been so easily dissuaded, with “opportunistic investors buying up the market via this ETF from passives giant Vanguard”, she added.

The head of analysis said that one reason the US market had come back into favour was the Federal Reserve unveiling its interest rates plan for the year, which removed a lot of investor’s uncertainty on the issue.

The Vanguard Funds S&P 500 UCITS ETF offers a more cost-effective way to gain exposure to some of the most influential companies in the world, with an ongoing charges figure (OCF) of 0.07%, and has a tracking error of 2.9, according to FE Analytics - the closer to zero the more accurate a tracker is.

iShares Core FTSE 100 ETF

Staying in the large-cap space and the £10.5bn iShares Core FTSE 100 ETF was another popular passive pick.

“The clue is in the name – this ETF is a great core holding of a well-diversified portfolio, offering investors exposure to the 100 largest companies in the UK,” Wall said.

As a result, this passive provided a “hefty weighing” to energy, materials and industrials “many of which have benefited from rising metals, oil and gas prices”, she added.

Indeed, while this combination had caused the FTSE 100 to lag its US-peer in the years when cyclicals were out of favour, this value overweight has put the FTSE 100 on the right side of recent market sentiments. The ETF also has an OCF of 0.07% and a 1.6% tracking error.

iShares Physical Gold ETC

Next was the iShares Physical Metal Physical Gold ETC, playing into the recent run on gold. The asset has traditionally been regarded as a ‘safe haven’ in markets and this characteristic “has proved very popular with investors over the past month” during the heightened market uncertainty, Wall said.

The ambiguity around central bank policies and inflation were the main drivers of market volatility until 24 February, when Russia’s invasion of the Ukraine eclipsed all previous market concerns.

When Russia initially attacked the Ukraine it sent markets into freefall but gold held up well. Indeed, Wall said: “In the week following Russia’s invasion of Ukraine investors sought out safety, buying gold ETFs, and funds invested for capital preservation.

“The gold price peaked at more than $2,000 per troy ounce at the beginning of March, but has since come off slightly.”

Invesco Markets Bloomberg Commodity ETF

Alongside gold, commodities also held up during the recent volatility caused by the war in Ukraine.

Oil and gas prices have reached decade highs as a result of the attack as both assets are a major export of Russia, along with aluminium and copper. The price of wheat, one of the Ukraine’s main trade, also soared over fears of a global shortage due to the ongoing war.

Wall said it was therefore “not surprising” to see Invesco Markets Bloomberg Commodity ETF among this group, as it provides “broad exposure to the entire sector as the Bloomberg index is composed of 24 commodities across energy, grains, industrial metals, precious metals, soft commodities and livestock”. The passive fund has a tracking error of 7.7% and an OCF of 0.19%.

iShares Global Clean Energy ETF

While several of the most popular ETFs were focused on near-term trends and events, the iShares Global Clean Energy ETF showed that “investors have not stopped looking to renewables for long-term gains”, Wall said.

The passive fund tracks the S&P Global Clean Energy Index, which is made up of companies S&P Global Clean Energy Index globally.

Investing in renewable energy sources was one of the preeminent themes of ethical investing, a style which has gained momentum with investors in recent years. Now though, amidst the spiking oil and gas prices there have been calls to accelerate the global transition to renewable energy sources to lessen the single state reliance for power, adding fuel to the fire.

The iShares Global Clean Energy ETF has an OCF of 0.48% and a tracking error of 24.9%.