Like many growth-orientated funds, Rathbone Global Opportunities has endured a tough quarter but investors thinking of selling should hold or look for opportunities to buy, according to experts.

Run by veteran manager James Thomson, the fund is down 10.9% year-to-date versus a 2.3% fall in the MSCI World index and a 4.7% decline from the average IA Global peer.

But for investors who have held for the past five years, Rathbone Global Opportunities has been a top performer – up 99.5%. Over the past decade it is up 303%, putting it in the top quartile of the sector for both time horizons.

Performance of fund and global equities year-to-date

Source: FE Analytics

The fund’s focus on quality-growth stocks however may leave it vulnerable to rising long-term yields and valuation headwinds if macroeconomic conditions change for the worse.

Some investors fear that if central banks tighten too sharply, it may tip global economies into a downturn or recession – especially given the war in Ukraine and coronavirus resurgence in Asia further complicating the economic outlook.

As such, Trustnet asked experts whether they would buy, hold or sell the fund given the potentially challenging market conditions.

Laith Khalaf, head of investment analysis at AJ Bell, suggested investors should hold.

“James Thomson isn’t a household name in the investment industry like Terry Smith or Nick Train, but his performance at the helm of Rathbone Global Opportunities merits a place at the top table of exceptional fund managers of the last two decades,” he said.

“Thomson’s approach is to pick a concentrated portfolio of growth stocks, though individual position sizes are relatively modest, which mitigates stock specific risk and allows for a broader contribution to returns from investee companies.”

Although Thomson is a growth manager, Khalaf pointed to his pragmatic approach which saw him tilt his portfolio towards stocks set to benefit from the reflation trade last year.

“Thomson is also only relatively young, so unlike many other managers with a successful 20-year track record under their belt, he could conceivably have another couple of decades in front of him,” he added.

“The growth investing style might face a more challenging time now interest rates are rising, but through the cycle, Thomson’s stock picking skills should still deliver the goods for investors.”

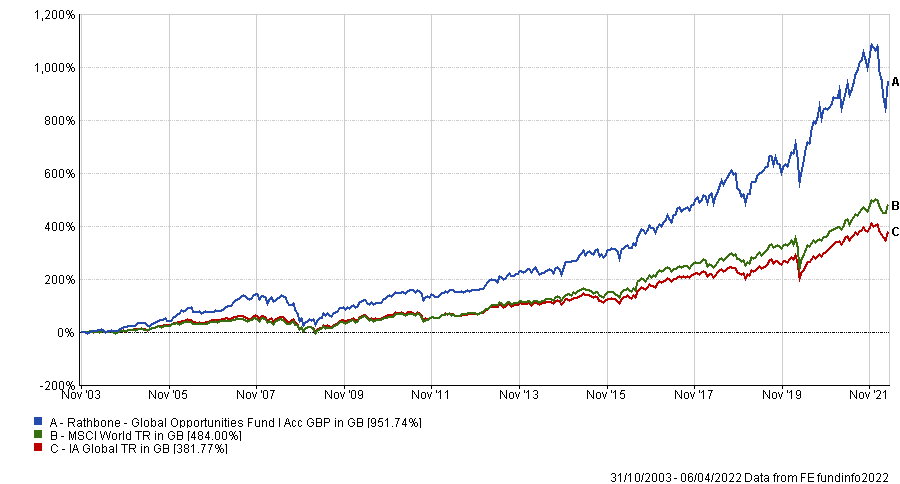

Performance of fund vs sector and global equities under Thomson

Source: FE Analytics

Darius McDermott, managing director at FundCalibre, also pointed to Thomson’s pragmatic approach.

“What impresses us most about James is his constant willingness to adapt and learn. A good example of this came after a difficult period during the global financial crisis in 2008, when he subsequently added in a defensive bucket of steady companies to the portfolio,” he said.

“We also like James’s willingness to look beyond the most obvious and well-known stocks. Most of his best ideas come from the mid-cap segment of the market, adding to his outperformance.”

Given the fund’s growth tilt, McDermott said it isn’t surprising that the fund has underperformed year-to-date. In fact he expects this.

“The portfolio does what it says on the tin,” he said. “We would consider adding to it on weakness when its style is out of favour. It is a rock-solid buy rating.”

Rob Morgan, chief analyst at Charles Stanley, praised Thomson for taking “full advantage” of the favourable conditions for growth investors through his “sensible” portfolio construction and good stock picking.

“This is a truly actively managed fund and Thomson has a clear view of what he wants in a stock,” he added. “The willingness and ability to completely avoid sectors and stocks that do not fit his qualitative criteria is an attraction of an active global growth fund.”

However, Morgan suggested investors pay attention to the fund’s size, which now stands at £3.9bn.

He warned that this large size is a factor to mindful of, given its lessened ability to access mid-cap names like it has in the past.

“Nonetheless, it is a good-quality option in the sector and therefore a hold and potentially something that could be added to on weakness in good quality growth companies,” he said.

“Although a more inflationary environment does pose risks in the short term, the robust nature of the holdings as well as an allocation to a defensive bucket, should mean it’s more of an ‘all weather’ option than an out-and out growth-orientated investment.”

Ben Yearsley, director at Fairview Investing, said he is still a buyer and holder of the long-term growth fund even though “we aren’t currently in a long-term growth market”.

But just in the same way he still holds value funds when they are out of favour he will do exactly the same with growth funds today.

“It’s all about having a balanced portfolio with different size, style and geographic biases,” he said. “Undoubtedly with inflation and rising rates high growth will come under pressure and it remains to be seen whether managers are true to their style or chase performance in uncomfortable periods.”

He pointed to Thomson’s track record of managing money through different market phases for the past 20 years and said he “should be adept at this”.

“There may be pockets of weakness when you can top up or buy for the first time, but there isn’t a rush in my view,” he added.

Emma Wall, head of investment analysis at Hargreaves Lansdown, also suggested investors hold Rathbone Global Opportunities rather than sell out. Like the previous commentators, she praised Thomson and said he is a “highly experienced and talented” fund manager.

“Our analysis shows that Thomson adds value through stock selection, and his robust track record places him favourably amongst peers,” she explained. “Yes, growth investing has been challenged of late, and plenty of uncertainty remains, with ongoing war in Ukraine and rising interest rates across the developed world.

“However, if you take a long-term view – which equity investing should be – then this period of volatility shouldn’t put you off this quality fund.”