The US has been the dominant global market over the past decade, with mega-cap companies such as Microsoft and Apple having a far-reaching international influence.

Of the 52 sectors in the investment association universe, IA North America was the third best performer over the past decade, climbing 272.9%.

Not to be outdone, the IA North American Smaller Companies is fourth, up 243% as the market is full of fast-growing healthcare and technology companies which have also benefited from the same trend as their large-cap counterparts.

However, it is notoriously difficult to beat the US market as it is so heavily dominated by these tech stocks. Indeed, among the 112 IA North America funds with a long enough track record, just 29% have beaten the S&P 500 index over 10 years.

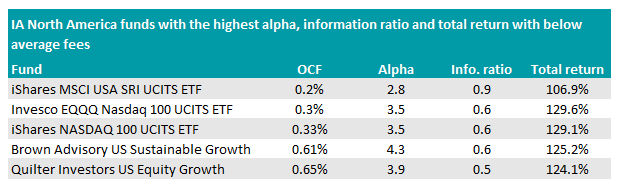

In the latest of its study, Trustnet has narrowed down the US funds that were within the sector’s top 10% for alpha, information ratio and total return over the past five years while charging investor’s below average prices. All data is benchmarked to the S&P 500.

IA North America

Some of the cheapest and best performing funds in the sector over the past five years were passives, with those that bought more tech-heavy indices coming out on top.

By tracking the US’ largest companies in the NASDAQ 100 index, the Invesco EQQQ Nasdaq 100 UCITS ETF and iShares NASDAQ 100 UCITS ETF made a total return of 129.6% and 129.1% over the period.

Both had an alpha score of 3.5, while investors paid an ongoing charges figure (OCF) of around 0.3% to hold the fund.

Another tracker fund, the iShares MSCI USA SRI UCITS ETF, met all the requirements and had a cheaper fee of 0.2% but did not perform as well.

It was up 106.9% over the past five years by tracking a backet of top environmental, social and governance (ESG) stocks held in the MSCI USA SRI Select Reduced Fossil Fuel index.

The fund performed well over the period compared to the rest of the sector, but the other two passives fared better by following the broader US market.

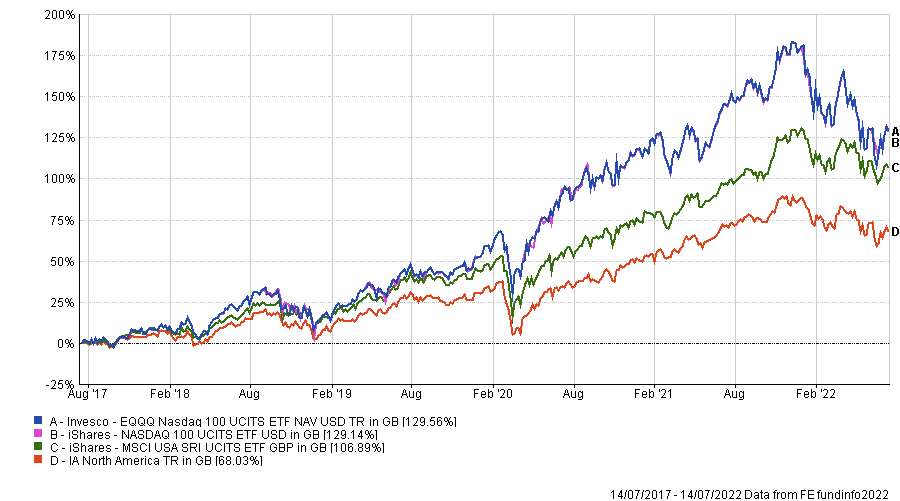

Total return of funds vs the sector over the past 5 years

Source: FE Analytics

On the actively managed side, the Brown Advisory US Sustainable Growth fund had the highest alpha on the list at 4.3 but its 0.61% charge was double that of the passives.

It was launched by managers David Powell and Karina Funk in April 2017, with returns climbing 125.2% over the past five years.

Technology assets make up the majority of the portfolio’s holdings at 42%, but this is slightly underweight the Russell 1000 Growth benchmark’s 46.2%. Instead, exposure to the healthcare sector was 14.2 percentage points higher than the index at 23.3%.

These high allocation to very growth-oriented sectors may have contributed to it being in the bottom quartile for volatility over the past five years, but its Sharpe ratio of 0.7 made it the second highest in the sector. This suggests that holding the fund over the period was a worthwhile ride, despite a bumpy journey.

Total return of fund vs sector

Source: FE Analytics

Likewise, the Quilter Investors US Equity Growth fund was also a profitable holding over the past five years, up 124.1%.

Returns were most likely boosted by its high allocation to FAANG companies Apple, Microsoft, Alphabet and Meta, which make up its top 22.6% of asset holdings.

It was one of the worst funds in the sector for volatility and downside risk but had the fourth highest returns, so investors who are not averse to risk taking may wish to consider this one.

That being said, its alpha of 2.1 was lower than some of the passives whilst also being more expensive, with an OCF of 0.68%.

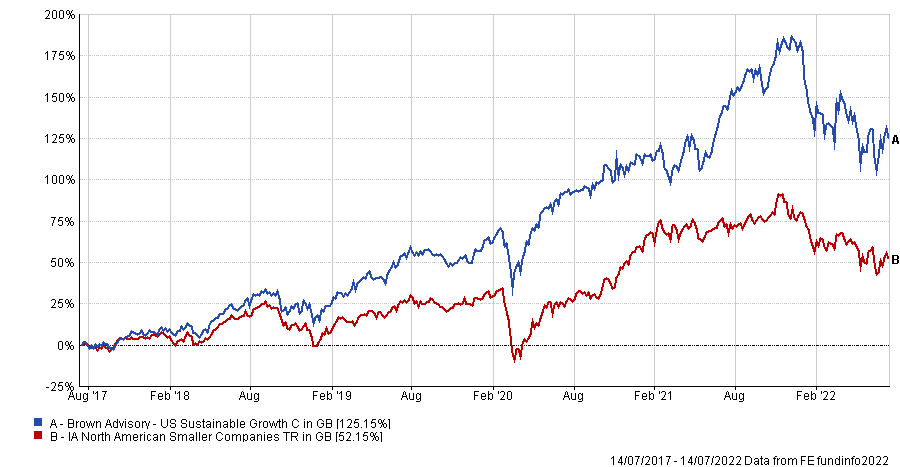

IA North American Smaller Companies

With a much smaller selection of portfolios to choose from, none of the 28 US smaller company funds met all the requirements.

Some did come close, however, such as the Brown Advisory US Smaller Companies – it outperformed its peers with a total return of 64.9% over the past five years and had a top decile alpha rating of 4.9.

Returns were within the top 20% of the sector, rather than 10%, but its top quartile Sharpe ratio of 0.4 suggests the risk and reward were a good balance.

Total return of fund vs sector over the past five years

Source: FE Analytics

The T. Rowe Price US Smaller Companies Equity Fund, on the other hand, had the second highest returns in the sector over the past five years, leaping 78.8%.

It’s alpha of 4.7 also ranked within the top decile, but the 0.5% information ratio meant it dipped into the top 20%.

Over the period, it had the lowest maximum gain when markets went up, but also had the lowest max drawdown when its peers were in decline.

Its 1.06% OCF is slightly higher than the sector average, but investors may be willing to pay this for the consistency in returns.

| Fund | OCF | Alpha | Info. ratio | Total return |

| Brown Advisory US Smaller Companies | 0.86% | 4.9 | 0.5 | 64.9% |

| T. Rowe Price US Smaller Companies Equity Fund | 1.06% | 4.7 | 0.5 | 78.8% |

Performance over five years.

Previously, Trustnet has looked at the cheapest funds offering top alpha, information ratios and total returns in the IA UK All Companies, IA UK Equity Income and IA UK Smaller Companies sectors.