Savings rates have improved significantly following this morning’s announcement that UK inflation spiked at 10.1% in September, which could work to savvy investors’ advantage, according to Rachel Springall, finance expert at Moneyfacts.

The rapid rate of inflation means that firms are offering the best deals they have in years, but they can change very quickly.

Although there is the potential for a significant interest rate hike at the next Bank of England Monetary Policy Committee meeting on 3rd November (the rate at which savings rates are calculated against), some accounts are already pricing in significant raises, which may or may not occur.

Indeed, now that the government and new chancellor Jeremy Hunt has walked back some of his predecessors pro-growth policies, which many speculated would lead to even higher interest rates, the Bank may not have to raise rates by as much as previously expected.

She added: “Savers would be wise to review their existing accounts now and switch to take advantage of the latest top rate deals.

“As we have seen time and time again, there is no guarantee that savers will see much benefit from a Base rate rise, so it’s important they reconsider their loyalty if they are getting a raw deal.”

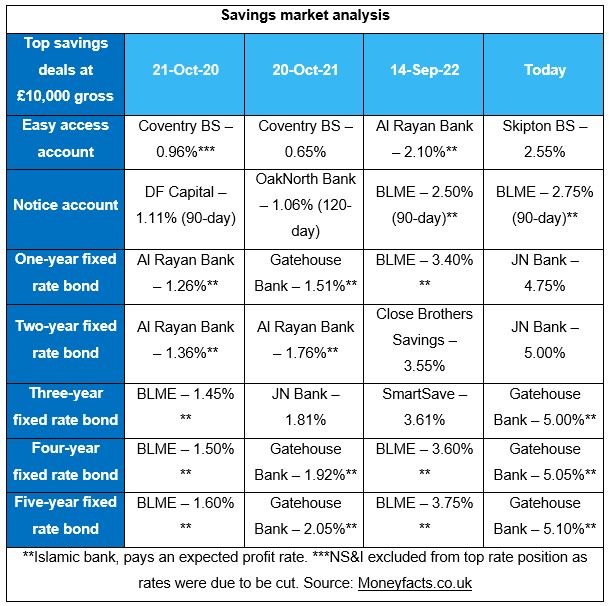

Those who have one-year bond yields approaching maturity may be interested to know that today’s best deal of 4.75% from JN Bank is 3.24 percentage points higher that Gatehouse Bank’s top rate of 1.51% this time last year.

Investors looking to tie up their cash for the medium-term could grab a savings rate of more than 5% by buying a three-year, four-year or five-year fixed rate bond.

Source: Moneyfacts

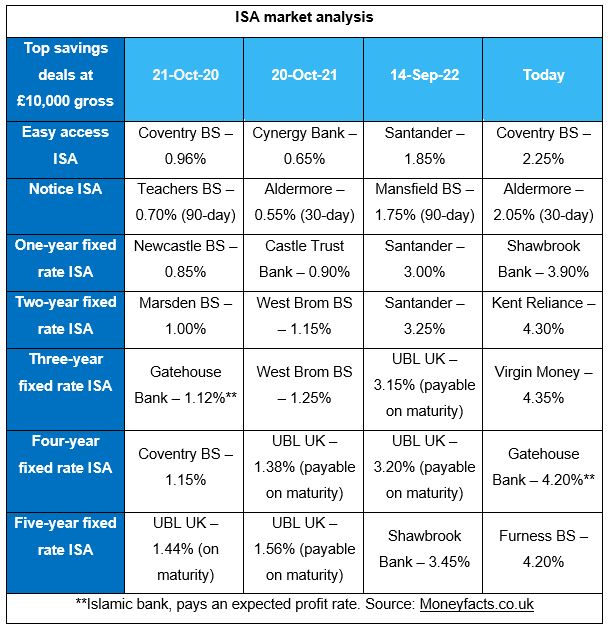

One-year cash ISAs are also up from last year, with Shawbrook Bank offering the top deal of 3.9%, up 3 percentage points from Castle Trust’s high of 0.9% 12 months ago.

The same can be said for longer-dated fixed rate ISAs, which are offering more than 4% for three-year, four-year and five-year deals.

However, one-year fixed bonds currently pay better, so “it’s imperative savers consider both their ISA allowance and their personal savings allowance along with comparing interest rates,” according to Springall.

She added: “Amid the cost-of-living crisis, some savers may prefer to keep their cash close to hand, and thankfully, variable rates on both easy access accounts and ISAs have improved but savers will need to check the terms of each account to ensure it suits their needs.”

Source: Moneyfacts

All of these deals are far from outpacing 10.1% inflation, but they’re very high compared to their historical average.

Springall said that the divergence between savings rates and inflation could narrow if the CPI index lowers to 8.4% in the third quarter of next year, making these deals even more attractive.

She added: “Inflation is still very much eroding the true spending power of savers’ cash, so it’s imperative savers do not become apathetic to switch at a time when competition in the top rate tables is rife.”