If you own Baillie Gifford Managed, its downward spiral will not have gone unnoticed.

The fund, co-managed by Iain McCombie and Steven Hay, was close to achieving the £10bn milestone of assets under management in September 2021, when it stood at £9.6bn.

Since then, inflation concerns and interest rate rises have hit the growth stocks that the fund (and its wider asset manager) have become known for. Now it stands at £6.3bn.

Yet much of this is performance-based. Indeed, just £483m has been pulled out by investors, according to FE data, while £2.7bn has been lost due to negative performance.

As such, many investors have clung on and it remains one of the biggest in its IA Mixed Investment 40-85% Shares sector. In fact, there are only six funds that have more in assets under management than the fund lost (£3.1bn) over the past year.

Whatever shape the fund’s performance curve might draw going forward, investors who continue to back it might want to make sure that the rest of their assets don’t replicate it.

Correlation data might come in handy, helping to identify which funds are exposed to the same risks as this struggling giant.

Performance of fund against sector over 5yrs

Source: FE Analytics

Laith Khalaf, head of investment analysis at AJ Bell, said that, as a mixed-asset fund, Baillie Gifford Managed can function as a core holding in a portfolio for investors looking for exposure to both bonds and equities.

“However, it is more risk-hungry than most mixed-asset funds and likely to have a higher equity weighting than most, as well as a preference for the growth-orientated stocks typically favoured by the Baillie Gifford investment philosophy,” he noted.

This has helped the fund over the long term, in which it is a top-quartile performer over three, five and 10 years – it is only over the past 12 months that the fund has ranked in the last position of its sector and fell 18 percentage points below its benchmark.

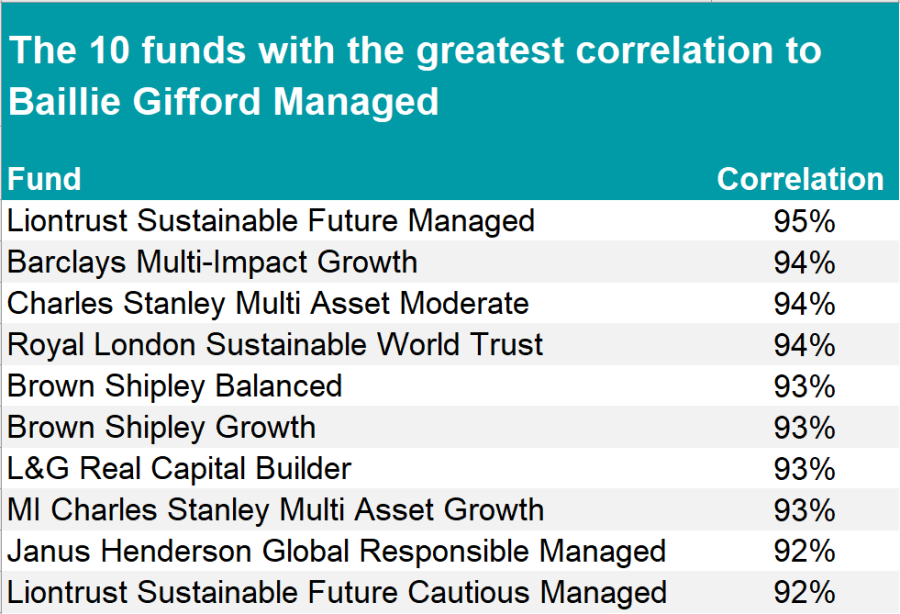

This differentiating trait translates into a wide range of correlation levels to other peer funds, spanning from 95% all the way down to 57%.

Source: FE Analytics

At the top of the table is Liontrust Sustainable Future Managed, whose performance moved in tandem to Baillie Gifford's 95% of the time. Like Baillie Gifford Managed, this fund also began its downward trajectory in late 2021. Its top weightings are to financials and technology equities in the US and the UK.

Also highly correlated are those funds that focus on growth, understandable considering Baillie Gifford’s penchant for these types of stocks. At 94%, Barclays Multi-Impact Growth occupies the second place in the ranking of the most correlated funds, not too far from Brown Shipley Growth and Charles Stanley Multi Asset Growth, both at 93%.

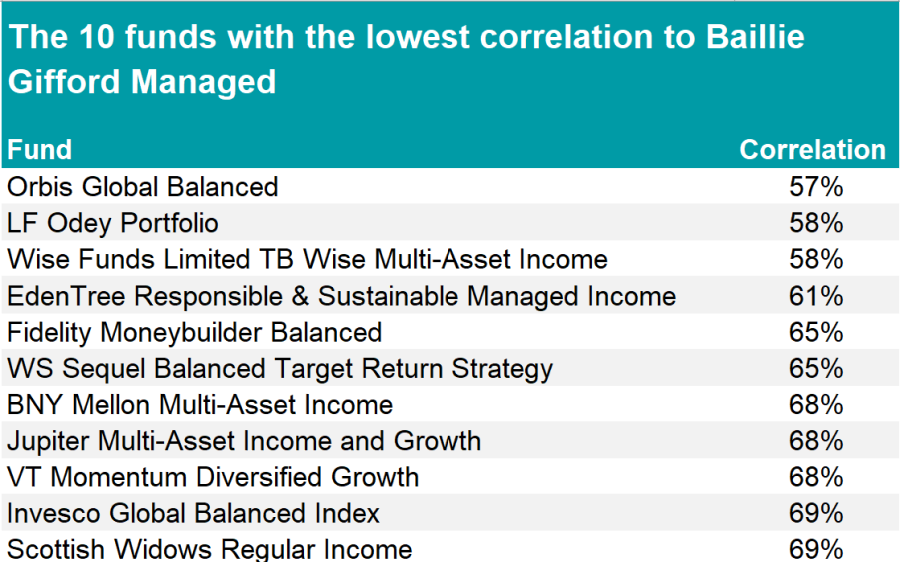

On the other side of the spectrum, funds with an income-based approach are at the bottom of the table, where they make up most of the top 10 of the least correlated funds, as shown below.

Source: FE Analytics

Wise Multi-Asset Income and EdenTree Responsible & Sustainable Managed Income achieve very low correlation at 58% and 61%, respectively, while Jupiter Multi-Asset Income has a 68% correlation.

However, it was Orbis Global Balanced that was the least correlated. It is much nimbler and has almost tripled in size in recent years, going from £37m in March 2020 to £100m at the end of October 2022. It is mainly invested in North American basic materials and industrials companies, although its top investments also include European and South Korean holdings.

While mixed-asset funds are diversified, the data shows that “there’s still a case for holding a few funds with differing styles in order to achieve a balance of investment approaches”, said Khalaf.

“For most investors looking for a multi-asset approach, Baillie Gifford Managed is likely to be towards the top end of their risk appetite, and so they might consider supplementing it with a more conservative mixed-asset fund like Personal Assets Trust or Ruffer Total Return.”