Equity funds lost £6.3bn of investors’ capital in 2022, marking it as the worst year for outflows in at least seven years, according to the latest data from Calastone.

The majority of these withdrawals occurred in the latter half of the year, with 75% of the outflows leaving equity markets in the third quarter alone.

Investors began to get cold feet as escalating inflation and interest rates showed no sign of stopping, but UK-focused funds were hit the worst.

Edward Glyn, head of global markets at Calastone, said: “Such large outflows from equity funds in 2022 without a corresponding increase in other asset classes is a very large vote of no-confidence.”

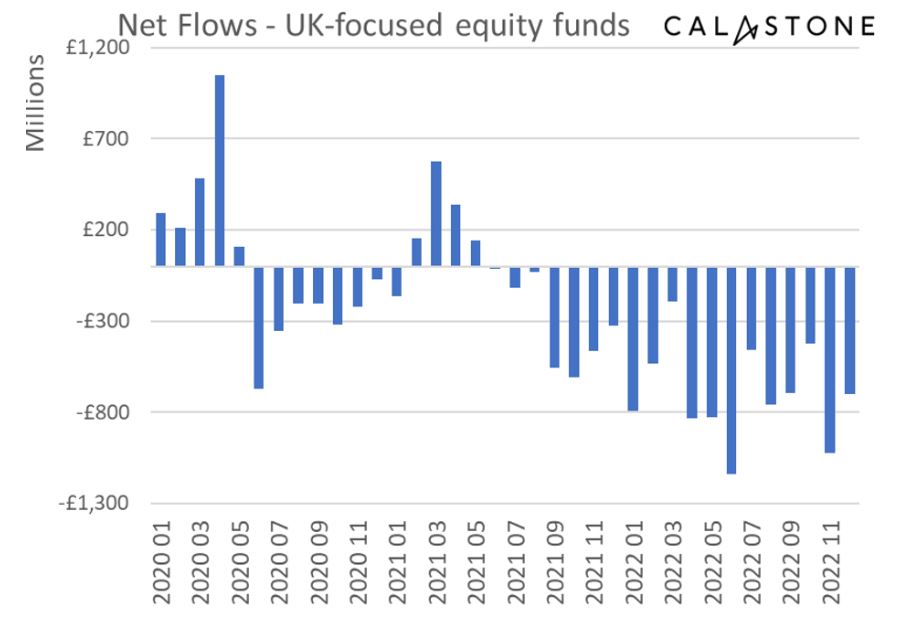

Funds investing in UK equities suffered a record high outflow of £8.4bn throughout the course of the year, meaning they have not had net inflows since May 2021.

Net flows of UK-focused equity funds over the past two years

Source: Calastone

This was the second consecutive year of net outflows for UK funds, but European portfolios had their fourth consecutive year of net selling as £2.7bn left the market. Indeed, North America funds also lost £1.2bn in 2022, making it the first year of net outflows since 2016.

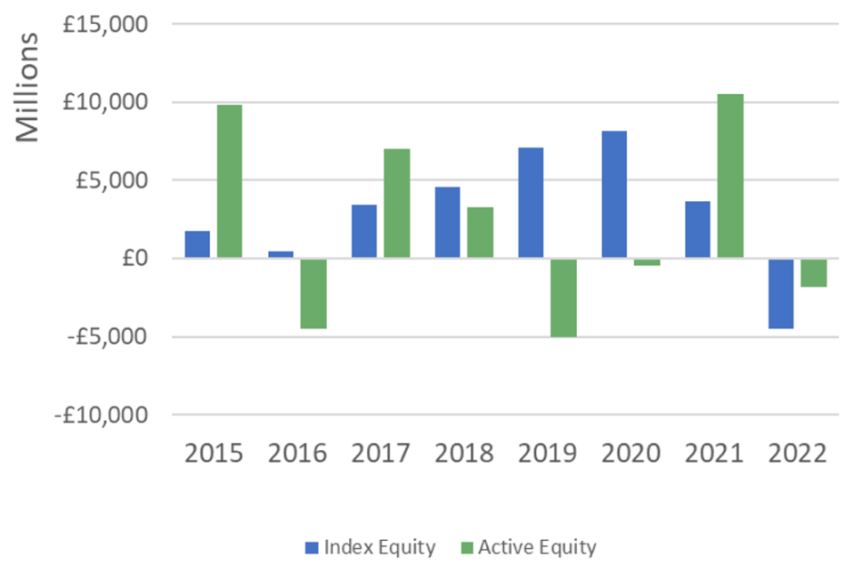

Passive equity funds had their first year of net outflows on record as investors withdrew £4.5bn from them, which is significantly higher than the £1.8bn divested from their active counterparts. Global index trackers shed the most, losing £3.3bn in 2022.

There was one bright spot however, as active global funds raised £8.1bn in new capital. The report by Calastone said this hike in sentiment was due to the rising popularity of environmental, social and governance (ESG) investing.

Passive vs active equity funds flows over the past eight years

Source: Calastone

Global ESG equity funds attracted £6.4bn in 2022, while those without an ESG mandate shed £1.5bn throughout the course of the year.

Among more optimistic investors, sentiment appeared generally more positive towards the end of the year, with £381m entering equity funds in December.

Forecasts that inflation has peaked and interest rate hikes are coming to a close could have boosted confidence, but investors were still unwilling to touch UK funds, with an additional £701m leaving that market that month.

Glyn said: “There is enormous uncertainty over the future course of interest rates and economic growth around the world and we may yet see the bear roar again before the bull market cycle can begin anew.

“The expectation that the UK economy will suffer the worst recession among major economies has prevented the current burst of optimism spreading to UK-focused funds.”

Meanwhile, in the property sector, funds experienced their lowest outflows since 2018, with just £535m taken out of these portfolios, a quarter of the £2.1bn withdrawn in 2021.

Open-ended property funds have been under fire since 2016, when Brexit caused a mass withdrawal from investors who were unsure whether the UK economy could thrive. These funds were forced to suspend dealing in an effort to raise the funds to pay back the investors that wanted out (through selling property – a notoriously slow process).

Glyn said that there may be more paint o come however, as interest rate rises will impact property prices, although inflation-linked rents may cushion the blow. Additionally, with recession on the cards, commercial property may struggle as businesses are unable to afford rental space.

“Sentiment has improved markedly, but there is enormous uncertainty over the future course of interest rates and economic growth in the UK and around the world, and we may yet see the bear roar again before the bull market cycle can begin anew,” he said.