Inflation in the UK stood at 10.1% in January as the rate of price increases dropped 0.4 percentage points from December, according to the latest findings by the Office for National Statistics (ONS).

This marks the third month consecutive month of inflation declines, with the consumer price index (CPI) falling from 11.1% high in October.

In January, household expenses, namely gas and electricity prices, continued to be the largest contributor to swelling costs.

Meanwhile transport prices, including motor fuels, were one of the main drags on rising inflation along with declines in restaurants and hotel prices.

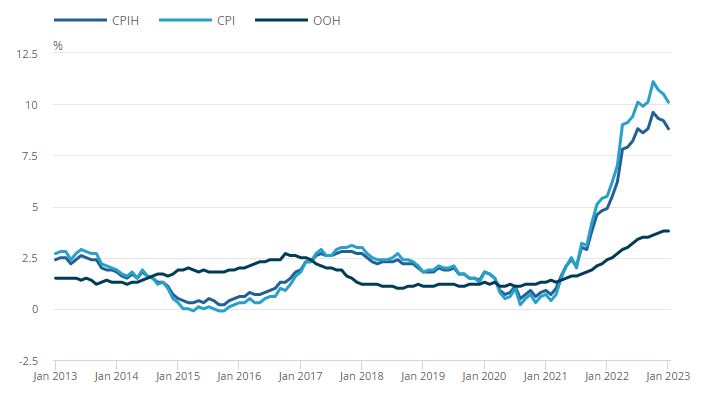

Inflation rates over the past 10 years

Source: ONS

Easing restaurant and hotel costs are a particularly encouraging sign given they have been susceptible to wage inflation, according to Hugh Gimber, global market strategist at JP Morgan.

However, he warned investors not to get too excited by falling inflation – rates are still far above the Bank of England’s 2% target and higher rates will likely be needed to return to normal levels.

Gimber said: “Both investors and policymakers should be wary of reading too much into one month of data. The overall message from this week’s data is that inflationary pressures in the UK economy remain strong, and further rate hikes are necessary.”

Indeed, he expects interest rates to rise an additional 50 basis points over the coming months before inflation gets under control.

Even so, a peak in interest rates does not necessarily signify the end of the cycle – the Bank might not begin to ease rates until the end of the year if inflation remains high, according to Ben Gutteridge, director of model portfolio services at Invesco.

This may be the case as current forecasts of inflation reaching 3% by the end of 2023 appear “ambitious,” he said.

However, he reassured investors that these projections have already been priced into UK stocks, so shareholders don’t need to worry about sharp drops in share prices if interest rates remain high.

Gutteridge said: “Though such an outcome makes for troubled reading, equity markets are forward looking in nature. This means UK stock markets can still perform well, even in the midst of a recession, as investors begin to anticipate recovery.

He also noted that many of the largest companies in the UK stock market are global in nature, so the domestic economy has relatively little sway on them.

Nonetheless, January’s inflation figures show that the Bank’s monetary tightening is having the desired effect, according to Rob Morgan, chief investment analyst at Charles Stanley.

He said: “While overall annual inflation is still in double digits, and there is still a long way to go, the trend of the past three months shows inflation is now cooling.”

Morgan agreed that interest rates are likely to reach 4.5% by the summer but he said that declining inflation has given the Bank more flexibility with future hikes.

He expects small hikes of 0.25 basis points at each of the monetary policy committee’s meetings, which will be gathering next on 23rd March.

Shallower hikes are a good sign, as raising rates too quickly at this late stage of the cycle could plunge the economy into a hard landing.

Morgan said: “The UK has experienced the highest annual inflation rate since 1981 and the Bank will want to stamp it out for good. Yet it is also fearful that setting rates too high could stall the economy and worsen any recession.”