Europe has enjoyed a renaissance over the past year as the market has surged despite headwinds including the Russia-Ukraine war, a potentially behind-the-curve central bank and high inflation.

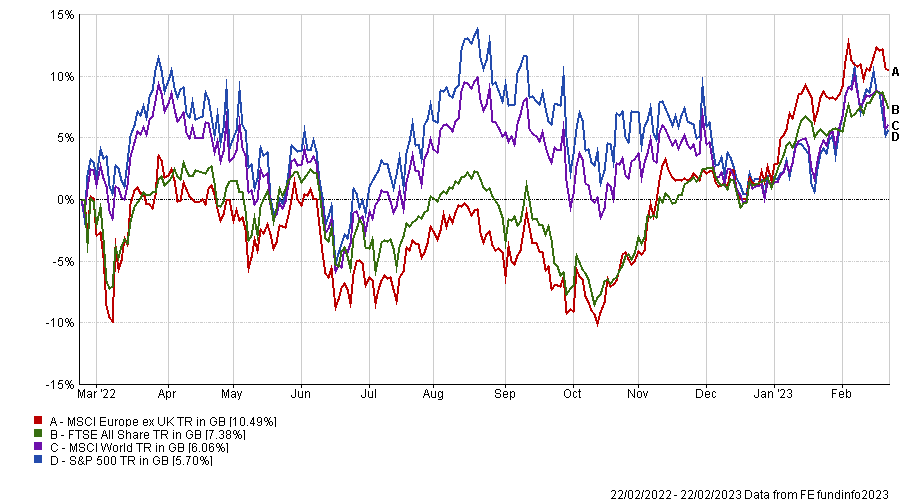

The market has surged over 12 months, with the MSCI Europe ex UK index up 10.5%, ahead of the S&P 500, MSCI World and FTSE All Share indices, as the below chart shows. Much of its gains have been recent. Since the calendar turned over to 2023 the European index is up 8.8%.

Some now believe Europe could overtake the US for the first time in decades. Writing for Trustnet earlier this month, James Sym, manager of the R&M European fund, called for a reassessment of the huge overweighting to the US in anticipation that valuations will soar and that the next bull cycle will belong to Europe.

Performance of indices over 1yr

Source: FE Analytics

However, where these opportunities lie is up for debate. While some see value in the companies on the continent leading the charge for renewable energy, others like the luxury brands that litter the market.

Below, three fund managers polled by Trustnet all had different ideas, explaining why they are optimistic on stocks from the technology, financials and industrials sectors.

Amadeus

Marcel Stotzel, manager of the Fidelity European fund, picked Amadeus, a leading Spanish business that provides travel technology for airlines, travel agents, hotels and airports.

Performance of stock over 1yr

Source: Google Finance

The stock looks attractive both in the long term, where the firm has the potential to disrupt its whole industry, and the shorter term.

“It has a web across the whole industry, which it can use to aggregate data and make sure that things operate well together,” he said.

“The data analytics that it can use to optimise the procedure of booking a flight, leaving your home to the airport, flying and staying in a hotel is very, very powerful. As a small example, if your flight is late, the airport would want to know but the hotel would want to know too, and having integrated data makes a very big difference in terms of rearranging gates or rearranging landing slots.”

More potential also comes from the information technology itself, said Stotzel, who mentioned the disruption US passengers suffered in December last year, when Southwest Airlines had to cancel more than 16,000 flights due to IT failures.

“The industry is still working on its systems. Travel agents or even agents in an airport still use old-school Matrix-style green screens. Ancient tech is still in use and it’s crumbling and needs to be refreshed,” the manager said. “It’s not going to wait another five years, so this is a real sweet spot to be in to take advantage of that.”

The company suffered a lot through Covid, Stotzel admitted, but its two biggest competitors have both become much weaker and as a result, Amadeus is getting very material market share.

“In the short term, the Asian travel market opening up again after the pandemic will boost returns as well,” he concluded.

Swissquote

Currently making up 2.7% of the Berenberg European Small Cap portoflio, Swissquote is manager Peter Kraus’ largest position, even though the fund is only lightly weighted on financials.

Performance of stock over 1yr

Source: Google Finance

“We don't own big southern European banks. After their performance in the past 20 years, there's not much attraction in terms of growth and margins now,” he said.

“Instead, we own other financials such as Swissquote, the biggest and most successful online broker in in Switzerland. The CEO and founder has a 15% share in the business, which is very entrepreneurial and innovative. It is attracting customers from the more established banks, from Credit Suisse to UBS, because it simply offers the best trading platform around”.

Kraus also highlighted the profitability of the company, whose earnings per share grow roughly 15 to 20% every year, he said.

“The pre-tax profit margin last year was around 42%, it’s highly cash-generative and we bought more of it as the stock was down in the first and second quarter of 2022. Now, it's one of the best performers in our fund and we sit on it for the long term.”

Befesa

Hywel Franklin, head of European equities at Mirabaud Asset Management, selected Befesa, whose stock initially floated on the Madrid stock exchange back in 1998 but is now listed in its adopted home of Germany.

Performance of stock over 1yr

Source: Google Finance

Befesa is an industrial processing business focused on the management of waste materials. Its operations focus on the treatment of metallurgical waste, particularly the collection and recycling of steel dust produced by steelmakers as a by-product of their manufacturing process.

“The company is a pioneer in the development of industrial processes for the circular economy and is an emerging global leader within the management of steel and aluminium waste products,” said Franklin.

“While Befesa may not be a very large company by stock market standards, it is the clear market leader in its area on a worldwide basis. In recent years, it expanded beyond its roots, dominating the European steel dust recycling market, establishing a dominant position in the US where it controls over half the market, and in Asia, where it is the pioneering market innovator and market leader in the Chinese market.

“Over the next few years, as Befesa’s Chinese production capacity comes online, it will extend its position still further, helping improve circularity in steel production globally,” the manager concluded.