Infrastructure investment trusts are emerging from a tough couple of years but there are many reasons to take a closer look at the beaten-up sector, from high dividends at a time when interest rates are coming down, to inflation protection and government-backed cashflows.

The IT infrastructure sector’s average dividend yield was 6.2% as of 31 December 2024, according to the Association of Investment Companies (AIC), while wide discounts (a sector average of -20.4%) offer new investors an attractive entry point and serve as a catalyst for boards to take action.

Markuz Jaffe, an analyst at Peel Hunt, said companies are employing a range of approaches to address persistent discounts, “often featuring capital allocation and comprising one or more of share buybacks, asset disposals, reducing leverage, upgraded dividend guidance or a revamped investment strategy”.

Discounts have also, in some cases, triggered continuation votes. Peel Hunt expects 11 infrastructure investment companies to hold a continuation or discontinuation vote over the next two years, representing more than half of the sector (excluding trusts that have proposed or initiated a wind-up). These include six trusts with discount-triggered mechanisms, four calendar-driven votes and one size-driven vote.

Jaffe expects these to spur boards into action ahead of time. “It's not so much the vote that usually causes the fireworks. It's what the boards do in advance of the vote that tends to be the marker in the sand, at which point the board or the manager or both realise they need to make sure investors are on side,” he said.

Hassan Raza, a portfolio manager at Capital Gearing Trust, agreed. “With the trust sector on high alert due to activist investors and several continuation votes on the horizon this year, boards will be under significant pressure to deliver strategic solutions that unlock shareholder value,” he said.

The infrastructure trust sector is also undergoing a wave of consolidation through wind-ups, mergers and acquisitions (M&A).

British Columbia Investment Management Corporation’s (BCI) has just bid for BBGI Infrastructure, which has a market value of £871m. And in November 2024, Atrato Onsite Energy’ commercial and residential rooftop solar portfolio was acquired by Brookfield Asset Management and Real Asset Investment Management in a £220m deal.

Meanwhile, several listed infrastructure strategies have initiated wind-ups in the past two years, especially at the smaller end of the market-cap spectrum.

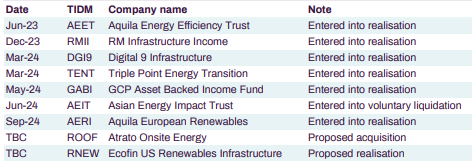

Infrastructure trusts that entered into or proposed a wind-up between Jan 2023 and Oct 2024

Sources: Peel Hunt, company data

Some wealth managers and asset allocators are taking advantage of these catalysts to move back in. Capital Gearing Trust recently increased its exposure to infrastructure assets, Raza said.

“Core infrastructure is particularly attractive on a risk-adjusted basis but, at these discounts, some solar funds are priced as if the sun won’t rise tomorrow. The market appears dislocated, requiring both consolidation and the return of capital,” he explained.

Jason Borbora-Sheen, co-portfolio manager of Ninety One’s multi-asset income strategies, sold out of infrastructure trusts in 2021 but has been building up his exposure since the end of 2023, although he remains “very cautiously sized”. He holds HICL Infrastructure, International Public Partnership, 3i Infrastructure and BBGI Global Infrastructure.

Infrastructure trusts are a “riches to rags” story having been the “darlings” of the wealth management industry between 2008 and 2019, Borbora-Sheen said. Wealth managers used infrastructure to generate income when interest rates were low but as rates rose they gravitated towards bonds instead. Selling pressure, an increase in discount rates and the macroeconomic backdrop led to a derating.

Going forward, he does not expect these trusts to rerate unless gilt yields crash but their dividend yields are so high that investors are being paid to wait. “You won’t make massive capital gains,” he pointed out, but these trusts serve as a valid alternative to bonds because they provide inflation-linked, government-backed cash flows.

He expects inflation to be more volatile over the next 10-15 years than in the recent past, which would impact the correlation between bonds and equities, making assets with an element of inflation linkage more attractive.

Robert Fullerton, a senior research analyst at Hawksmoor Investment Management, agreed. Infrastructure debt pays higher yields than corporate bonds, both in terms of the dividend yield and the underlying portfolio yield, at a time when credit spreads are tight, he said.

However, Matt Ennion, head of investment fund research at Quilter Cheviot, said large discounts are a challenge. Core infrastructure trusts used to have too much debt but they have been selling assets to pay that down and buy back shares. “I just think they need to be a bit more aggressive at this stage because [discounts have] drifted on for a long time,” he said.

Once discounts come in, he believes trusts should recycle capital into higher returning investments such as construction.

The story is similar for renewable energy trusts but they still have a lot of debt and are not doing enough buybacks, Ennion said. He also thinks there are too many small trusts and consolidation is inevitable. “There’s a buyers’ strike at the moment and if there’s no demand, you’ve got to reduce the supply,” he said.

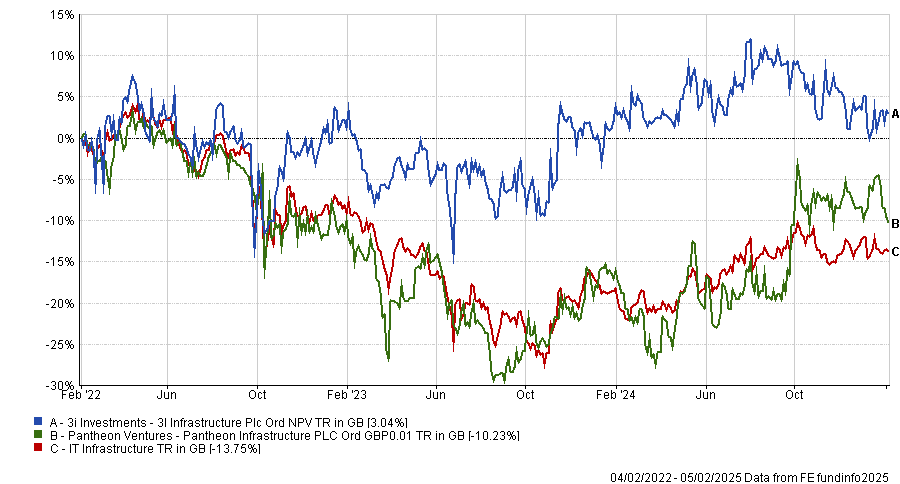

His two outstanding infrastructure trusts are 3i Infrastructure and Pantheon Infrastructure. They both have good track records, strong performance and high-quality assets.

Performance of trusts vs sector over 3yrs

Source: FE Analytics

They pursue a private equity style strategy: buying assets or companies and improving their value before selling them on five to seven years later. Even so, their discounts are wide, which offers value to new investors, he noted.