Six funds in the IA Asia Pacific Excluding Japan sector with strong long-term performance are going through a rough patch right now and three of them are managed by Fidelity International.

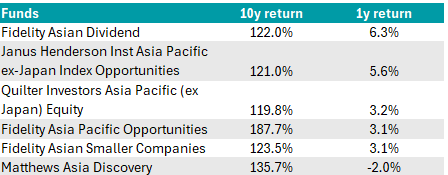

Fidelity Asian Dividend, Asia Pacific Opportunities and Asian Smaller Companies have gone from being first-quartile within their sector over a 10-year period to bottom quartile over the past 12 months.

In this series, Trustnet is looking at long-term outperformers that are currently having a hard time and vice versa, the funds that have emerged over the past 12 months after a decade of hardship.

At £1.4bn, the largest in the list by assets under management (AUM) is Fidelity Asia Pacific Opportunities, run by FE fundinfo Alpha Manager Anthony Srom. It was the top fund by returns in its sector over the past 10 years, returning 185.4% against the 89.6% of the average peer. Yet it couldn’t keep up with its own success over the shorter term, sinking to 96th position out of 117 funds over one year and trailing the competition by almost three percentage points.

Researchers at RSMR still back the fund, which they deemed “suited as a satellite holding, unless investors are willing to exercise a degree of patience”, and admired the manager’s ability to avoid ‘overheated’ areas of the market.

Performance of funds against sector over 1yr

Source: FE Analytics

The second-largest of the three funds is Fidelity Asian Smaller Companies, led by Alpha Manager Nitin Bajaj, who follows a fundamentals-driven, bottom-up approach.

Like many managers in this list, his style is tilted towards value. Having remained in the first quartile of performance over 10, five and three years, the fund has been struggling at the bottom of the fourth quartile this past year, with a 5.9% return against the sector’s average of 14.8%.

Finally, Asian Dividend, managed by Jochen Breuer, has a small portfolio of £73m, invested in a concentrated number of dividend-paying mid- to large-caps and some small-caps. It has a historic yield of 3.6%.

A spokesperson at Fidelity International attributed the difficulties of these funds to top-down macro factors, such as weak Chinese consumption, tech demand driven by artificial intelligence, evolving shareholder initiatives and government policy, which significantly influenced Asian equity markets last year.

“2024 was driven by a narrow market leadership, particularly among large-cap stocks, and strong momentum in markets like India, Japan, and Taiwan. Our performance is strongest when corporate fundamental factors drive markets,” they said.

“While it may face headwinds in narrow markets, our focus on fundamental research and robust portfolio construction positions us for future success. These periods often provide mispriced opportunities that long-term fundamental investors can capitalise on when markets normalise.”

The Asian market remains one of Fidelity’s strengths, as fund pickers told Trustnet, with a suite of vehicles that have generally performed well, thanks to strong resources in the region.

Concluding the list of short-term tailgaters are Janus Henderson Inst Asia Pacific ex-Japan Index Opportunities, Quilter Investors Asia Pacific (ex Japan) Equity and Matthews Asia Discovery.

Long-term outperformers struggling in the short-term

Source: Trustnet

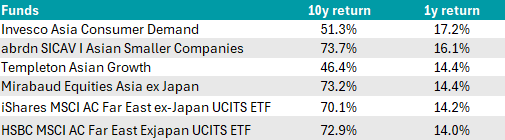

Leaving value and special situations funds behind, six long-term underperformers that follow a momentum or growth-driven approach seem to be turning a corner.

With the Asian market staging a recovering over more recent timeframes, two passive exchange-traded funds (ETF) in particular have captured the most of this upside, iShares MSCI AC Far East ex Japan UCITS ETF and HSBC MSCI AC Far East ex Japan UCITS ETF.

Among the actively managed cohort, Invesco Asia Consumer Demand stood out for having achieved the highest return over the year among the funds in this study (17.2%). Managers William Yuen, Shekhar Sambhshivan and Mike Shiao invest in companies that they think will benefit from growth in domestic consumption in Asian economies.

Judging by its AUM, the Templeton Asian Growth fund is the most popular of the six vehicles on the mend, with £1.7bn in its portfolio. Managed by Sukumar Rajah and Eric Mok, its top-10 holdings include recognisable names such as Taiwan Semiconductor Manufacturing Company, Tencent, Alibaba and Samsung.

Long-term underperformers recovering in the short-term

Source: Trustnet

One small-cap fund has made the list too: abrdn SICAV I Asian Smaller Companies. It has returned 15.8% in the past year, in line with the sector and well above its benchmark, the MSCI AC Asia Pacific ex Japan Small Cap index (4.9%).

Mirabaud Equities Asia ex Japan completed the list.

This article is the second instalment of a series and follows a review of the IA UK All Companies sector.–