The UK has come roaring back into fashion over the past year or so as a number of factors have caused the domestic market to outperform most of its rivals.

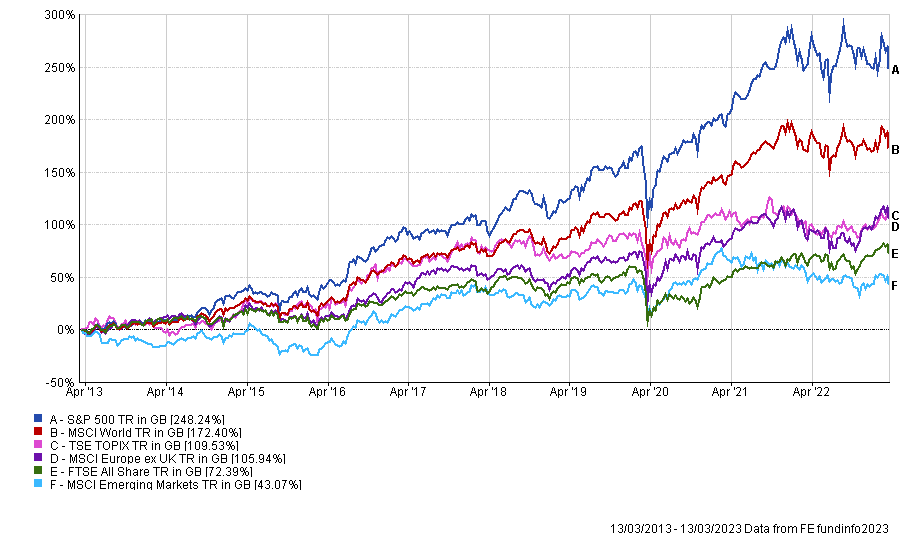

Over 12 months, the FTSE All Share index is up 10.7%, beating the likes of the Japanese Topix and US S&P 500 as well as the MSCI Emerging Markets index. Only the MSCI Europe ex UK index is ahead, up 15.6%.

This is, in part, thanks to its composition, with the UK market made up of a number of ‘value’ sectors such as oil, commodities and financials, which have soared since the Covid pandemic.

Inflation – caused initially during the global re-opening and turbocharged by Russia’s invasion of Ukraine – has flipped the economic script. Central banks have aggressively hiked interest rates and removed monetary stimulus for the first time in more than a decade.

But this is only a near-term phenomenon. Indeed, against the same peer group composite, the FTSE All Share has been the second worst performer over 10 years, up 77.1% (around a third of the S&P 500’s gain).

Performance of indices over 1 and 10yrs

Source: FE Analytics

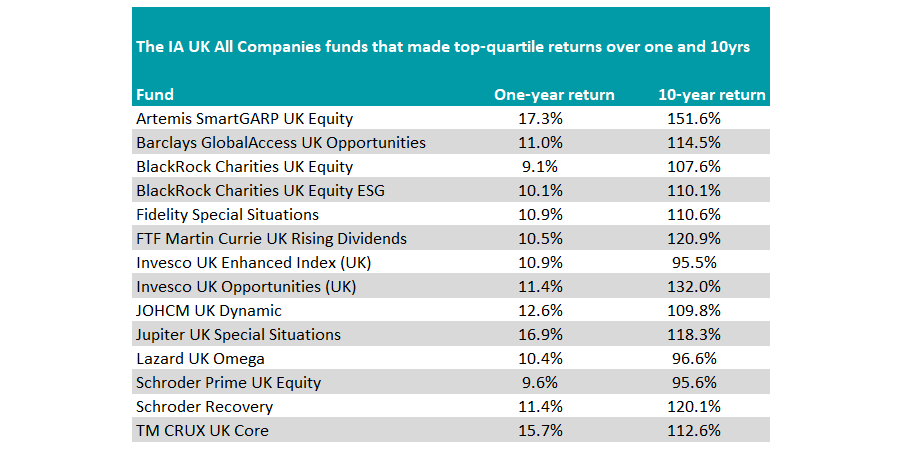

Funds that have thrived in both environments have been few and far between, but some have emerged. Of the 197 with a 10-year track record, 14 (7%) have achieved a top-quartile return over both one and 10 years.

Managers with a value tilt have come out well over the past year, with three specialist funds making the list. Schroder Recovery achieved the feat, with managers Kevin Murphy and Andrew Lyddon buying cheap companies in anticipation of a rebound in fortunes.

Analysts at Square Mile Investment Consulting & Research said: “As a strategy focused on companies that have fallen foul of investor sentiment, this is clearly not a fund for the faint-hearted. However, in our opinion, one of the characteristics that stands this fund in good stead is that its managers clearly have a sound appreciation of the dangers that this type of investment can entail.”

They added that there is “ample empirical evidence” the value strategy works, but managers that buy stocks this way need “steely determination”.

Other names on the list that invest with a similar mindset are FE fundinfo Alpha Manager Alex Wright and Jonathan Winton’s Fidelity Special Situations fund and Ben Whitmore’s Jupiter UK Special Situations fund.

“Such investment strategies can produce some exceptional periods of performance, but they can also generate lengthy periods of underperformance, which at times could be severe,” said the analysts at Square Mile.

“Investors should enter a fund such as this with their eyes open and be prepared to weather the bad times as much as the managers who are running the fund. This is a fund that perhaps should not be held in isolation but a limited allocation may fit well in a wider portfolio of funds.”

Source: FE Analytics

FE fundinfo Alpha Manager Alex Savvides’ JOHCM UK Dynamic portfolio invests in businesses that have problems they are addressing and is another that fits that mould.

Recently, he told Trustnet: “The price you pay for an asset will always be one of the key defining factors of whether you can generate value from the investment that you're making, and it just so happens that at the moment, the starting valuations that you can find on the UK stock market are extremely cheap, relative to history and relative to overseas stock markets.”

Invesco UK Opportunities manager Martin Walker – whose portfolio also made the list – is another that focuses on valuations as the starting point for all of his investments.

“The strongest factor in my investment approach is valuations. I'm looking to exploit value opportunities as they move around the market, so it’s a dynamic active strategy. When I don't find a sector or stock attractive, I just won't hold it,” he told Trustnet.

The best performer on the list however is the Artemis SmartGARP UK Equity fund. GARP stands for ‘growth at a reasonable price’, meaning manager Philip Wolstencroft puts equal weighting to valuation and future growth prospects.

A screen is applied to companies that are growing faster than the market, but on lower valuations, before the manager then selects from these options. Current top holdings include HSBC, BP and Imperial Brands – all traditional value names – although the portfolio can invest anywhere.