Investors have flocked to the safe haven of gold in the midst of the Sillicon Valley Bank (SVB) crisis, with the precious metal hitting an all-time sterling high of £1,645 per ounce on Monday.

Global stocks have plummeted since the problems at SVB were brought to light and there was a run on the bank, which lent money to technology start-ups and venture capital firms.

The bank’s collapse has not been a one-off, however, with fellow mid-sized US bank Signature Bank also failing, while UBS bought European financial giant Credit Suisse as part of a government-brokered deal after the firm's shares tanked.

Adrian Ash, director of research at BullionVault, said the current market environment is similar, although not identical, to the 2008 financial crisis, when the “sudden loss of confidence in mainstream finance” caused investors to rethink their savings and understand that “bank deposits are debt, not property”.

The firm said there was a record £4.5m of gold bought over the weekend at a time when gold exchange-traded funds (ETFs) were closed. The previous record was in March 2020.

“From talking to new gold investors, including larger buyers, they are less concerned less about price right now than by certainty of title. Wholesale bullion stands out as the most tradable of physical assets. It's the deep liquidity in gold, added to the security of outright ownership, which is driving this jump in new demand.”

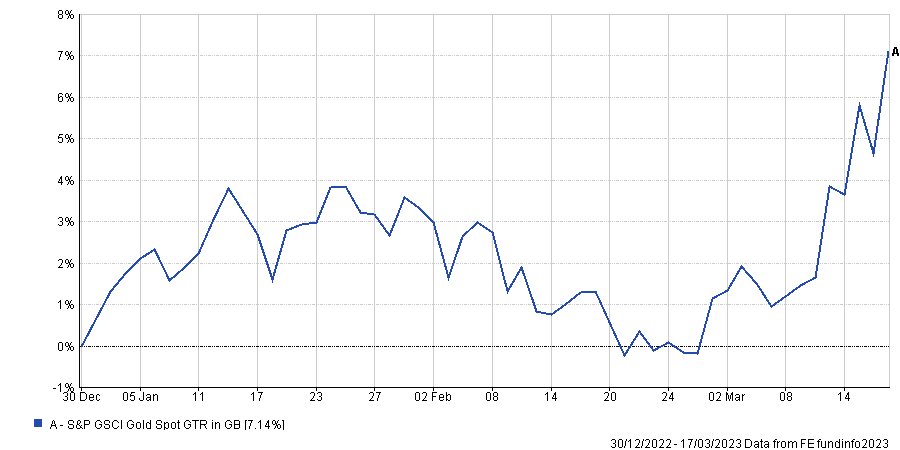

Total return of gold spot price in 2023

Source: FE Analytics

Nitesh Shah, head of commodities and macroeconomic research at WisdomTree, said that despite “decisive moves” by the Federal Reserve (among others) there has been a clear “flight to safety”, with demand for government bonds rising.

Yields on 10-year US Treasuries were down from 4% on 9 March to 3.4% by 17 March. Over this time, gold was up 8.7%.

He highlighted that this is not a sign of broad-based liquidity issues, as gold is often sold in this environment as people aim to free up cash for other needs.

This is the “key short-term risk” for gold, with a broader market meltdown causing investors to sell their precious metal holdings to raise liquidity for other obligations.

“The current crisis appears different in that there are no visible signs of panic gold selling and that could be indicative that the stress in certain parts of the banking sector are idiosyncratic,” he said.

“Nevertheless, investors have been reminded that unexpected events occur with greater frequency than they hoped and have sought to rebuild defensive positions that will help to hedge against further turbulence.”

The precious metal is often used as a hedge and could be so again this year if markets interpret monetary policy as incorrect. Both tightening to aggressively or loosening too early could be viewed by markets as a mistake, he noted.

In Europe, a 50 basis point rise in March was “bold”, but coupled with dovish commentary means markets are expecting fewer rate rises in the future.

Meanwhile, in the US, “if the Fed doesn’t soften its hawkish stance, it risks transforming a bank liquidity issue into a recession”, said Shah.

“If the Fed does act either by terminating quantitative tightening or prematurely ending the hike cycle, the central bank’s monetary largess will linger for longer. Either way, gold is likely to benefit. Gold tends to do well in recessions and is seen as the antithesis to central bank created fiat currencies. We therefore expect gold to hold onto the past week’s gains in this time of turbulence.”