European equities went into the winter under a cloud, with fears that cold weather and an energy crisis would hamstring the economy, but funds investing in the continent have been some of the strongest performers of recent months, FE fundinfo data shows.

In the autumn of 2022, many analysts were tipping European equities for a bout of underperformance on the back of recessionary risk, soaring energy prices and a reliance on Russian gas.

However, the market has defied these expectations. The Euro STOXX index made a 7.5% total return between 1 December 2022 and 21 March 2023. This compares with a 2.4% loss from the MSCI AC World.

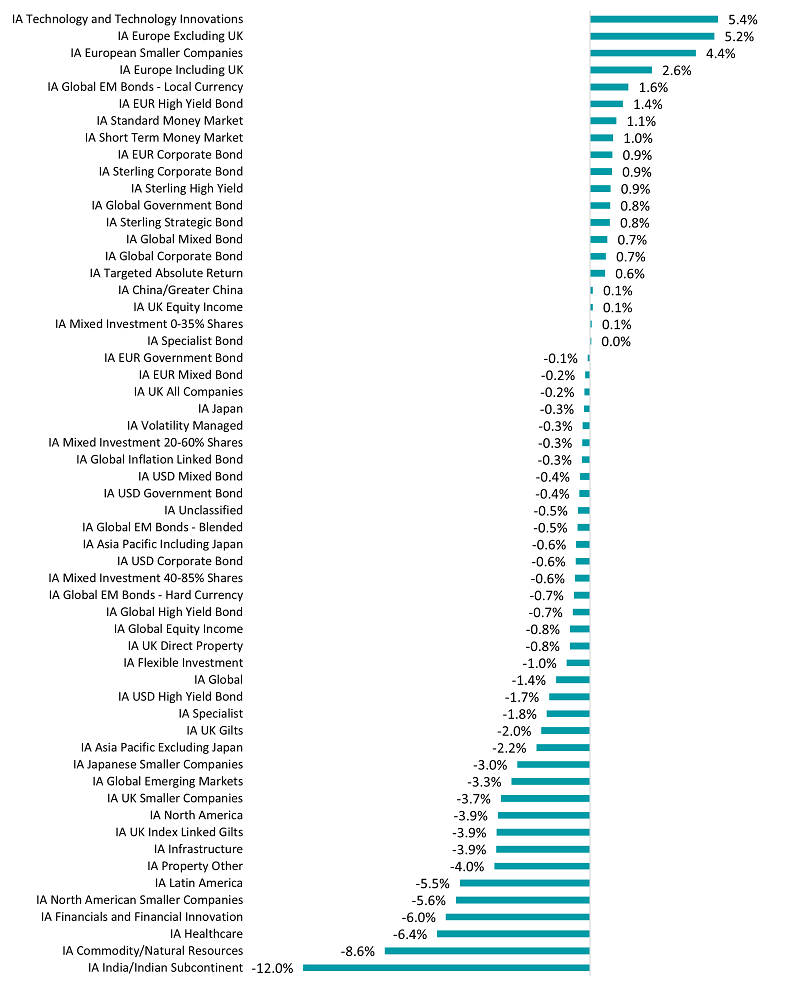

A look at the average returns of the 57 sectors in the Investment Association universe shows the IA Europe Excluding UK, IA European Smaller Companies and IA Europe Including UK sectors have made the second, third and fourth-highest returns respectively since the start of December.

The IA Technology and Technology Innovations sector is the only peer group to have outperformed European stocks over this time frame.

Performance of fund sectors since 1 Dec 2022

Source: FinXL

This is in contrast to 2022, when the IA Europe Excluding UK and IA Europe Including UK sectors were mid-table for their average returns while IA European Smaller Companies was one of the worst performers with a loss of 21.1%.

Charles Younes, head of manager research at FE Investments, said: “A warmer winter prevented the widely expected energy crisis in Europe from materialising.

“As a result, economic activity in the region has exceeded expectations and Europe has avoided recession. Smaller companies and cyclical stocks have been the biggest beneficiaries of the better economic performance.”

As the table below shows, the top four highest-returning European equity funds are trackers and all focus on areas that would benefit from improved confidence: growth stocks, small- and mid-caps, and consumer discretionary stocks.

Source: FinXL

Schroder European Recovery is the best-performing active fund from the three European sectors, making 10.6% over the winter months. As its name suggests, the £400m fund invests in out-of-favour companies and this had led to a structural overweight to energy, banks and telecommunications

However, FE Investments analysts added: “Given its strict valuation approach, in 2022 the fund took profits on many financials and energy names that have rerated significantly and invested the proceeds into quality names, primarily healthcare stocks, which offered more compelling valuations.

“The increase in quality exposure should help in protecting the portfolio in a recessionary scenario, when 's he fund cyclical bias would be out of favour.”

BNY Mellon Small Cap Euroland, LF Brook Continental European, BlackRock European Dynamic, Jupiter Europe (Ex UK) Smaller Companies and Wellington Strategic European Equity are other funds that have made the highest returns during the winter months.

Just 11 European equity funds made a loss over this period. SPDR MSCI Europe Energy UCITS ETF fared the worst, falling 6.2%, followed by New Capital Dynamic European Equity (down 3.2%) and Xtrackers FTSE Developed Europe Real Estate UCITS ETF (down 2.4%).

Younes ended with a note of caution on the outlook for the European market: “The rapid reopening of China should prove beneficial for European exports, however, there are still several risks for European equities.

“Inflation remains stubbornly high and the European Central Bank has committed to higher interest rates in its efforts to bring it back to target, and the actions of the US Federal Reserve remains the key driver of global markets.”