Around £3.5bn worth of shares have been bought back by investment trusts since the start of 2022, according to data from Peel Hunt, as boards defend shareholders from widening discounts.

The companies that have been the most aggressive in their buyback schemes are those with a commitment to keeping shares trading around par.

Troy Income & Growth has been the biggest buyer of its own shares, repurchasing around 17% of the overall total shares in issuance.

Momentum Multi-Asset Value Trust and Martin Currie Global Portfolio were in joint second, bringing back 14% of the total shares since the start of 2022.

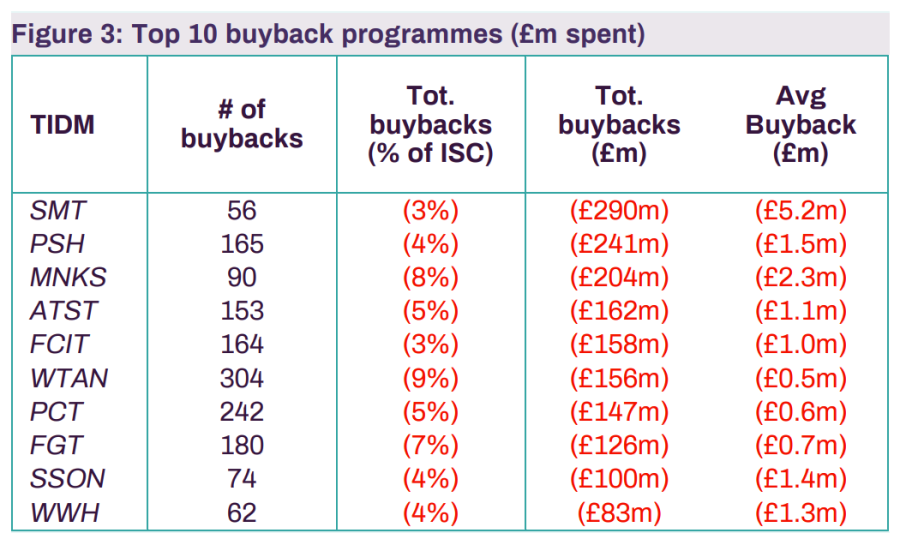

Others have also been busy. Scottish Mortgage, in the midst of a boardroom overhaul, was one of three trusts to buyback more than £200m worth of shares over the period. On average, the board bought back £5.2m each time it entered the market, totalling £290m, or 3% of the trust’s total.

Pershing Square Holdings and Monks were the others, buying back £241m and £204m respectively.

Source: Peel Hunt

The report, written by analysts Thomas Pocock, Anthony Leatham and Markuz Jaffe, noted that it can be challenging to measure the effectiveness of different buyback programmes, given each trust rarely shares the same goals with respect to discount.

“However, one proxy for efficacy can be the measure of discount volatility, with a more effective programme hopefully leading to lower variation. We note when we run this analysis, there is a higher correlation between both the percentage of shares bought back and frequency of buybacks to lower discount volatility than there is between the cash amount spent and volatility,” the report read.

“The average discount volatility for trusts that conducted at least one buyback was 4.1% vs 6.1% for trusts with no buybacks in the measurement period.”

The report also revealed that there are estimated discount levels at which buybacks are more likely to take place. While some trusts have no explicit defence level, there are typical ranges where these buybacks occur.

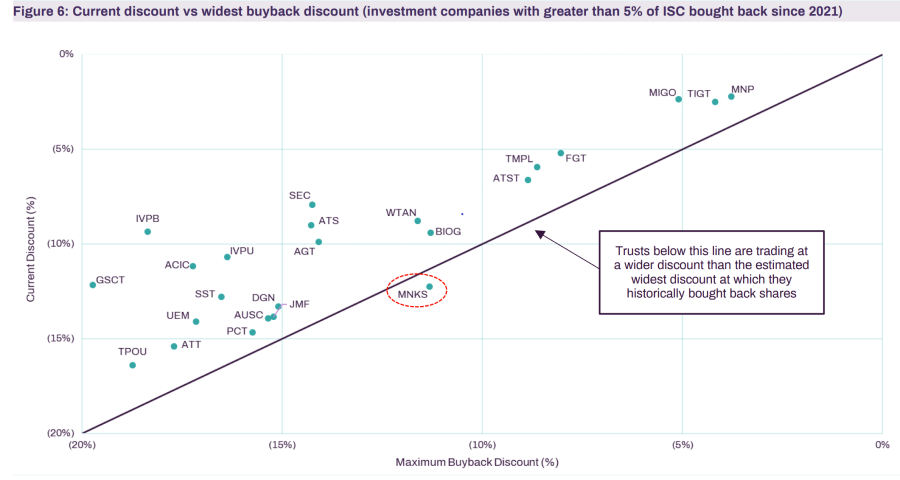

“Recent volatility has resulted in a number of investment company discounts widening out. Looking at those trusts that bought back over 5% of their share capital since 2021, we can identify whether there are any asymmetric re-rating opportunities,” it read.

Monks is the only trust under the line in the chart below, which shows the trusts that are currently on a wider discount than they typically defend at.

The trust’s buybacks have typically occurred in the range of a 1-11% discount. It is currently on a 12% discount.

Source: Peel Hunt

Not all companies were buying back shares however, with some issuing shares over the course of the past 14 months.

“Whilst asset class and trust-specific sentiment will generally drive growth trajectories, we note that a number of those trusts that have had significant expansion over the past 15 months have had robust discount control mechanisms in place and have benefited from periods of trading above net asset value,” the report said.

TwentyFour Select Monthly Income increased its shares in issue by an estimated 25%, while Ashoka India Equity issued an estimated 14% of its original share capital.

Capital Gearing and Personal Assets in the IT Flexible sector each have active zero discount policies and have been able to issue over £500m of equity between them.

Personal Assets manager Sebastian Lyon, founder and chief investment officer at Troy Asset Management, said many trust boards overseeing portfolios remain “prisoners of their own discount and believe they can do little about it”.

He explained that some investors do not like discount control mechanisms as trusts’ discount/premium dynamic can be a good source of returns if bought and sold at the right time.

These investors are often short-termist and not interested in the trust’s underlying investments, he said.

“A premium is just as bad. Excess demand pushes shares to a premium, in the same way that excess supply leads to shares trading on a discount. The outcome is exaggerated price movements in both directions, leading to undesirable volatility,” said Lyon. “Our experience shows that a high premium, however desirable, is rarely sustained.”