Picking the right place to put your money can be a dauting task for many investors with thousands of options available. Savers in the UK can pick between around 4,000 funds and 377 investment companies.

Yet there are some that all investors should have in their portfolio, according to the experts. Below, Trustnet asks five independent financial advisers which fund they would recommend to any client.

A majority of them opted for index trackers for their low cost, long-term performance, but also to mitigate the inherent risk of a manager.

Haresh Raghwani, director of Craufurd Hale Wealth Management said, it is essential for an investor to have an exposure to the US market, which is the largest in the world.

The S&P 500 index of the largest US stocks and has made an average total annual return of 9% in nominal terms and 6.8% in real terms between 1996 mid-June 2022.

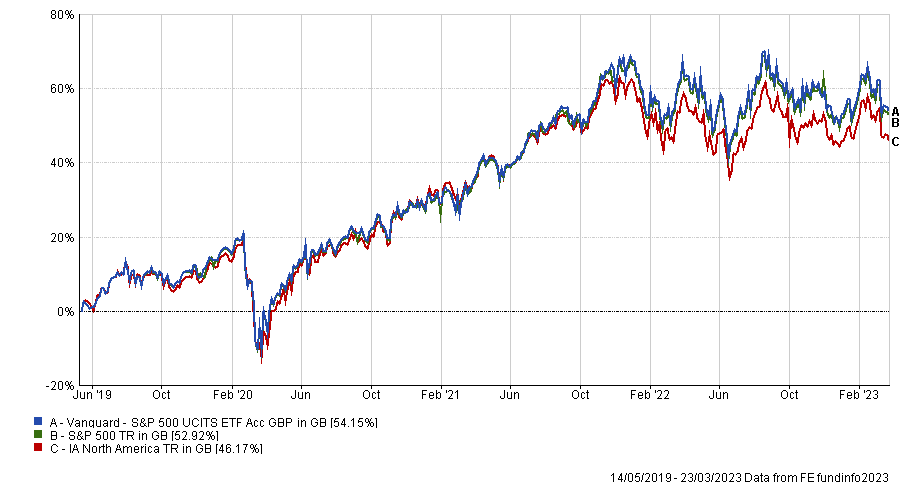

He picked the Vanguard S&P 500 ETF, which tracks the index. His main criteria were performance and cost.

Raghwani added: “Whilst I appreciate past returns are not a guide to future performance, the US market will continue to grow. I have no doubt.

“You have exciting businesses that are involved in tech, health care and the consumer market for example. We know that tech and healthcare are growing sectors.“

Jason Hollands, managing director at Bestinvest, also chose the Vanguard S&P 500 ETF, as it is one of the lowest cost options with a 0.07% ongoing charge figure.

He said: “The US is a market that is notoriously difficult for active fund managers to beat and therefore I find myself making what might be considered the somewhat boring suggestion that most ISA portfolios should probably hold an S&P 500 Index tracker as a long-term position.

“In this respect, I am at least in the good company of legendary investor Warren Buffett – the Oracle of Omaha – who is a big fan of S&P 500 index funds and owns a couple of them in the portfolio of his Berkshire Hathaway investment firm.”

Others suggested a more global approach. Jessica Ayres, chartered financial adviser at Timothy James & Partners, was one.

She said: “After giving this much thought, I had to settle on a global equity tracker, and not just to gain cheap exposure to global equity markets – holding a top global equity tracker as part of the global equity allocation provides consistent outperformance.”

Her global equity tracker of choice is Fidelity Index World, which has a tracking error ratio to the MSCI World index over 10 years of 3.46. As such, it is among the top 25% of funds that deviate the least from this index in the IA Global sector. Vanguard Global Stock Index Investor, Vanguard Global Stock Index Investor and Vanguard Global Stock Index Institutional Plus track the index most closely with a tracking error ratio of 0.07.

Ayres added: “As well has having the expected low charging structure (OCF of 0.12%), this fund has a track record of consistent delivery over 10 years.”

The index (and therefore the fund) has a strong bias toward US equities, with roughly 68% allocated in this region, which she said should be held as part of a diversified portfolio.

Turning closer to home, some investors might also want to put money to work in UK companies. Research from Quilter found that 64% of people with at least £60,000 in investible assets have a quarter of their portfolio invested in the UK, while around 8% of them have the entirety of their portfolio invested in the home market.

David Lamb, director of Lamb Financial, said: “In practice, the asset allocation will depend upon the risk profile of the investor but I would suggest a low-cost UK equity index tracker because they are low cost and follow the stock market (and therefore over the longer term beat inflation), without the cost, or risk of a fund manager.

Lamb specifically picked the HSBC FTSE All Share Index, which is one of the funds to deviate the least from the FTSE All Share index over the past 10 years. It has a tracking error ratio is 2.65.

It is also in the top quartile of the IA UK All Companies sector in terms of size, with £2.24bn in AUM and OCF of 0.14%, which also among the cheapest in the sector.

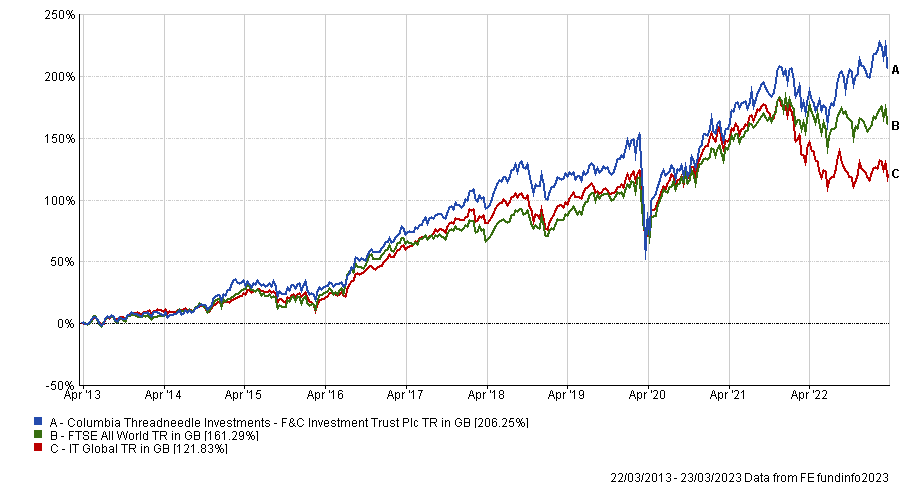

The only active suggestion came from Doug Brodie, chief executive of Chancery Lane, who selected an investment trust with a track record of 155 years.

He said: “If there’s one investment every investor should hold in their ISA it is F&C Investment Trust. An investor needs to keep investing ambitions firmly anchored in the long term, and F&C certainly encourages that with both its returns and its history.

“This is the oldest retail investment fund in the world, it started in the same year as the last public hanging in the UK, 1868.”

Over the last 10 years, F&C Investment Trust has beaten the FTSE All World index except in 2016 and 2020. It is also one of the eight dividend heroes, which are the investment companies that have been able to raise their pay outs annually for at least 50 years.