Central banks need to reassess their expectations for inflation and accept that price hikes are here to stay, according to Karen Ward, chief market strategist for EMEA at JP Morgan Asset Management.

Monetary policy around the globe was fairly relaxed over the past decade as anaemic inflation and economic growth meant there was little need for higher rates, but investors need to adjust to higher inflation and interest rates for the foreseeable future in the new era.

Ward said: “Those forces that kept inflation low for the past 30 years just won’t be as profound as they were. It’s going to come down and I think we’re past the worst of it today, but we are not going back to the zero inflation and low interest rate environment that we've had in the past. It is important that investors acknowledge that.”

Many of the transitory pressures caused by supply chain hold ups and energy price hikes have passed, but Ward said that central banks have been “caught off guard” by domestic inflation.

This is a lot stickier than the short-term drivers that pushed up prices in recent years, so it will take a while for inflation to stabilise.

Rather than keeping interest rates high over the long term, Ward suggested that it might be more effective for central banks to raise their annual inflation targets.

She said: “I personally believe that eventually the central banks should start having a discussion about whether a 3% inflation target is better than 2%.

“My belief is that if they want to avoid having to use quantitative easing constantly, if you start with the premise that quantitative easing is not substitutable for interest rate policy, then you have no choice but to raise the nominal inflation target.”

Accepting a higher rate of inflation may not sound good, but it could be a better alternative to squeezing the economy when the natural inflation dampeners are gone, according to Ward.

“I don’t suddenly want them to go soft on inflation or concede defeat – I don't want to talk about this anytime soon at all,” she said.

“But ultimately, I think shifting to a slightly higher nominal inflation and interest rate target gives them a lot more freedom as to how they control the economy sustainably.”

Indeed, accepting a more realistic inflation target might ease pressure on markets and be better than clinging to the same expectations they have held in the past.

Ward said: “I think we’re past the peak in global inflation and it will gradually start coming down, but that era of low and stable inflation is gone.”

A new era of higher inflation and interest rates is also likely to have a sizable impact on what types of assets perform well over the coming years.

Growth investing dominated global markets over the past decade, but it has fallen out of favour now that monetary tightening has squeezed spending.

Given the new conditions that investors can expect from the coming years, Ward is leaning more in favour of value as a big outperformer in future.

She said: “We’re thinking about the long-term investment planning for our clients, so I’m personally a little more compelled by the value side.

“Not to say there aren’t fabulous growth opportunities out there – there absolutely are – but we just need to be a bit more selective.”

In this new environment, the main drivers of returns will be spread across the market rather than concentrated in a few dominant sectors such as technology or healthcare.

Ward said: “I think that nominal growth will be higher, interest rates will be consistently higher and growth will be more evenly dispersed around the economy. Therefore, I'm even more compelled by valuations in the value section of the market.”

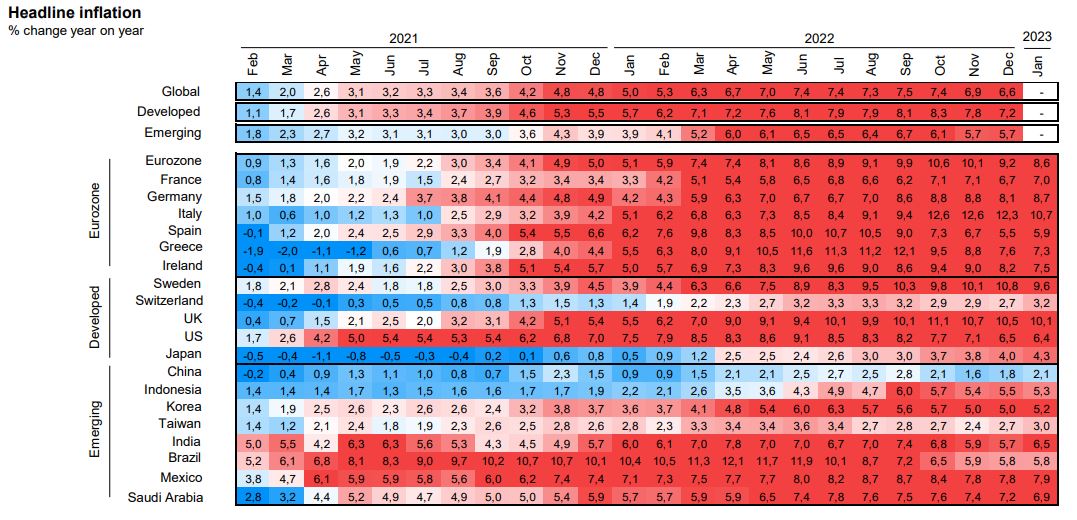

One area that might experience a surge in growth this year is China, according to Ward. While most companies around the globe are struggling to adjust to more hostile market conditions, those domiciled in China are the only ones not facing an inflation problem.

Source: J.P. Morgan

This has taken one hurdle away from Chinese companies, with the winding down of Covid restrictions acting as an added tailwind.

There was a rally in the MSCI China index at the start of the year following news that zero-Covid policies would be disbanded, climbing 9.2% in January before settling at 0.7% year-to-date.

However, Ward said that investors can expect another burst of activity in the Chinese market once consumers start spending their lockdown savings.

“I think we're going to see an enormous pent up demand boom, they've been insane. They've been saving and I think the growth that we’ll see over the next coming weeks and quarters will take everyone by surprise,” she added.

“We think that there is some upside here to see double-digit earnings growth in that region that you won’t see anywhere else in the world and that will have support the Chinese market over the coming year.”

European equities on the other hand could continue to suffer a headwind from higher inflation over the short term. While most external inflationary pressures have eased in most markets, they still play a significant role in price rises in Europe, according to Ward.

She said: “In the eurozone, these transitory parts of inflation that the central banks can say ‘that’s not our fault’ are still a pretty big component of inflation and that will start to drop out, but that underlying inflationary pressure, I’m not sure we really have our hands on that yet.”