Investors have traditionally allocated the equity side of their portfolio through geographies, picking global funds alongside regional exposure such as the US, UK and emerging markets.

However, an alternative approach is to allocate assets thematically via exchange-traded funds (ETFs), even for investors who might not have used them before, such as those with traditional 60/40 portfolios.

According to a recent survey from HANetf, 42% of investors that use ETFs do so to gain exposure to certain themes. Nowadays, there are an ever-increasing number of ETFs to choose from, with research from Bloomberg Intelligence finding that 77 thematic funds were launched in 2021 and 38 in 2022.

Investors now have more options to distribute their investment budget through specific themes such as cybersecurity or robotics instead of or in addition to the usual geographic allocation in their portfolio.

James Newstead, investment analyst at Dennehy Wealth, said thematic ETFs can be considered “pure plays” on high-growth themes that can offer “huge amounts of runway” for compounding, provided investors do not buy them at “grossly overvalued price points”.

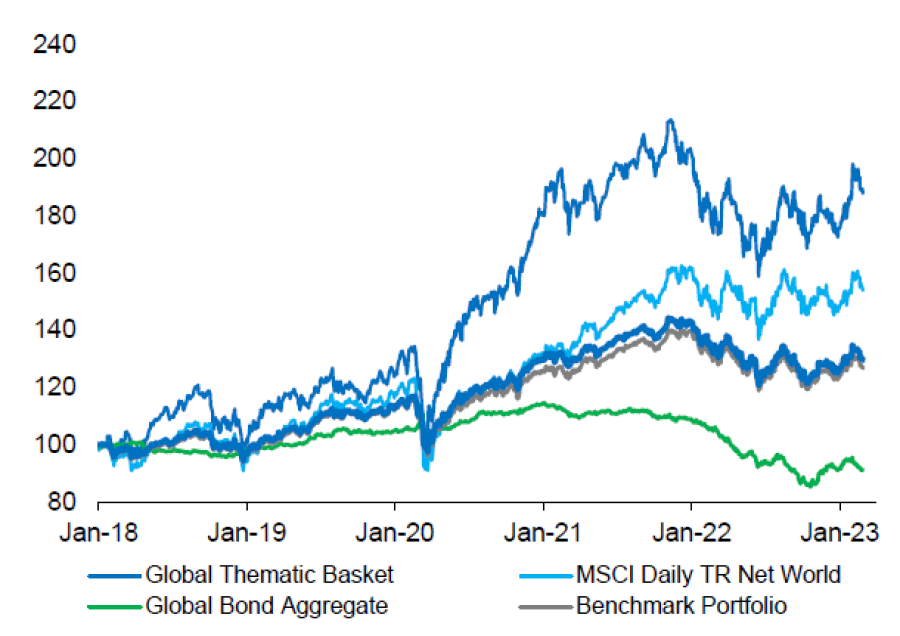

For instance, Legal & General Investment Management (LGIM) built a portfolio made of 50% equity, 40% fixed income and 10% thematic ETFs. Over five years, it outperformed a 60/40 benchmark portfolio, global bond and the MSCI World index.

Historical simulated performance of a 50/40/10 portfolio against a 60/40 benchmark portfolio, global bond and MSCI World

Source: LGIM

Newstead fixes a limit at 20% for pure thematic allocations. However, he added that the entirety of the equity side can be made of thematic funds if utilising a broader definition.

He said: “They can be used as the sole equity building blocks quite comfortably, provided we are applying a broad definition of thematic that includes smart beta and megatrend ETFs.

“For example MSCI’s factor focused (especially Momentum), emerging Asia, AI/Automation and infrastructure ETFs.”

Performance of MSCI World Momentum and MSCI World over 10 years

Source: FE Analytics

For Andy Merricks, fund manager at 8AM Global, thematic ETFs are “genuinely” a part of a global equity allocation budget.

He says: “All those themes such as cybersecurity, clean water, et cetera, are all global in nature. The fact that a lot of asset allocation models only allocate geographically means they're missing out on the opportunities that thematic investment offers.

“The other advantage about holding thematic ETFs is that a lot of the themes are quite young. You don’t always know which ones are going to dominate and which ones will fall by the wayside. So, by investing in an ETF, you're basically investing in everything in that space, which pretty well guarantees that you'll get the winners and decrease your exposure to the losers.”

However, the proportion of exposure to thematic ETFs also depends on an investor’s time horizon.

Graham Bentley, chief investment officer at Avellemy, said: “It depends on whether you have a tactical tilt or not, because the vast majority of that 60% equity will be focused on standard geographic splits.

“Your separate pot for thematics can either be a relatively small satellite or you could have your whole global equity exposure aimed at those themes if your strategic approach is long-term enough.”

A reason why a long-term horizon may be necessary is because investing in a theme may only pay off after a few decades.

An example of that is an investor that would have pitched their entire portfolio toward technology in the late 1990s at the time of the dot.com bubble.

Bentley added: “You would have been virtually ruined by the time you got to 2003, because those themes didn't come through for another 20 years.

“These types of long-term themes sound good in theory, but at the end of the day, it's the market that dictates if people aren't pushing those prices up. No matter how sensible your view of the future is, it doesn't mean it will translate into performance.”

Another risk is that a theme might turn out to be a fad and never pay off at all. A recent example of this is online education.

Merricks said: “Online education looked like it was a theme that was developing through the various lockdowns. Then the Chinese government shut it down overnight and that had a knock on effect to other edtech companies around the world.”

In addition to the risk-awareness, Newstead said that an investor interested in a thematic ETF should be willing and able to research the ETF in question and understand the associated unsystematic risk.

He added that they should also keep on top of market trends and changes to ensure the theme they are betting on is still unfolding as they expect it to.

While it is impossible to predict what themes will become dominant in the future, some are better positioned today to grow in significance.

That is the case of healthcare due to the demographic dynamics. The World Health Organization estimates that the proportion of the world’s population over 60 years will grow from 12% to 22% between 2015 and 2050.

Merricks said that healthcare is not only about pharmaceuticals or biotech firms but also things such as the development in medical devices, remote surgery or genomic diagnosis. Bentley added data, cybersecurity and AI were other “obvious” themes that investors may want exposure to.