The RIT Capital Partners trust has sunk to a 20.1% discount following recent criticism from analysts, but some are saying that this has opened an attractive window to buy.

Trouble began in January after Alan Brierley, director of investment company research at Investec scrutinised its “ominously” high private equity exposure.

He said that these high-risk assets, which had shot up from a 24% exposure to 45% over the past two years, contradicted the trust’s aim of preserving capital and had “radically transformed” its risk profile.

In March, Brierley then advised investors to sell their shares in RIT Capital Partners, stating that it had become “uninvestible”.

“We have become increasingly nervous about the risk profile, and specifically the late-stage venture capital exposure, and this lack of transparency surrounding what is a key issue is the final straw for us,” he said.

However, Ewan Lovett-Turner, director of Numis, said that fears about the trust were overstated and investors should in fact take advantage of its discounted price.

“We continue to believe that negative sentiment towards RIT Capital is excessive and the discount offers a very attractive value opportunity for investors to gain exposure to a range of assets that we expect to deliver an attractive, and defensive, risk-return profile,” he said.

Concerns about its private equity exposure have largely passed according to Lovett-Turner, who said that the recent sale of Infinity (which resulted in a 30% uplift) and upcoming fundraising for Webull, will be a relief to worried investors.

Likewise, the imminent sale of two companies in its top 10 direct holdings should reconcile some of the private equity fears that have surrounded the trust in recent months.

However, Lovett-Turner said that improved communication by management of RIT Capital Partners to shareholders was needed to recover sentiment.

“Increased disclosure and communication will also be key to giving investors renewed faith in the company,” he added.

In his past condemnations, Brierley said that the trust’s lack of transparency was “simply not acceptable,” especially given the portfolio’s change in composition and underperformance in recent years.

Its total return of 11.3% over the past three years trailed 6.2 percentage points behind its peers in the IT Flexible Investment sector and shareholders of the trust deserved to know why.

Brierley said: “Given an objective of preserving shareholders’ capital and a participation rate of just 41% in risk-off environments, last year was deeply disappointing.”

“We believe that investors are entitled to ask RIT Capital why it believes that it should not make a full disclosure of the methodology.”

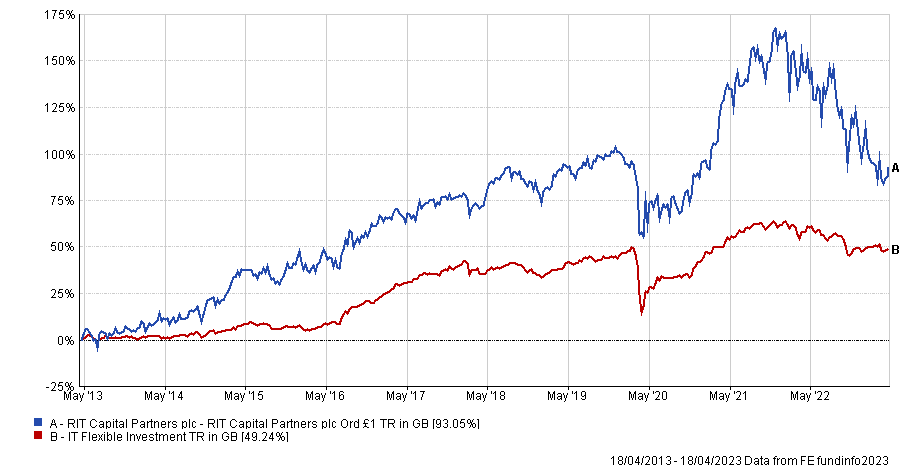

Nevertheless, James Carthew, co-founder of QuotedData, said that recent negative sentiment had been driven by the sensationalism of short-term fears, when it would be more accurate to judge the trust on its long-term performance.

Over the past decade, it outperformed its peer group by 43.9 percentage points, with returns climbing 93.1% over the period.

Total return of trust vs sector over the past 10 years

Source: FE Analytics

Carthew: “We believe this [recent criticism] is unjustified and presents a rare opportunity to buy a unique trust with an impressive long-term track record.

“The current discount represents a rare opportunity to invest in this unique trust at a meaningful discount to the value of its underlying assets.”

Like Lovett-Turner, he said that fears over private equity had been overplayed and did not present as big of a risk as the market had priced in.

“We feel that the market has become overly cautious around any possible write-down in the value of unlisted assets,” he added.

“Even if the predictions of the more negative analysts were to play out, the trust’s current share price would likely still equate to a meaningful discount to NAV, and therefore an attractive entry price given RIT’s long-standing track record of success.”

RIT Capital Partners is a corporate client of both Numis and QuotedData.