Investment trust research firm Numis Securities has revaluated its recommended list in April, promoting two portfolios to a ‘buy’ endorsement and demoting two others.

One that they identified as an attractive buying opportunity was the Odyssean Investment Trust thanks to the significantly undervalued assets in the UK smaller companies sector.

Numis analysts said that managers Stuart Widdowson and Ed Wielechowski have a unique investment style, using a private equity approach in public markets.

Researchers at the firm added: “They generate returns through taking significant stakes in businesses that have fallen out of favour and are trading at discounts to their intrinsic value.

“The managers will actively engage with portfolio companies to ensure self-help programmes are in place, such as management and strategy changes, as well as repositioning and improved communication to the markets.”

Indeed, the £187m trust has a concentrated portfolio of 18 holdings but has been known to go as low as 15 in the past.

Having such a high stake in each of its holdings allows the managers to influence improvements in the companies, which will then lead to private equity firms acquiring them in future.

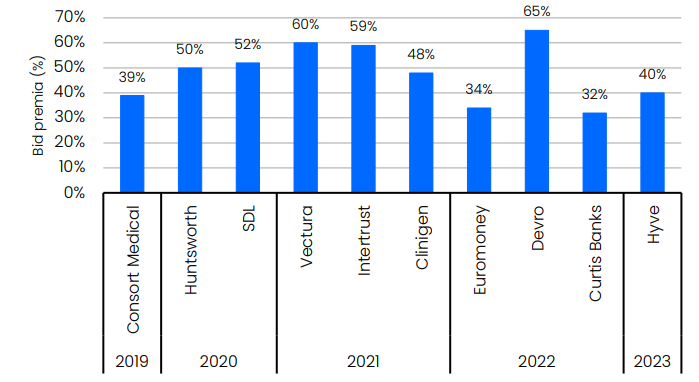

In the past five years alone, 10 of the trusts holdings have been taken over, which has been a significant boost to returns, according to Numis analysts.

Mergers and acquisitions activity since launch

Source: Numis

Odyssean’s concentrated portfolio of UK small-caps has led to a number of acquisitions, but researchers at Numis warned that this high-conviction approach can lead to periods of underperformance relative to the market.

“Investors need to be comfortable that performance may differ significantly from small-cap indices over short periods, given the concentrated portfolio,” they said.

“However, we believe that the stock-picking record speaks for itself and that Odyssean represents an attractive and differentiated addition to a portfolio.”

Over the long term, Odyssean’s total return has more than tripled that of the IT UK Smaller Companies sector, climbing 62.6% since launching in 2018 compared to the peer group’s 17.9%.

Total return of trust vs sector since launch

Source: FE Analytics

Another trust that the Numis added to its recommended list was AVI Japan Opportunity, with an evolving macroeconomic backdrop and cheap currency making it “a compelling time to invest in Japan”.

Like Odyssean, manager Joe Bauernfreund buys undervalued Japanese smaller companies and uses his position as a shareholder to encourage improvements within them. Numis analysts noted the recent successes it had by engaging with pump manufacturer, Teikoku Electric.

Bauernfreund influenced the company to exit a loss-making past of the business that resulted in a series of buybacks for 8.5% of share capital and an 110% increase dividends, boosting returns last year.

Researchers at Numis said: “It benefits from a strong management team and presents an attractive way to access the market, whilst benefiting from the trend of an increased focus on delivering returns to shareholders in Japan.

“As an engaged/activist investor it has a concentrated portfolio of companies with high levels of cash and seeks to crystallise value through engagement on capital efficiency, ESG [environmental, social and governance], investor communication and operational strategy.”

Working with Teikoku Electric may have ended in success, but Numis analysts said its recent engagement with heat exchanger manufacturer, Tokyo Radiator, proved that this approach can not be applied to every holding.

It exited its position in the company after attempts to engage failed, which “reinforces the importance of the underlying quality of the business,” according to the researchers.

This was a reminder that influencing change can take time and the longer AVI Japan Opportunity holds a company for, the more important its fundamentals become.

Nevertheless, the £166m trust beat its four peers in the IT Japanese Smaller Companies sector by 18.3 percentage points since launching in 2018, climbing 22.9% over the period.

Total return of trust vs sector since launch

Source: FE Analytics

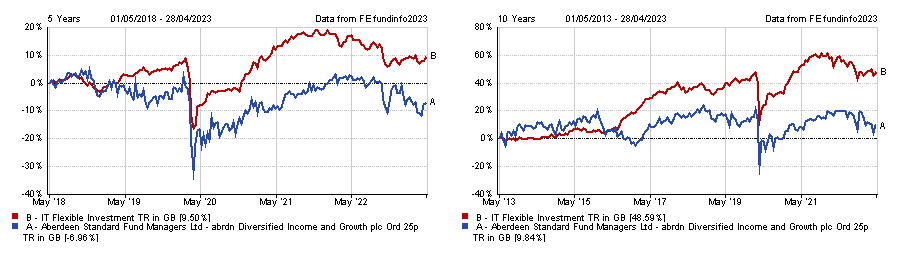

To make room,, Numis researchers removed abrdn Diversified Income & Growth from the recommended list after a long period “consistently underwhelming” performance.

The £262m trust is up 9.8% over the past decade while the rest of the IT Flexible Investment sector rose 48.6%. Even over the past five years, returns are down 7% whilst its peers climbed 9.5%, with the analysts noting many investors have been waiting for a rebound that appears increasingly unlikely to happen.

Total return of trust vs sector over the past five and 10 years

Source: FE Analytics

“We expect that after many investors have been waiting so long for the ‘jam tomorrow’ that a rerating is unlikely in the near term, despite its 26% discount,” they added.

“There is also the spectre of significant restructuring within abrdn. As a result, we favour other multi-asset/defensive funds on the return and discount outlook.”

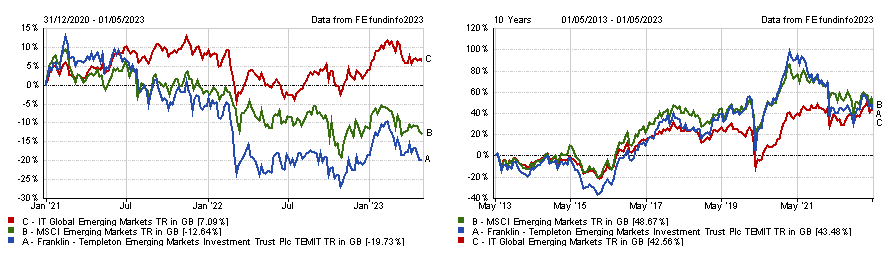

Numis also removed Templeton Emerging Markets due to the “lacklustre performance” it delivered since it was first added to the recommended list in 2021.

It beat the IT Global Emerging Markets sector over the past decade with a total return of 43.5%, but it is down 19.7% since the start of 2021 while its peers climbed 7.1%.

Total return of trust vs sector and benchmark since 2021 and over the past decade

Source: FE Analytics

Researchers at Numis said that its discount of 13.3% is likely to stay “stubbornly wide,” although “there may be scope for some narrowing due to a performance triggered tender on the horizon”.

Nonetheless, there are better alternatives for those seeking exposure to emerging markets, they added. JPMorgan Emerging Markets and Mobius Investment Trust remain on the buy list and make a good pairing for those looking to invest in the region.