During the Covid lockdowns, I was lucky enough to be in the group of people whose savings pot got bigger instead of smaller, so I entered 2022 with money that I wouldn’t have had otherwise.

I knew that I ought to invest it, but it took me a few months working as a finance reporter and an incumbent ISA deadline before feeling confident enough to actually start doing something about it.

Deciding how to invest your money for the first time can be overwhelming because you have so many decisions to make: which platform do I invest with? Do I take professional advice? Which investments make more sense for me?

Two things helped me.

Firstly, I decided that I didn’t have to make decisions that distracted me (perhaps even kept me!) from the actual investing. Because my bank specialises in online brokerage and has a cheap stock and shares ISA option, I decided that I didn’t have to look for other options elsewhere. This Trustnet guide helps you figure out which platform is best for you, but the best for me was the one that gave me one less thing to think about.

Secondly, two lessons I have learned in my job were very useful to me. One, it’s not about ‘timing the market’, but ‘time in the market’. This slogan is used to indicate that it doesn’t really matter when you decide to invest, as long as you do it with a long-term perspective: in 10 years’ time, it won’t really matter if you’ve entered the market at a not-so-favourable time, because it is relatively safe to assume that its growth will generate a return despite the short-term ups and downs in performance.

Two, relative performance is… relative. Writing this piece was my first step towards the realisation that yes, the funds I choose might perform terribly compared to their peers, but if they don’t lose money, I’ll still have made at least some money, and that’s enough for me; if they do lose money this year, at least they’ll have a solid track record to reassure me they won’t the next. Or the next (see previous point). I do like to think I’m young enough to still have plenty of time ahead of me.

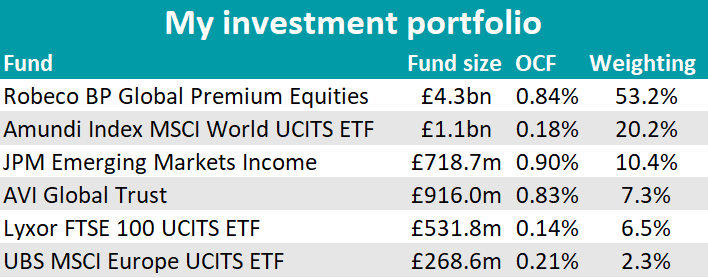

As of today, I own six vehicles – three trackers and three active solutions (two funds and one trust), which made a total return of 0% (but just give them time!) since the time of investment approximately a year ago (with subsequent top-ups).

Source: FE Analytics

The more stable performances so far have come from the three exchange-traded funds (ETFs), which are also the first ones I bought – the Amundi IS MSCI World UCITS ETF (+6.4%), the Lyxor FTSE 100 UCITS ETF (+3%) and the UBS (Lux) FS MSCI Europe UCITS ETF (+4.5%).

The MSCI World index has 1% weighting to the US, 10.4% to European equities and 4.3% to the UK, and given the different drivers for returns behind these markets (the US being generally more growth- and Europe and the UK more value-driven), I decided to add some extra exposure to the latter to balance it out.

I chose these trackers to get a cheap, broad-brush exposure to equity markets, which I would then try to complement with other investments, such as Robeco BP Global Premium Equities.

This five FE fundinfo Crown-rated fund focuses on companies with attractive value characteristics, strong business fundamentals and improving momentum, selecting stocks across market capitalizations, regions and sectors from developed countries across the world.

Given its active valuation-focused approach, I thought it would give my portfolio a different source of return than what I get from tracking an index, and so far it’s behaved quite differently than the ETFs. With a -3.2% since the point of investment, it’s been my biggest detractor.

My next two investments, JPM Emerging Markets Income and the AVI Global Trust, are an attempt to add something completely different for the sake of diversification.

The former is managed by a team that includes FE fundinfo Alpha Manager Isaac Thong. I chose it for my emerging markets exposure because it can cover a wide spectrum of the market (including small capitalisation companies) and unlike traditional income funds, it attributes equal importance to both income generation and capital appreciation, which should provide an added layer of downside protection.

It has an active share of 80% and its yield has been above that of the index for the most part of the fund’s life. So far, it contributed -0.7% to my investments.

Finally, I liked AVI Global Trust for its highly differentiated portfolio of stocks that the managers believe are trading at a discount to their intrinsic value. Not only are the companies they buy at a discount, but the trust is itself on a discount (currently 10.4%) – one of the reasons why Quoted Data highlighted it back in March for being on a “double discount”. Since I bought it, it has accrued 4.3%.

I do check my investments almost daily, but I don't think it brings much, except sometimes when I'm feeling positive and I move some money from my ISA account where it sits as cash to one of the funds. The next step will probably be to re-assess my weightings and move more of the cash into the market.

Obviously this is just a bit of curiosity into how I've started out my investment journey, but it might inspire someone to make their first steps - although if you're a beginner investor who reads Trustnet, you're probably on the good path already.