Inflation has been hotly debated by both investors and central bankers in recent years, with two factions emerging: those who believe inflation will stick around for longer than markets expect and those who haven’t lost faith in central banks to put the inflation genie back into its bottle.

As headline consumer price indices now recede from their peaks, the question is at what level inflation will stabilise – above or close to the central banks’ targets of 2%.

Two weeks ago, Trustnet suggested a perfect portfolio for a stickier inflation. Below we look at the opposite scenario, with Adam Norris, investment manager in the multi-manager team at Columbia Threadneedle Investments, sharing his five fund ideas for investors to consider if inflation continues its downward slope.

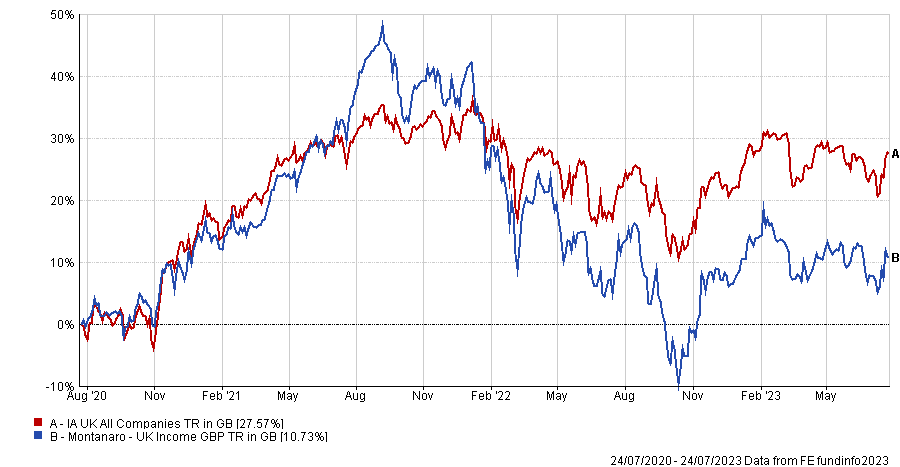

We begin with Montanaro UK Income, a €710m strategy investing in quality-growth stocks of small- and mid-cap companies.

Performance of fund over 3yrs against sector

Source: FE Analytics

“It’s difficult to think of a more shunned combination than UK-listed small caps with a quality-growth focus over the past 18 months,” said Norris.

“UK economic growth has been lacklustre and rising interest rates have harmed companies trading on optically high earnings multiples. However, with inflation falling and the market pricing fewer interest rate hikes than previously, this fund is likely to benefit from a more stable UK economy, while also trading at some of its cheapest relative valuations to the wider market since its inception in 2016.”

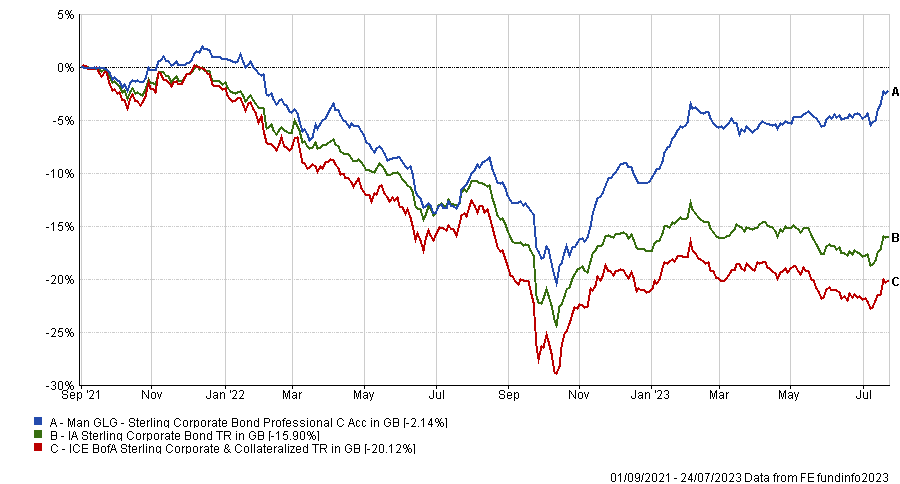

The second pick was Man GLG Sterling Corporate Bond run by FE fundinfo Alpha Manager Jonathan Golan.

Performance of fund over 3yrs against sector Source: FE Analytics

Source: FE Analytics

The rationale here was that if government bond yields are beginning to fall, coupled with a more benign economic outlook, then corporate bonds stand to be a strong winner in performance terms.

“With UK corporate bonds underperforming in both European and US equivalents over the past 18 months, Golan has a strong track record of capturing returns in a strong upwards market,” said Norris.

“The fund is relatively small [£532m of assets under management] and nimble to capture idiosyncratic opportunities within the UK market and deliver outperformance vs peer group, particularly those with larger funds.”

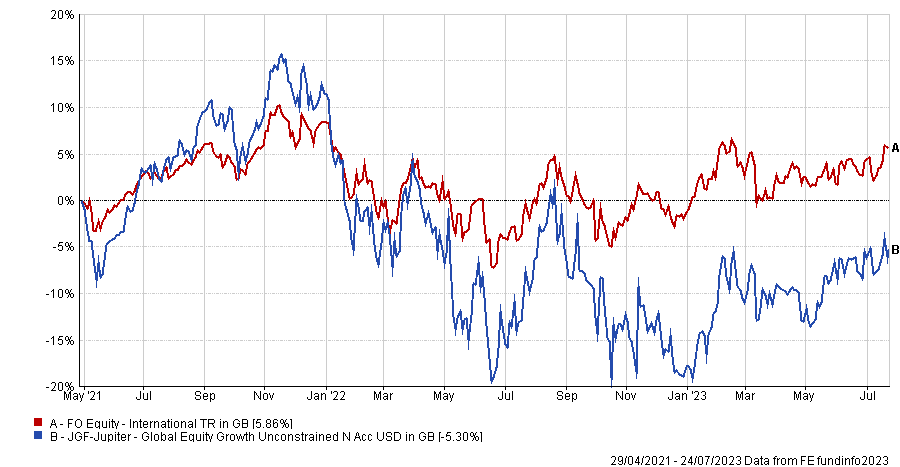

For those who are looking for an investment process that focuses on growing technology companies – which he said are resilient in times of stress and adaptable to their operating environment – Norris suggested Jupiter Global Growth Unconstrained.

Performance of fund over 3yrs against sector

Source: FE Analytics

“The portfolio is split into two parts, with the majority in favour of durable businesses with repeatable cash flows and the minority into companies that have a larger range of outcomes – even this can be to the downside too,” he said.

“The latter part of the portfolio tends to be exposed to businesses that are growing rapidly, and with inflation coupled with the cost of capital potentially falling, this could stand to benefit from a re-rating.”

Norris then moved on to property real estate investment trusts (REITs), many of which have endured a torrid time in performance terms over the past 12 months.

REITs frequently contain leverage in the company to gear investors into strong market returns, but the same can be true in reverse, with the sector facing a double hit of increasing debt costs at the same time as falling property valuations.

However, as bond yields stabilise and with many already fearing a dire economic outcome, LXI REIT is in a good place to capture reversing performance, said the investment manager.

Performance of fund over 3yrs against sector

Source: FE Analytics

“The portfolio is already positioned defensively from an economic perspective, but despite resilient rental income, the fund has traded a large discount to its net asset value,” he said.

“The management team, led by Simon Lee, focus on relative value between sectors rather than just acting as asset aggregators and we expect further rotation between assets to continue to drive performance for the company.”

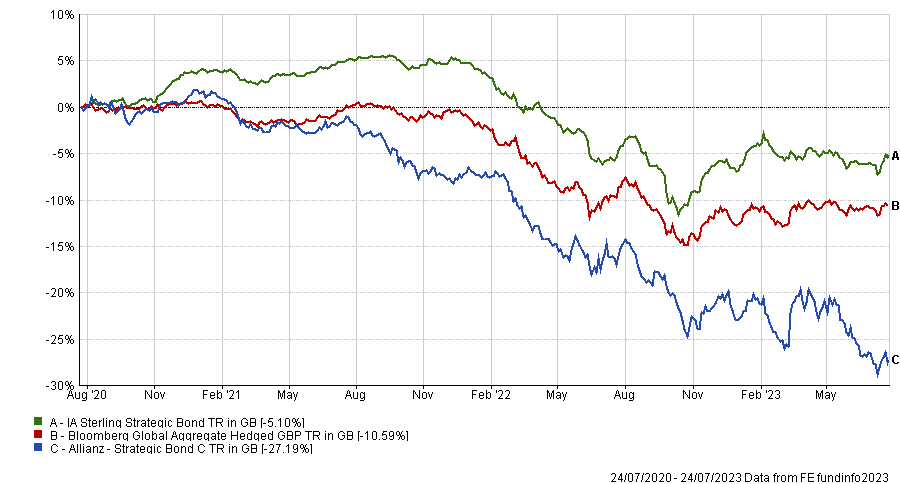

Finally, Mike Riddell’s Allianz Strategic Bond is the right fund for a hard-landing scenario, with the manager having a reputation for protecting investor capital when economic growth is sharply weakening.

Performance of fund over 3yrs against sector and index

Source: FE Analytics

“Interest rate hikes tend to have a lagged effect into the economy and since central banks only began raising interest rates through 2022, the true effects of tightening financial conditions are yet to be felt. If inflation is already falling and the economic pain is still to come, then investors may be looking at a hard-landing economy. If so, Allianz Strategic Bond is the fund to consider,” said Norris.

“The fund is full of government bond duration, so it should benefit as bond yields fall, as well as outright short corporate bond credit spreads, meaning it will benefit as borrowing levels rise for corporates. A hard landing should be a good outcome for Mike Riddell’s performance.”