ESG investors could be missing out on attractive opportunities if they overlook companies where the sustainable case is not immediately obvious, according to Aegon Asset Management.

Georgina Laird, senior responsible investment associate at Aegon, said investors need to look for those underappreciated companies that have a meaningful positive impact, even if that impact is not entirely apparent.

“Often a company’s role in creating a sustainable future is not clear at first glance, but a closer look shows its products are a key enabler of the transition,” she said. “Similarly, a company may not have the most world-changing products, but its practices – the ‘how’ it does things – are having a considerable positive impact on society.”

Below, Laird highlights three companies where a little digging reveals a sustainable investment case.

Oxford Nanopore

The first example of a sustainability stock that might not appear ‘ESG’ at first glance is Oxford Nanopore. The firm operates in the gene sequencing field, which has applications as diverse as healthcare, agriculture or forensics, benefiting many areas of sustainability from food production to biodiversity.

“Oxford Nanopore is a key enabler in this area. The company makes a novel generation of DNA/RNA sequencing technology that is changing the way we live and work,” Laird said.

“They have designed a unique gene sequencing lab that is compact enough to fit in a suitcase. That suitcase can travel to the fields in Africa or rivers in Asia and help to test the environment in real time, directly informing actions to address biodiversity challenges. Scientists can now carry a (relatively) inexpensive lab in their backpack.”

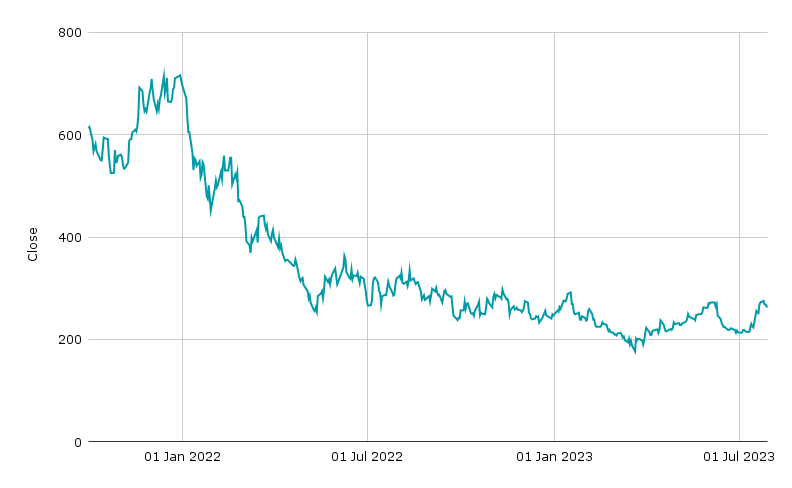

Oxford Nanopore’s share price since IPO

Source: Google Finance

Nvidia

Nvidia has captured investors’ attention recently, but more for its connection with the blooming artificial intelligence (AI) industry than its sustainability. It is a dominant supplier of artificial intelligence hardware and software, designing graphics processing units (GPUs), application programming interfaces (APIs) for data science and high-performance computing and system on a chip units (SoCs) for the mobile computing and automotive market.

However, Laird argued there are reasons why sustainable investors should be interested too. One of these is Nvidia’s exposure to the convergence of healthcare and semiconductor technology, which is a growing trend.

The firm’s healthcare platform began by powering medical devices but has since broadened into simulation genomic analysis; the overall business mix of medical devices and AI simulation has now shifted from 80/20 to 50/50.

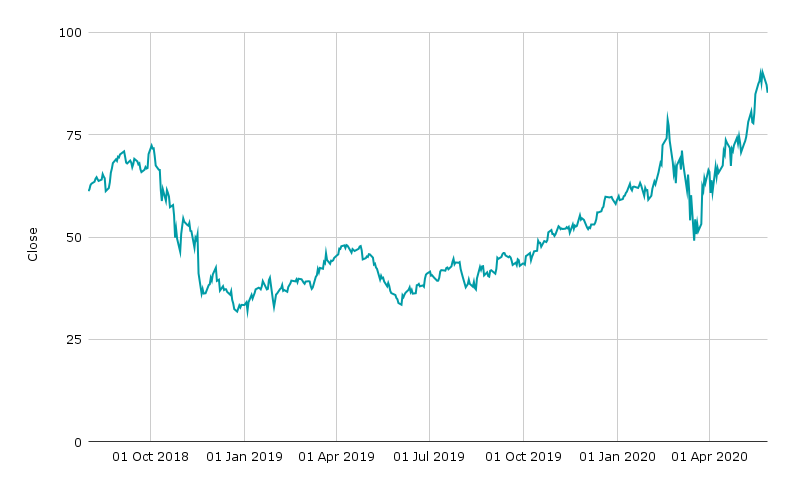

Nvidia’s share price over 5yrs

Source: Google Finance

“For example, Oxford Nanopore has combined its technology with Nvidia to deliver the fastest ever human gene sequencing sample in just five hours. This is a great example of first and second order impact working together,” Laird said.

“AI spending within healthcare is growing at a rapid pace, given the exponential growth in data and the increasing computational demand for AI. Nvidia believes that an inflection point will be reached this year as the cost of genomic analysis declines drastically, enabling an acceleration of drug discovery and much more beyond this.”

Dynatrace

Laird’s third sustainable stock pick was Dynatrace. It offers a software intelligence platform that monitors and optimises application performance, software development and security practices, IT infrastructure, and user experience for businesses and government agencies.

She said: “Dynatrace has recently launched a Carbon Impact app which can deliver real-time insights into the carbon footprint of an organisation’s hybrid and multi-cloud ecosystem.

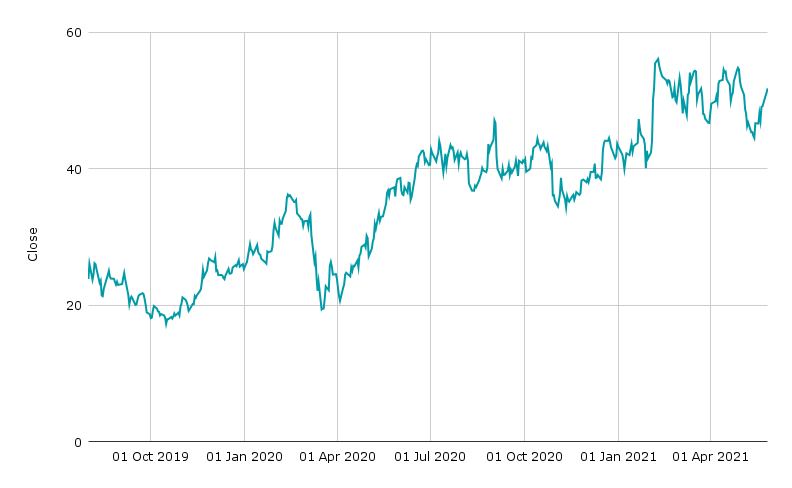

Dynatrace’s share price over 5yrs

Source: Google Finance

“The app translates utilisation metrics including CPU, memory, disk, and network input/output into their CO2 equivalent and automatically identifies opportunities to reduce carbon emission.”

Although some cloud providers already offer tools to measure carbon emissions from the use of their services, these currently do not support multi-cloud environments or account for the footprint of on-premises services. Dynatrace’s Carbon Impact app, on the other hand, does allow this, creating the opportunity for a holistic approach to the management and reduction of carbon emissions.

This is all the more relevant given incoming regulatory mandates such as the ISSB sustainability-related disclosures, and those being proposed by the SEC in the US and the European Parliament, that require stronger climate-related company disclosures.