The reputation of bonds as a ‘safe haven’ asset has typically reserved them to the interest of older investors wanting lower risk and more security.

But given bonds are now offering the highest yields in years and a potentially greater return versus equities, should young people be moving into fixed income?

Gavin Haynes, co-founder of Fairview Investing, said the investment case for young people to buy bonds is significantly more appealing now than it has been in the past.

“It was not long ago that fixed interest funds were offering miserly yields and were best described as offering return-free risk,” he said. “The enhanced yields available today are making the asset class look much more attractively valued.”

Equities often make a better long-time return than bonds, hence why young investors with a lengthy time horizon usually have portfolios dominated by stocks.

However, investing in bonds now at their unusually high rates could be a rare instance where they can outperform equities over the long term, according to Haynes.

“At the current time I do believe that bonds can have a part to play for younger investors taking a longer-term perspective,” he explained.

“The power of compounding can come into play if reinvesting the income provided by bond funds. As interest rates peak, they should also regain their diversification benefits versus equities.”

This was echoed by Oliver Faizallah, head of fixed income research at Charles Stanley, who said now is an uncommon entry point that could give investors a better return from bonds than equities.

He pointed specifically to high yield bonds, stating that they have the greatest chance of beating equities by the widest stretch.

“Historically, in these circumstances, there has been greater and prolonged drawdowns in equity markets relative to high yield,” Faizallah said.

“For higher risk clients, with a long time horizon who are seeking to achieve a long-term return objective, high yield is particularly attractive relative to parts of the equity market, offering potential for higher returns, with relatively less risk.”

High yield bonds are at the more volatile end of the fixed income market, but young investors have the benefit of a long time horizon to take more risk and ultimately make a larger return.

A good way for investors to get exposure to the best opportunities in the fixed income space is by holding Nomura Global Dynamic Bond, according to FundCalibre managing director Darius McDermott.

He said holding bonds would add a strong element of diversification to investors’ portfolios and the impressive returns on the Nomura fund can deliver some attractive capital growth too.

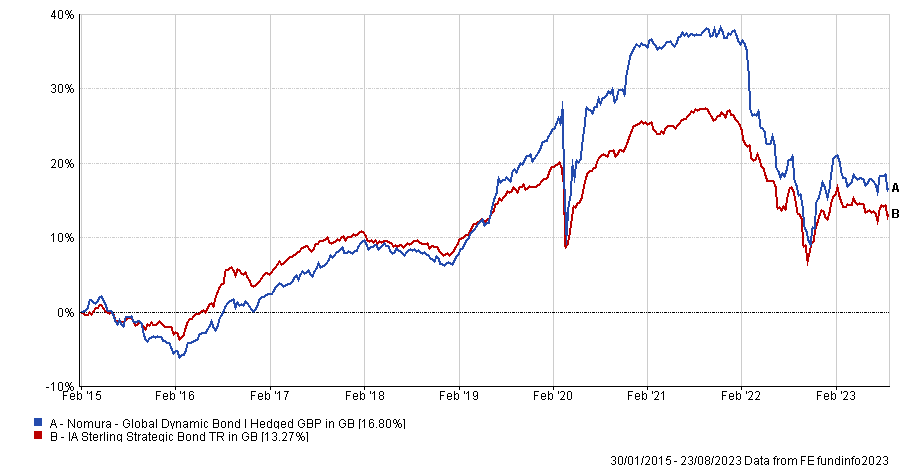

The $2.4bn portfolio was up 16.8% over the past decade, beating the average IA Sterling Strategic Bond fund by 3.5 percentage points.

Total return of fund vs sector over the past 10 years

Source: FE Analytics

Its lead on the peer group was much wider back when returns peaked at 38.2% in 2021, but tough economic conditions have pulled performance down across most funds last year.

Nevertheless, McDermott said fixed income funds – and Nomura Global Dynamic Bond in particular – could soon make some hefty returns once interest rates begin to fall.

He added that FE fundinfo Alpha Manager Richard Hodges is an expert in the field of fixed income and has built an excellent portfolio of the globe’s best bond opportunities.

“He is incredibly knowledgeable about bond securities and derivatives and uses this skillset and a flexible mandate, to exploit opportunities,” McDermott said.

“Nomura Global Dynamic fund offers an excellent option for all market conditions in terms of both yield and capital return.”