Investors hoping to make the best of the past decade through global funds would have been better off picking those with higher upside over those that protected during the worst of the markets, according to data from FE Analytics.

The past decade has been one of two distinct periods. The first half was one of slow but steadily rising markets. However, since 2020 volatility has been the main theme. Although stocks have broadly continued to do well there have been some steep losses at various times.

As such, the data suggests investors would have generally been better off picking the high-octane funds that performed well during the good times rather than those with downside protection.

In this series, Trustnet uses the upside capture ratio to identify the funds that have made the most money during rising markets and downside capture ratio for those that did well when markets fell.

An upside capture score of greater than 100% mean a fund has made more than the market when it has been rising, while lower downside capture metrics mean a portfolio has fallen less during tougher times. Both scores are calculated against a relevant benchmark: for the IA Global sector we used the MSCI World index. Previously we looked at emerging markets funds.

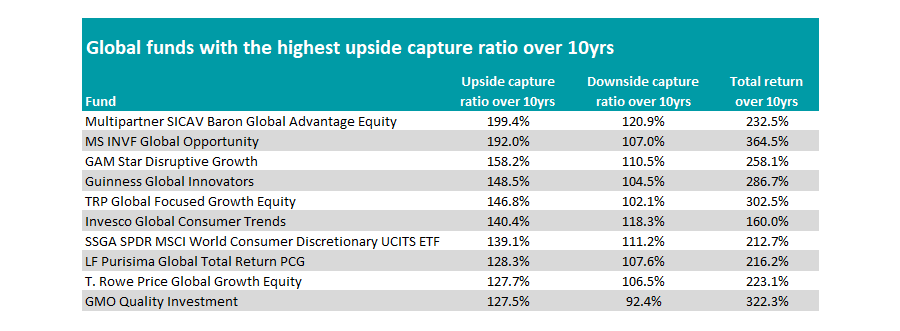

Those with the highest upside capture ratio consistently beat their peers, according to the data, with all in the first or second quartile of the sector over the decade.

The list below also houses the best performer over 10 years, MS INVF Global Opportunity, which made 364.5%.

Source: FE Analytics

It combined a 192% upside capture ratio with a 107% downside capture ratio, which together contributed to a total return over the period of 364.5%.

The $11.9bn fund is a growth portfolio with the majority (48%) split between consumer discretionary and technology names, with taxi firm Uber Technologies its largest holding at 9.8% of the portfolio.

This has dragged performance in recent years, with the fund sitting in the bottom quartile of the sector over three years, although it has returned to the top of the charts over 12 months as technology names have been rejuvenated following the rise of artificial intelligence (AI).

The second-best global fund of the decade is GMO Quality Investment, which had a lower upside capture ratio, sneaking onto the list in 10th place. However, its lower downside score helped it avoid some of the losses of its peers. Overall the $1.4bn fund made 322.3% in 10 years.

There were two clear themes among the list of funds with the highest upside – portfolios focused on growth and specialist consumer brands funds.

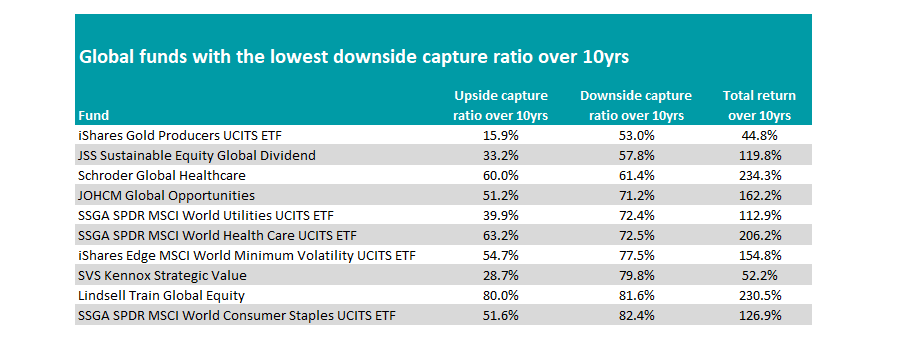

Turning to those that protected when markets fell, healthcare specialists provided investors with some security, with both Schroder Global Healthcare and SSGA SPDR MSCI World Health Care UCITS ETF making the top 10 funds with the lowest downside capture ratios.

The former was also the best performer on the list, up 234.3% over 10 years, good enough for 11th place in the 237-strong IA Global sector.

The list was dominated by passive funds invested in specialist areas, with iShares Gold Producers UCITS ETF the best at protecting investors. When markets fell, it dropped by around half the amount.

However, its total return of 44.8% was sixth-worst in the sector over 10 years as the gold price underwhelmed for much of the decade and producers spent much of their attention on cutting costs and improving capital expenditure rather than expanding.

Source: FE Analytics

Of the active funds, Lindsell Train Global Equity stands out. It was the second-best performer on the list behind Schroder Global Healthcare. Run by FE fundinfo Alpha Manager Nick Train, the portfolio invests in global brands that he believes will be around for decades.

Of those able to protect on the downside, it was the best at not missing out on the upside either, although its 80% capture score means it still lagged the MSCI World index when global stocks rocketed.

Another notable portfolio is JOHCM Global Opportunities managed by Alpha Managers Ben Leyland and Robert Lancastle, which has had considerable cash weightings over the past decade as the managers opted on the side of caution, waiting for prices to fall before making new entries to the portfolio.

This is reflected in its 71.2% downside capture score, although when markets rose the fund typically only made around half the returns of the benchmark.

Only four of the funds on this table – Lindsell Train Global Equity, JOHCM Global Opportunities, Schroder Global Healthcare and SSGA SPDR MSCI World Health Care UCITS ETF – made above-average returns in the decade.