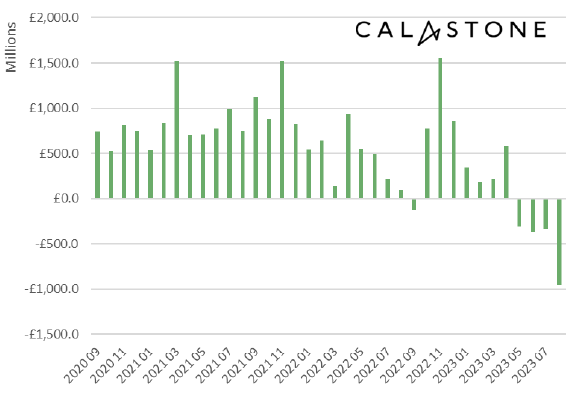

Environmental, social and governance (ESG) funds had their worst month on record in August, with UK investors withdrawing £953m throughout the month, according to new data from Calastone.

It was the fourth consecutive month of outflows for ESG funds, taking the total net money removed from these portfolios since May up to almost £2bn.

The high-growth nature of ESG investing meant performance was strong in the era of free cash and low interest rates and before 2023 they only encountered one month of outflows, but tightening monetary policy has soured investors’ appetites.

Net flows of ESG equity funds over the past three years

Source: Calastone

Calastone’s head of global markets Edward Glyn said passive funds are beating active ESG funds, which is another key driver of outflows and puts pressure on asset managers to improve performance.

“The move out of ESG funds has gathered pace in a remarkable reversal after the boom in recent years,” he said. “Four months of outflows signals a new trend emerging that fund houses will have to work hard to counteract.”

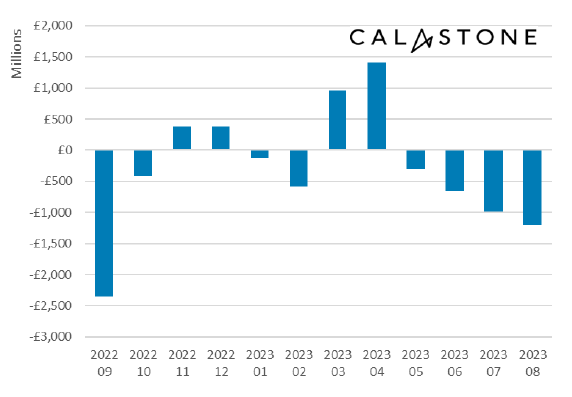

However the worst hit group overall was UK equity funds, with investors withdrawing £811m in August – the 27th consecutive month in which UK investors divested from their home market.

Glyn said “fear was a big motivator” in August as signs that UK inflation was much stickier than expected upped the likelihood of more interest rate hikes to come.

Indeed, UK investors removed a total of £1.2bn from equity funds overall in August, making it the seventh worst month on record.

Equity fund flows over the past year

Source: Calastone

Most of those outflows occurred in the first half of the month when negative economic data struck fear in investors and improved sentiment later in August couldn’t make up for those losses.

Glyn said: “Tepid economic data in the second half of the month boosted hopes that central banks may begin to lower interest rates sooner rather than later after all, and that has driven the market rally.

“But it’s not been enough to tempt fund investors back into to riskier assets. A clearer prognosis from central banks this month would help investors set their direction for the next few months.”

There were a couple of equity markets that UK investors were willing to put their money in, including global equity funds, which received inflows of £1.2bn throughout August. Emerging market funds also took in £180m.

They were the only two equity fund groups with positive inflows in 2023, raking in £9bn and £2.1bn respectively this year.

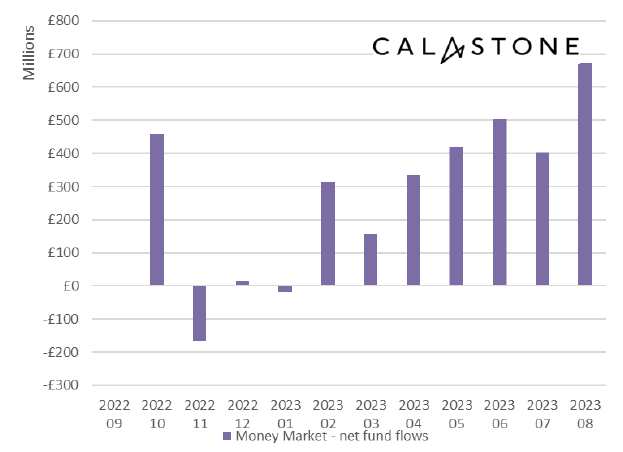

However, the Calastone report said “the biggest beneficiaries of investor risk-aversion in August” was money market funds.

As equity markets around the world continued to look volatile, investors poured £673m in money market funds last month – the second highest on record behind the pandemic-fear of March 2020.

Money market fund flows over the past year

Source: Calastone

High interest rates have upped the yields on money market funds and their more predictable returns relative to equity portfolios has made them popular among UK investors, according to Glynn.

He said: “With savings interest rates and yields on safe-haven money market funds at their highest level since 2007, it doesn’t take much to cause a rout.”