The global stock market has soared more than 10% over 2023 so far but some areas are in much more favour than others, FE fundinfo data shows.

Equities tanked in 2022 as central banks around the world hiked interest rates from historic lows, in a bid to tackle surging inflation. The MSCI AC World index fell 8.1% (in sterling terms) last year as investors adjusted to the new dynamic.

While central banks are still lifting rates, inflation has been falling from its highs and markets are expecting the hiking cycle to draw to a close.

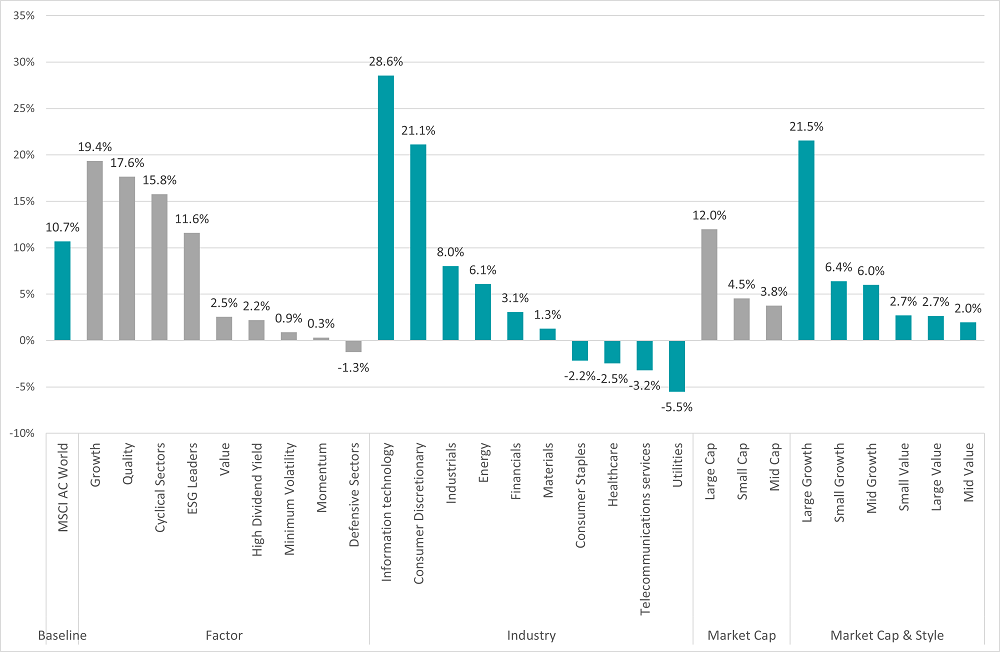

This has been part of the reason for the rally in global share prices this year – as the chart below shows, the MSCI AC World index is up 10.7% in 2023.

Global equity snapshot – 2023 YTD

Source: FinXL

Added to declining inflation and slowing interest rate hikes are factors such as surprising resilience in the global economy, which has so far avoided falling into recession, a strong employment situation and decent corporate profits.

This means that stocks have been the best part of the market to be in 2023. Global corporate bonds are down around 1% while global treasuries have dropped more than 5%. Commodities – which rocketed in 2022’s inflationary environment – are still rising but have generally been outpaced by equities this year.

However, as the chart above makes clear, the rally in global share prices has not fallen equally.

The factors section shows how growth stocks have led the market, with a 19.4% total return (in sterling terms) over the year to date. Growth stocks were the ones hit hardest in 2022 as they tend to be more sensitive to rising interest rates.

Cyclical stocks are also doing well in 2023, reflecting the resilience in the global economy and growing confidence that central banks can engineer a ‘soft landing’ while fighting inflation.

Value, on the other hand, is struggling. The style spent a decade out in the cold when rates were at historic lows then bounced back in 2022 as investors fled growth stocks, but suffered this year when growth returned to favour.

A look at the industry section shows how 2023 is being dominated by tech stocks, with the MSCI AC World Information Technology index up 28.6%. Investors have returned to tech stocks thanks to the hype around artificial intelligence combined with the fact that many were looking more attractively priced after some hefty falls last year.

However, it’s worth noting that it is a handful of tech stocks that are responsible for a significant chunk of the rally, with the ‘Magnificent Seven’ of Nvidia, Meta Platforms, Amazon, Microsoft, Apple, Alphabet and Tesla posting some impressive gains this year.

This is reflected in the fact that large-cap stocks – of which the above all are – have returned much more than the mid- and small-cap parts of the market. Likewise, the large-cap growth segment is the clear winner of 2023 so far, gaining 21.5%.

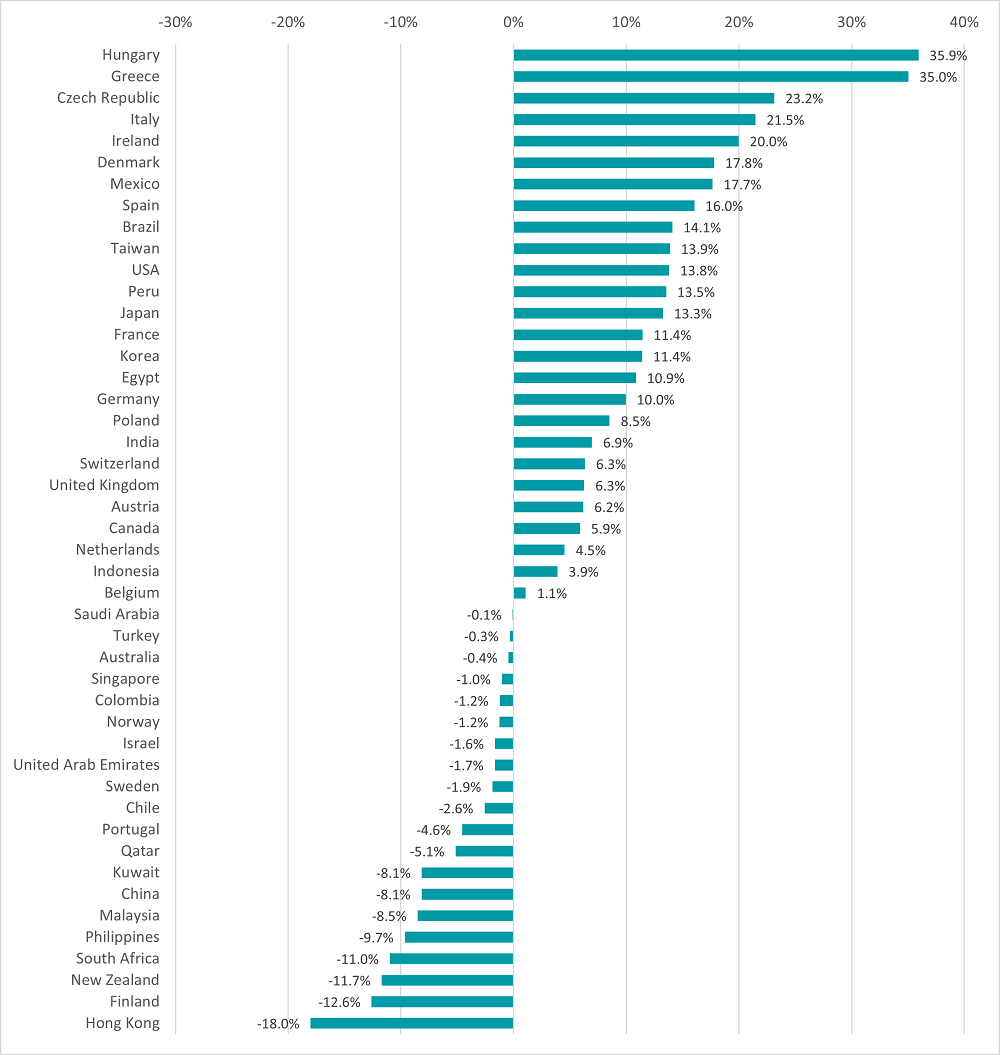

MSCI AC World constituent countries – 2023 YTD

Source: FinXL

How the global stock market is performing on a geographic basis can be seen in the chart above, which includes all 47 countries in the MSCI AC World index (23 developed markets and 24 emerging markets).

Many of the best performing countries are relatively small markets. Hungary tops the list, but the index only includes three stocks, while there’s only 10 stocks in the Greek index.