After 20 years at the helm of the Murray International Trust, manager Bruce Stout recently announced he will retire in June 2024. Under his tenure, the trust has built a reputation for its focus on defensive businesses that have the capacity to retain both earnings and dividends while keeping valuation in mind.

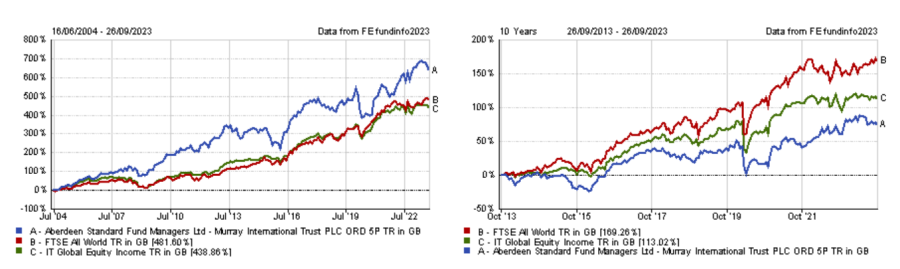

This approach was rewarded during the 2000s and through the global financial crisis and the trust has returned 640.5% to investors since Stout took over. However, it has struggled in the past 10 years during an era in which growth stocks have dominated markets.

Performance of trust vs sector and benchmark since Stout started and over 10yrs

Source: FE Analytics

Although Stout will leave the trust in less than a year, co-managers Samantha Fitzpatrick and Martin Connaghan are confident they can keep the investment approach the same.

Below, the management team discuss their strategy, explain their allocations and tell why investors should get used to a higher interest rate environment.

Could you describe your investment process?

Fitzpatrick: As a starting point, we use the expertise of regional analysts who give us a list of stocks that may be appropriate for Murray International.

We then identify the companies we deem suitable, looking for quality companies that we understand and can value. The end goal is to come up with a diversified list of names that will contribute to both the income and the capital growth objectives of the trust.

The trust has a strong exposure to emerging markets relative to global indices and peers. Is there any reason for that?

Connaghan: It's simply done with a view to delivering our investment objective. Emerging markets allow us to do that. Everybody thinks that you have to be invested in the US or nowhere at all, but you could have had annualised returns of 18% or 19% over the past 20 years in emerging markets if you have had access to solid businesses.

Fitzpatrick: We're not trying to have a particular allocation to any market or sector. We look for opportunities at the company level.

As global investors, what is your view on UK equities?

Connaghan: We have a mid-single digit allocation to the UK and hold names such as Unilever for example. The starting point for debates around the UK weighting is that domestic stocks are trading at a discount relative to the rest of the world and you would expect that gap to narrow.

It’s not the most compelling place to start, because they have always traded at a discount to other regions of the globe and for a reason. What are the underlying businesses? Maybe it is justified? So for us, very often we find more interesting companies when we start going down the market.

What have been your best and worst calls over the past 12 months?

Fitzpatrick: From a total return perspective, the tech names have been the standout performers. Broadcom, in particular, has been very strong and is now the biggest position in the portfolio thanks to the company’s performance.

Another name that has done well is BE Semiconductor. It's a Dutch company, which isn’t very well known and relatively small with a market cap below €10bn. We entered this position about 18 months ago. It didn't do well initially as semiconductor stocks were quite out of favour, but there has been a rebound this year.

Conversely, Sociedad Quimica y Minera de Chile (SQM), a Chilean mining company, has been one of the weaker names in the trust. We don't think we have made a mistake with that stock because the yield and the capital that it has generated over the holding period has been strong. It was up hugely last year but performance has moderated this year.

-

What is your outlook for the years to come?

Connaghan: The next 15 years are probably not going to be like the prior 15 with regards to interest rates, free trade and geopolitics.

Stout: For the first time, a whole generation of investors is getting to grips with the fact that money isn't free anymore. There's a price to it and that does change the potential risk and return balance. People will have to get used to it, because they may think that what we have seen in the past 10 years was normal, but there was nothing normal about that.

Fitzpatrick: From a more general market backdrop perspective, people fixate very much on whether or not a recession is going to happen in the US and the UK, but if you look at places such as Brazil or Mexico, they have had their rate hikes earlier and inflation has come down hugely.

They are in a much stronger position than many places in the developed world and we are trying to capitalise on companies that can benefit from that.

Will anything change after Stout’s retirement?

Fitzpatrick: The process will remain the same. It was the same before he came along and it will be the same after he retires. The trust belongs to the shareholders. They choose what they want it to achieve and it's our job to try to deliver on that. That’s what we have done for several years and will continue to do.

The trust has a high dividend yield (4.6%). How much reserves do you have?

Fitzpatrick: The figure as at the end of June 2023 was £70m, which is equivalent to roughly one full year's worth of dividend payments. If we were to not earn anything from our underlying holdings, we could still match the dividend.

Although we dipped into our reserves in 2020 and 2021, dividends of the underlying positions recovered better than expected last year. We have been able to raise the dividend and to add back into our reserves.