The FTSE 100 has made a 5.5% total return over 2023 so far, outpacing its mid- and small-cap rivals, but one of its members has surged more than 100% over this time.

As markets enter the final quarter of the year, now seems like a good time to find out which companies are topping the FTSE 100’s performance rankings – and which aren’t doing so well.

Source: FinXL

At the top of the table is aerospace and defence company Rolls Royce with an eye-catching 137% total return since the start of the year.

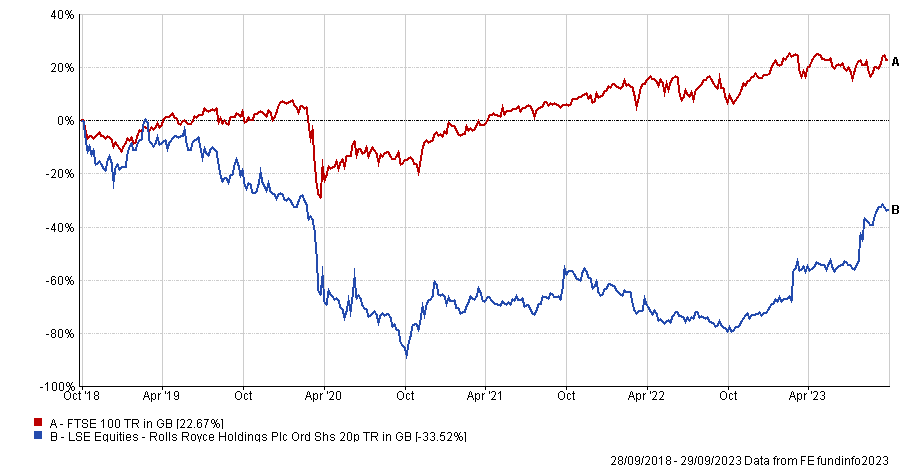

Rolls Royce was one of the biggest losers of the Covid-19 pandemic after the global lockdown hit demand for its engines and their servicing. On a five-year view, its share price is down 33.5% – significantly underperforming the FTSE 100’s 22.7% gain.

However, the company’s civil aerospace division is starting to recover now global travel has resumed while the conflict in Ukraine means it has benefitted from increased spending on defence.

Mark Crouch, analyst at eToro, said: “While the engineering giant’s balance sheet still requires quite a bit of work, investors will welcome the sharp uptick in revenue, profitability and margins compared with the same period last year.

“There is a feeling that Rolls now has a bit of momentum behind it. Investors have picked up on this and attitudes have definitely shifted towards the firm over the past year.”

Performance of Rolls Royce vs FTSE 100 over 5yrs

Source: FE Analytics

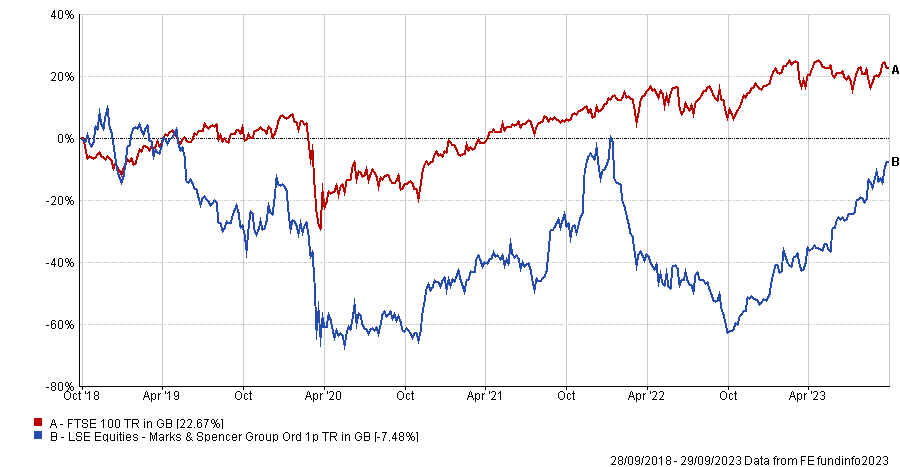

High Street stalwart Marks & Spencer is in second place with a 91.9% total return since the start of 2023. The stock only returned to the FTSE 100 in the past few weeks after a spell in the FTSE 250.

The company is implementing its latest turnaround strategy, which involves upgrading its store network, investing in technology and e-commence, and focusing on the value and quality of its clothing and food lines.

This strategy has been paying off, with the group upgrading its profit forecast and unveiling strong sales growth in the first 19 weeks of its financial year.

Susannah Streeter, head of money and markets at Hargreaves Lansdown, said: “The focus of the M&S brand on both quality and price has been a clear advantage and its stock selection has received the thumbs up from shoppers.

“Shrinking its estate, and closing larger stores in town centres, is a strategy bearing fruit with smaller shops in retail parks offering easy to use click and collect services.”

Performance of Marks & Spencer vs FTSE 100 over 5yrs

Source: FE Analytics

In third place is Melrose Industries, up 68.3%. It has historically specialised in buying poorly managed industrial business and turning them around but has more recently changed its strategic direction to be a long-term aerospace group.

The firm recently posted a strong set of half-year results and announced that Simon Peckham and Geoffrey Martin will step down as chief executive and group finance director respectively in March 2024.

Peter Dilnot (currently Melrose chief operating officer) will become CEO and Matthew Gregory (currently chief financial officer at Melrose-owned GKN Aerospace) group finance director, “thus providing management continuity as Melrose becomes a pureplay aerospace group”, the company said in its first-half report.

Performance of Melrose Industries vs FTSE 100 over 5yrs

Source: FE Analytics

But there have been some heavy falls in the FTSE 100 this year, with Mexican miner Fresnillo coming off the worst after slumping 37.8%. The company posted a significant drop in interim profits for 2023, driven by cost inflation and a sharp appreciation of the Mexican peso.

Sports-betting, gaming and interactive entertainment company Entain is down 28.4%. Its earnings have been volatile and the firm recently announced a revenue downgrade.

Industrial mining giant Anglo American is down 26.7%, after falling commodity prices contributed to a 13% drop in revenue for the first half of 2023.