Achieving outstanding performance across both the 2000s and the 2010s wasn’t an easy task, as both decades had distinctive drivers. While the 2000s is remembered as a commodities super cycle, US growth stocks dominated the 2010s.

The difficulty to maintain the same level of performance over the two decades is perhaps best illustrated by BlackRock World Mining. While the trust returned 531% between January 2000 and December 2009, making it the best performer in the Association of Investment Companies, it made a bottom-quartile return in the following decade.

Below, we have researched the trusts that were able to navigate changes and come on top of each of the two previous decades.

According to FE Analytics, only five close-ended funds have achieved this feat, with all of them belonging to different sectors and investing in different asset classes.

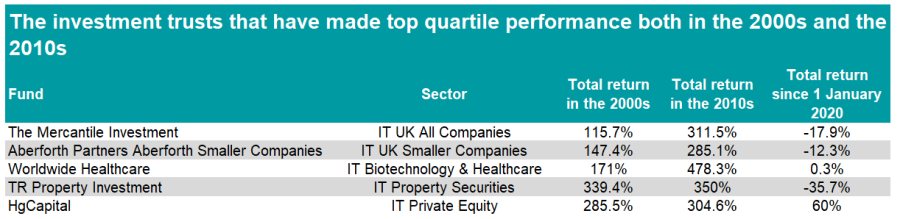

The investment trusts that have made top quartile performance both in the 2000s and the 2010s

Source: FE Analytics

Three equity portfolios, Mercantile, Aberforth Smaller Companies and Worldwide Healthcare, are among the trusts that had top-quartile performances in each decade.

Mercantile, which is part of the IT UK All Companies sector, returned 115.7% in the 2000s and 311.5% in the 2010s. The portfolio, managed by Anthony Lynch and Guy Anderson since 2010, is invested in quality UK small- and mid-cap companies.

Performance of trust since 1 January 2000 vs sector

Source: FE Analytics

The trust has had a difficult start in the current decade, however, and sits in the bottom quartile between 1 January 2020 and 3 October 2023.

Aberforth Smaller Companies also focuses on UK equities, but goes deeper in the market cap value chain, investing in small and micro-caps with a value tilt in the investment style.

Similar to Mercantile, an investment in Aberforth Smaller Companies on 1 January 2020 would have delivered negative returns so far in this decade.

Performance of trust since 1 January 2000 vs sector and benchmark

Source: FE Analytics

Yet, some professional investors, such as Peter Hewitt, manager of the CT Global Managed Portfolio trust, see both trusts as good options to tap into the potential of UK mid- and small-caps.

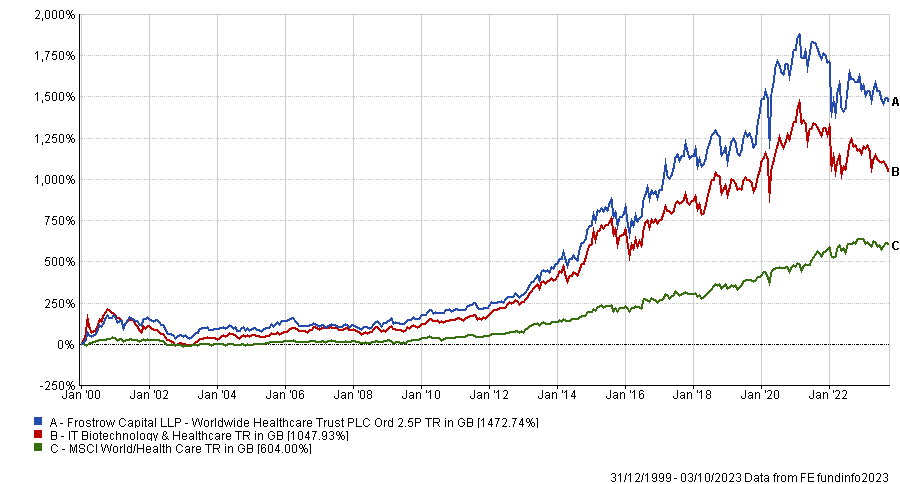

Worldwide Healthcare invests across all the sub sectors and market caps within healthcare and is currently the largest of the eight trusts in the IT Biotechnology & Healthcare sector. It is also one of the oldest portfolios in the sector, as five of the eight trusts were launched in the 2010s.

So far in this decade, the trust has returned 0.3%. The reasons for this modest performance is an underweight to the Covid winners as well as an overweight to life sciences, biotech and China.

Experts believe, however, that Worldwide Healthcare is well positioned to benefit from long-term drivers supporting the healthcare industry.

For instance, Alena Kosava, formerly head of investment research at AJ Bell, said at the end of last year: “With the long-term drivers behind healthcare well established and further investment set to continue making for an exciting future ahead for drug development, this broad, diversified play on healthcare looks attractive after a period of significant underperformance.”

Performance of trust since 1 January 2000 vs sector and benchmark

Source: FE Analytics

Outside of equities, a trust investing in property and another in private equities have managed to make top-quartile returns in the two previous decades.

TR Property invests in property stocks across Europe and also has some physical exposure in the UK. While the trust returned 339.4% in the 2000s and 350% in the 2010s, the portfolio’s value fell in 2022 as a result of rising interest rates.

Yet, Ryan Hughes head of investment partnerships at AJ Bell, said now could be a good entry point as risks have been priced in and we might edge closer to the end of the interest rate hiking cycle. As a result, value may start to emerge from the asset class.

Performance of trust since 1 January 2000 vs sector and benchmark

Source: FE Analytics

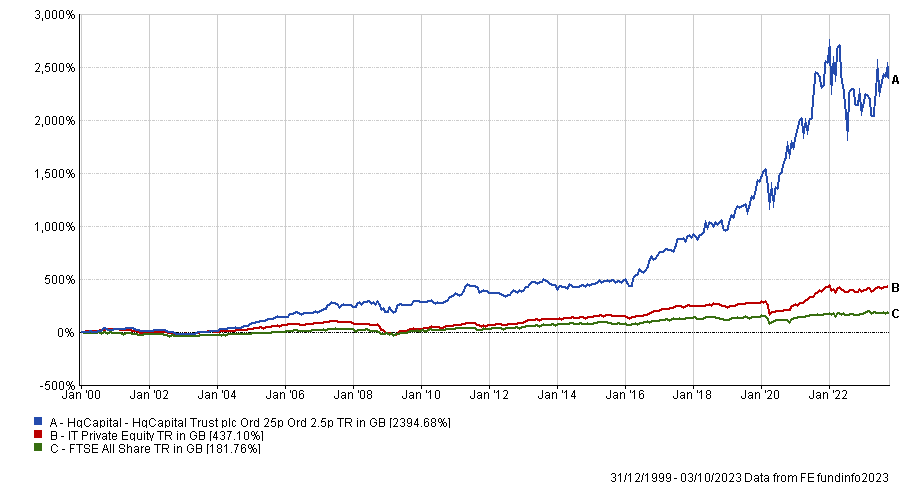

Finally, HgCapital Trust* invests in private European technology companies seeking to automate business processes and increase efficiency. It currently has approximately 50 holdings, with 68.3% of the portfolio concentrated in the top 10 holdings.

The trust returned 285.5% and 304.6% in the 2000s and 2010s respectively. Unlike the other trusts, HgCapital has been able to maintain its top-quartile performance so far in the 2020s, but was trading on a discount close to 20% at the time of writing.

Performance of trust since 1 January 2000 vs sector and benchmark

Source: FE Analytics

Analysts at Numis argued at the beginning of the year that private equity deserves more space in investors’ portfolio, given the risk/return opportunities and the attractive valuation opportunities created by wide discounts in the sector.

*HgCapital Trust is an investor in FE fundinfo.