Growth-oriented trusts with a preference for technology companies have underperformed in recent years, but Peter Hewitt has been rebuilding his exposure to them in the CT Global Managed Portfolio this year.

He cut allocations to the likes of Allianz Technology and Polar Capital Technology in his trust-of-trusts during their downturn but has been ramping up exposure as the outlook for growth investing improves.

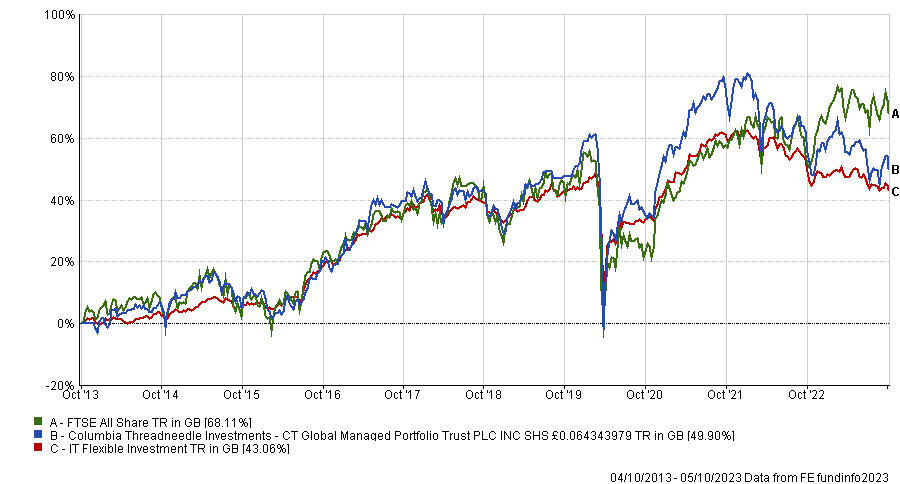

Having allocations to these types of trusts has been beneficial to CT Global Managed Portfolio’s long-term performance, with returns up 49.9% over the past decade, although it was overtaken by the FTSE All Share benchmark in 2022.

Total return of trust vs benchmark and sector over the past 10 years

Source: FE Analytics

Here, Hewitt tells Trustnet why Scottish Mortgage is the best place to start when investing for the long term and why he is “not going anywhere near China again”.

Trusts are selling at large discounts currently – how has it been investing in them lately?

Performance went off to the moon at the end of 2019 but during lockdown I was old enough to know that it couldn’t go on – and it didn’t. Inflation started taking off and interest rates went up in 2021, so we saw a huge derating across the sector and lots of underperformance. So investment trusts have been horrible for the past 18 months.

But the average sector discount at the start of last year was 2% and now it's 17% and you’re not going to underperform when discounts are that deep. I don’t see that going any higher than 20%.

We had a lot of large positions in technology trusts before, but I’ve since reduced those and the top 10 holdings looks very different today.

Do you still own those technology trusts?

I’ve actually moved back into Allianz Technology and Polar Capital Technology this year. If you want to get exposed to the mega-cap tech companies in America, these are the two trusts to do it. About half of their portfolios are in stocks like Microsoft, Apple and Alphabet, which have done very well off the back of the artificial intelligence story.

It could be a fad but I’ve been told artificial intelligence is like the internet was in 1995. That tells me it’s not just a fad – it's going to change almost everything across a lot of sectors and the immediate beneficiaries are the likes of Microsoft and Meta.

How have they performed since you went back into them?

They’ve been our best performers this year, with Polar Capital up around 29% in 2023 and Allianz as next best at about 25%. They have benefitted from strong underlying revenue and profits performance in the top 10 holdings and probably being too cheap after the major sell off last year.

They both also have sizeable holdings in NVIDIA, which dominates in chips for artificial intelligence applications and is growing exponentially.

Total return of trusts vs sector in 2023

Source: FE Analytics

Wil you continue rebuilding your technology exposure?

Until I added a bit to Allianz and Polar Capital in May, I had not bought any since I had first gotten them. It’s the same with Scottish Mortgage – these were around 5% and I put them down to about 1% because I thought if I sell them, I’ll never get back into them.

If I sold them I’d have to move onto something else, but they weren’t going to do me any more damage by underperforming. They’re small holdings but I can guarantee I’ll be adding to them from next year.

Including Scottish Mortgage?

I would say if you don’t own it and you want to put away a few quid into an investment trust every month, Scottish Mortgage is the place to start.

It’s on a 20% discount and has some really interesting holdings but it’s not going to perform in the next year, so you've got to be a genuinely long-term investor. If you’ve got a young child and you want to pay for them to go to university, this is how you do it.

Scottish Mortgage will generate massive returns over the next 10 years but it will either be all good or all bad because it’s so aggressively managed.

Baillie Gifford have access to some unbelievable companies so I’m not giving up on it. Scottish Mortgage is a wonderful winner that has delivered some great performance without owning the same mega tech companies its peers do.

Total return of trust vs benchmark and sector over the past year

Source: FE Analytics

What else have you been buying?

I made some additions to technology, but I’ve mainly been buying into the UK. The US market is selling on 19 times earnings and the UK is on 10, which is really cheap.

The UK has been in the relegation zone since the Brexit referendum in 2016 and there’s been plenty of toxic fiascos since then, but there comes a point where there's not much more to sell. If interest rates are not at the peak then they're close and by this time next year the UK is probably going to be in a much better financial environment.

Trusts investing in small and mid-cap companies are looking particularly cheap. I’ve been buying a few of them such as Mercantile, Lowland and Merchants Trust, but the best one of all is Aberforth Smaller Companies. It takes a value-oriented approach to buy listed British companies that aren’t very inspiring but very cheap, so you can make a lot of money in this one.

What about your worst performing trust?

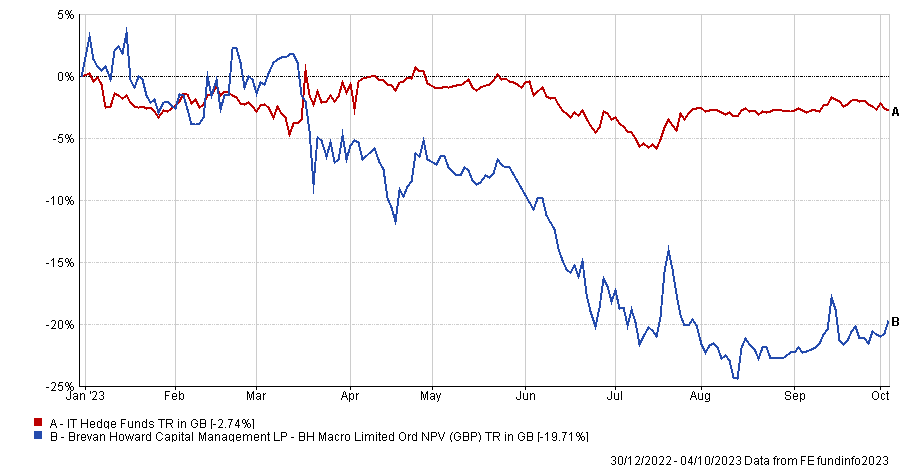

That was BH Macro, which is down about 21% in 2023. It is an investment trust that has holdings in a number of Brevan Howard hedge funds, which employs a macro strategy.

That fund was wrongfooted by the SVB banking failure in the US where it was positioned for interest rates and bond yields to rise and they did the reverse as, for a while, there was concern over the implications for the wider US banking system.

The net asset value fell more than 6%, however it was trading at a premium and has moved to over a 10% discount subsequently. Ironically, it was the Managed Portfolio Trust’s best performer in 2022, but long term it remains a solid hold.

Total return of trust vs sector in 2023

Source: FE Analytics

You no longer have any exposure to China – why is that?

I don’t like China and I’m very mild about Asia in general. I did own the Baillie Gifford China Growth trust for a bit, but when you have totalitarian regimes they can decide to do whatever they want.

What made me cautious was when the government decided the education sector was not going to be private anymore and when one of the founders of Alibaba disappeared, never to be seen again. If what you’re doing happens to coincide with the Communist Party's view it will probably be okay but if it doesn’t, tough luck.

China has had a real growth slowdown anyway, which affects all the other Asian countries. I do own some Asian trusts and I will come back in there, but I'm not going anywhere near China again. There’s so many other opportunities, so why take the risk?