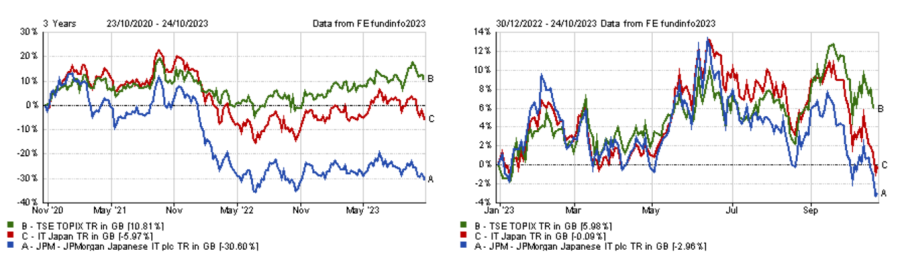

The past few years have been difficult for shareholders of the JPMorgan Japanese IT as the trust has underperformed its benchmark since 2020.

At the AIC Investment Company Showcase, a shareholder who bought his shares in the trust three years ago pointed out that he would have been better off with a tracker fund. Indeed, the trust’s share price is down 30.6% over that period, while the Topix rose 10.8%.

Moreover, the trust has not benefited from the Japan rally this year and is down 3% year-to-date, while the Topix is up 6%.

Performance of trust over 3yrs and YTD vs sector and benchmark

Source: FE Analytics

The trust co-manager, Nicholas Weindling acknowledged the disappointing performance over the past few years and explained why he thinks the portfolio hasn’t performed in spite of the tailwinds for Japanese equities.

One is due to the changes in corporate governance which have so far “disproportionately” benefited companies trading on low valuations, whereas the trust focuses on quality-growth companies which usually attract higher valuations.

“Japan is a very unusual market. While the US has been totally led by the Magnificent Seven stocks, value has been the dominating factor in Japan in recent times,” Weindling said.

For example, a sector that people have been buying this year in Japan is banks, but Weindling believes that they won’t prove to be a good investment on a long-term horizon.

He said: “People expect monetary policy changes, so they have been buying Japanese banks. We don’t own Japanese banks because the long-term outlook is bad. It is an extremely competitive industry in a country where the population is falling.”

Nonetheless, Weindling remains confident about the long-term outlook of his portfolio, as he is seeing structural improvements in Japan, such as improving return on equity (ROE), a ratio measuring a company’s profitability and efficiency in profit generation, as Japanese corporates are starting to deploy their large cash reserves.

This is due to reforms that the Tokyo Stock Exchange is enforcing but also a generational shift within Japanese corporates.

Weindling said: “Why do some Japanese companies think that they need to have so much cash? That takes us back to the bubble era in the early 1990s when the Imperial Palace in Tokyo was worth more than the entire state of California.

“When the bubble burst, real estate valuations and equity prices fell. Several Japanese banks went bankrupt and companies started to hoard cash because they couldn't borrow that money from anywhere. Now that is all in the distant past, we are starting to see companies changing with the generation shift.”

He added that Japanese domestic asset managers are now putting pressure on companies and challenging boards at annual general meetings, which is something they historically didn’t do.

Inflation is also a tailwind for Japan, as the country has been in deflation for several decades.

Weindling said: “Japan has been a strong market this year, although it is not as good in sterling terms, which is due to currency weakness. That could be coming to an end because the Bank of England may stop hiking interest rates.

“Meanwhile, Japan is moving the other way, so this headwind could dissipate over the next year or two. Japan is probably the only country in the world where inflation is a good thing.”

Yet, not everybody shares Weindling’s bullishness on Japanese equities. For instance, its stablemate JPMorgan Global Growth & Income is underweight Japan relative to its benchmark.

Amit Parmar, manager of JPMorgan Global Growth & Income, said: “There are some absolutely fantastic companies in Japan, but they tend to trade on very high multiples. Then, you have a large swathe of the market which is frankly lower quality and that we don't want to own.

“That middle cohort of great companies trading on reasonable valuations is being more and more compressed.”

Parmar was also not sure that the Tokyo Stock Exchange’s reform forcing companies trading on a price-to-book ratio of less than one to come up with a plan to improve would lead to long-term opportunities.

“The question is then: is this a business where sustainable earnings can actually being delivered, regardless of the valuation?,” he added.