Cash yields are higher than they have been in decades, but people shouldn’t ignore income funds just because cash seems more valuable.

In fact, from cash accounts comes a false sense of security, according to Fidelity International’s multi-asset manager George Efstathopoulos, as they don’t beat inflation and investors could also be missing out on capital appreciation and dividend increases.

Sometimes, they also miss out on better rates, as there are indeed income funds around that pay higher dividends than what’s available through savings accounts.

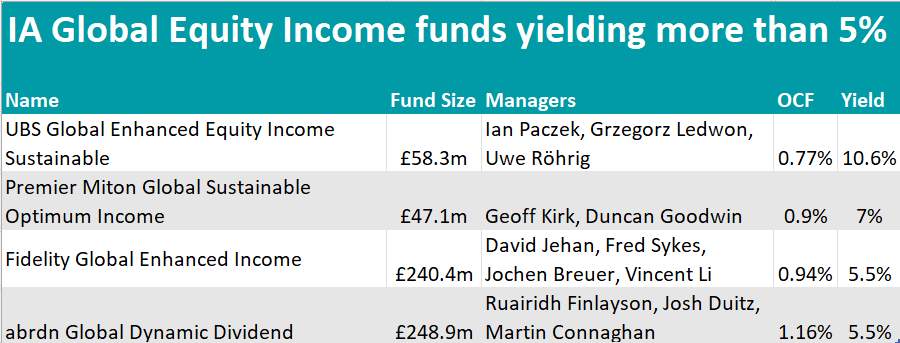

Below, we look at the global funds and trusts that pay out more than 5% yearly – with the caveat that dividends are never a guarantee, but cash yields are.

In the IA Global Equity Income sector, investors can get as much as 10.6% yearly, which is the current yield of the UBS Global Enhanced Equity Income Sustainable trust, which aims to generate at least 110% of the income of the MSCI ACWI Index (GBP-hedged) in any 12-month period.

At 0.77%, the fund’s ongoing charge figure (OCF) is the lowest in the list.

The vehicle mainly invests in North American equities, which make up 54.3% of the whole portfolio, and European stocks (15.7%). Its first holdings are the two oil companies Pioneer Natural Resources and Chevron (both approximately making up 2.6% of the portfolio), closely followed by digital communications company Cisco (2.5%).

Source: FE Analytics

In second place, at a 7% yield and beating its target yield of 6% per annum, is Premier Miton Global Sustainable Optimum Income, managed by Geoff Kirk and Duncan Goodwin.

Investing in companies of different sizes, sectors and geographic regions across the world, the managers focus on long-term sustainable growth themes, which could include stocks in the health and wellbeing, energy transition and circular economy, and other sectors.

At 4.2%, the largest holding is the London Stock Exchange Group, but the largest allocation in the portfolio is to information technology (28.4%) versus 17.4% in financials.

Next up are Fidelity Global Enhanced Income and abrdn Global Dynamic Dividend, both of which yield 5.5%.

The two have an 88% correlation to each other (meaning that they have moved in tandem for 88% of the time), but they play some sectors differently. The main differences in weightings are in the basic materials space (10.3% for the abrdn fund and 2.7% for Fidelity) and the money markets, where Fidelity keeps 15.7% of its portfolio versus nought for abrdn. Moreover, 60.8% of the latter’s portfolio is invested in the US – for the former, which focuses more on European stocks, that’s only 16.6%.

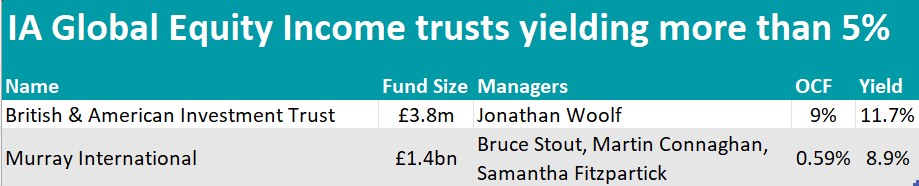

In the investment company universe, the list is much shorter, with only two trusts that currently yield more than 5%.

However, this is where the highest yield is paid, as The British & American Investment Trust yields 11.7%.

The trust predominantly invests in investment trusts and other leading UK and US-quoted companies to achieve a balance of income and growth.

It currently trades on a 28.56% discount and has gross gearing of 11%.

Source: FE Analytics

Finally, the £1.4bn Murray International trust is currently yielding 8.9%, even though income is not its sole focus; co-managers Samantha Fitzpatrick and Martin Connaghan (Bruce Stout announced he will retire in June 2024) also take capital growth into account.

Under Stout’s tenure, the trust has built a reputation for its focus on defensive businesses that have the capacity to retain both earnings and dividends while keeping valuation in mind and the strategy won’t change after his retirement.

The trust is currently on an 8.28% discount and is 7% geared.