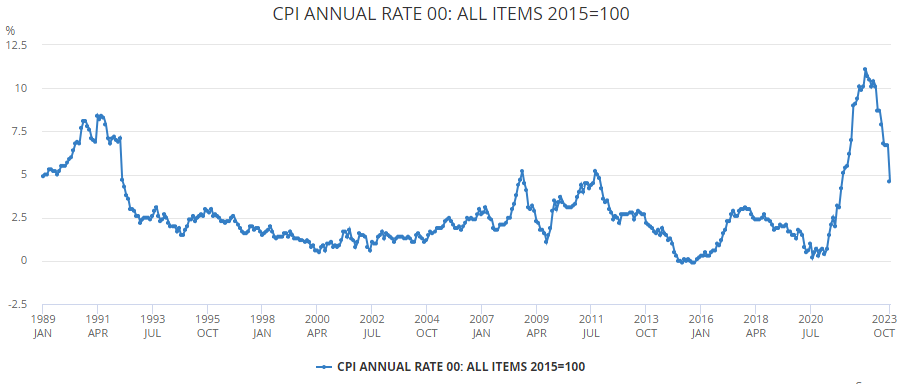

The Consumer Prices Index (CPI) rose by 4.6% in the 12 months to October 2023, down significantly from 6.7% in September and from the 11.1% peak in October 2022, according to data from the Office for National Statistics.

The headline figure was aided by gas and electricity prices, which fell due to a reduction in the energy price cap, as well as the cost of food and non-alcoholic beverages flattening.

Lowering inflation was one of prime minister Rishi Sunak’s five priorities, with Lindsay James, investment strategist at Quilter Investors, noting that today’s figures will allow him to “breathe a deep sigh of relief”.

“Halving inflation was meant to be the easiest of his five priorities to achieve as it was a year-on-year comparison and 2022 saw inflation rise sharply. Although things got a little close for comfort, today’s sharp drop in inflation to 4.6% is a positive step on the long road back to target levels,” she said.

It is not just the prime minister who has reasons to celebrate. After pausing interest rates to allow its hiking cycle to take effect, members of the Bank of England’s Monetary Policy Committee may also feel vindicated, according to experts, who suggested that the latest figures mean rates will be kept on hold until well into next year.

Source: Office for National Statistics

James Lynch, fixed income investment manager at Aegon Asset Management, said: “Now that the Bank of England has paused interest rates at 5.25% at two meetings in a row, they really did need some confirmation that they are on the correct course of action and they got that this morning with the October inflation numbers.”

Today’s numbers were lower than had been forecast by the Bank, which had expected CPI around 4.8%. Crucially, Lynch noted, services fell to 6.6% while they expected 6.9%.

However, Rob Morgan, chief investment analyst at Charles Stanley Direct, noted that rising wages continue to put “inflationary pressures” in certain areas. He noted the owner occupiers' housing costs (OOH) component of the wider measure CPIH hit its highest annual rate since July 1992 at 5.4%.

“This reflects higher mortgage rates, so many households will still be feeling the pinch, especially compared to last winter when government support for energy bills was in place and had the effect of reducing overall household expenditure,” he said.

Core inflation excluding volatile food and energy prices decelerated to 5.7% in October from 6.1%, a faster fall than expected. Myron Jobson, senior personal finance analyst at interactive investor, pointed out that Bank of England policymakers monitor this figure closely. “This reading adds to convictions that the interest rate cycle may well be over,” he said.

Hugh Gimber, global market strategist at JP Morgan Asset Management, agreed. “For the Bank of England (BoE), the weakness in core inflation will be more significant than the drop in the headline figures. The drag lower from energy base effects as last year’s changes to the price cap fall out of the numbers has been long awaited, and well understood. More important, is to see some of the stickier parts of the inflation basket cooling more quickly than previously forecasted."

The UK’s softer inflation numbers follow similar news from the US yesterday, where headline CPI was unchanged for October, leading experts to predict that the Federal Reserve’s rate hiking cycle may have come to an end.

Thomas Simons, senior US economist at Jefferies, described October’s CPI data as “a sight for sore eyes among Fed policymakers”.

“Signs of easing inflation pressure may result in some amount of unintended easing of financial conditions, with the market pricing out rate hikes and starting to price in more cuts,” Simons said. “The road back down to 2% inflation is going to be bumpy, but now it at least feels like the journey has started.”

Darius McDermott, managing director at Chelsea Financial Services, expects the stock market to rally on the back of the subdued inflation figures in the UK today and the US yesterday. These numbers indicate that interest rates have probably peaked and “the next move might be downwards if the economy slows down further or GDP stays very low,” he explained.

UK small-caps in particular should rebound from their “very cheap starting values”, McDermott said.

Jonathan Boyar, principal advisor to the MAPFRE AM US Forgotten Value fund, also expects the 'higher for longer' rhetoric to fade, which should be positive for US equity markets, especially small caps, he said.