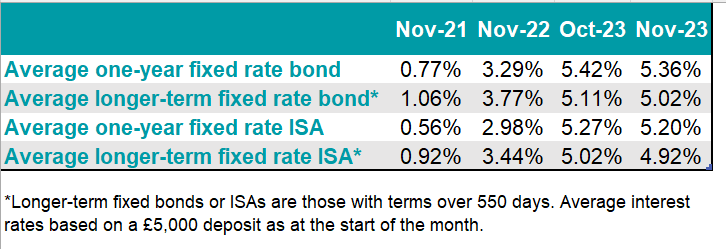

The interest rates savers get paid from fixed-term cash savings has been cut across the board while flexible products remain competitive, the Moneyfacts UK Savings Trends Treasury report has shown.

Fixed rates fell month-on-month for the first time since 2021, with a magnitude of cuts not seen since 2020. The average one-year fixed rate account is now yielding 5.36% versus the 5.42% at the end of last month.

This is due to inflation slowing down and expectations that the Bank of England will pause and eventually cut base rates at it turns to laxer monetary policy. Moneyfacts finance expert Rachel Springall said it was a “disappointing” (albeit unsurprising) news for savers.

Average rates on fixed-rate savings accounts

Source: Moneyfacts Treasury Reports

“There was a clear downward trend in the fixed market as all average fixed rates fell for the first time since March 2021. It is the first time that the average one-year fixed bond and ISA rates have fallen in more than two years,” she said.

“There are expectations for interest rates to drop in the months ahead, so fixed savings rates could fall further before the year is over.”

But there are exceptions, with some providers still enhancing their fixed rate savings deals. Challenger banks could also go against the trend and increase their rates if they need to entice deposits to fund their future lending, Springall said.

As of today, the best-paying one-year account is Metro Bank’s, which offers 5.91% either monthly or on the anniversary date. As for ISA products, savers can get up to 5.85% with Virgin Money. This is according to Moneyfacts and based on a lump sum of £20,000.

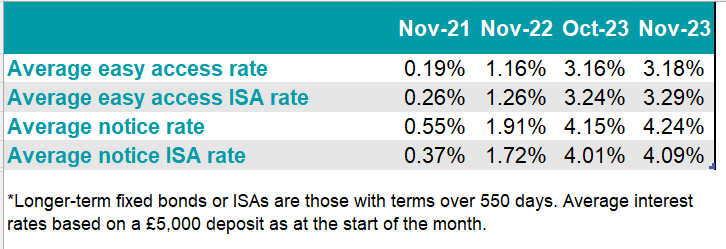

On the positive side, variable rates have risen for the 21st consecutive month, the longest streak since Moneyfacts records began in 2007, benefiting savers who prefer to keep their cash in a flexible pot.

There was also strong momentum across notice accounts and notice ISAs (accounts that accept redemptions after a certain notice period), as shown in the table below.

Average rates on easy-access accounts

Source: Moneyfacts Treasury Reports

Here, the best-payer is again Metro Bank with a 5.22% variable rate paid monthly, but this includes a 3.46% bonus for the first 12 months only. In the ISA wrapper, this goes down to 5.11% including bonus. Ulster Bank’s Loyalty Saver account pays 5.20% yearly with no bonus.

With a 180-days’ notice savers can get better rates – 5.59% monthly with Oxbury Bank or 5.30% with Mansfield Building Society for ISA customers.

“The uplift in rates should encourage savers to review their existing portfolio as they could get a better return elsewhere. However, it is worth noting that some of the best deals have withdrawal restrictions or carry an introductory bonus, so savers will need to check all the terms of any account carefully,” said Springall.

“Despite a slight dip in the choice of products, there are still many deals to choose from designed to suit different requirements. To secure the best possible deal, savers will need to act quickly, as providers can control any spikes in demand with subsequent rate cuts and withdrawals.”