Within emerging markets we have witnessed considerable transformation over the past few decades with many emerging economies possessing cutting-edge companies, which over time have become industry leaders.

The new reality in emerging markets is characterised by increased institutional resilience, improved economic diversification and the rise of world-leading emerging market companies.

South Korea stands out as an example of a country that has greatly evolved over time. The country has transformed from a manufacturing consumer electronics and durables hub to becoming an industry front-runner and leader in new age technologies including semiconductors, electric vehicle (EV) batteries and biologics.

It is also one of the very few markets globally where the internet ecosystem is dominated by domestic companies. The country is also at the forefront of innovation, with the highest per capita patent filings in the world.

It’s not only the technology industry where South Korea has made progress. Whilst Korean cosmetics have been well known globally, more recently, it has also emerged as a major exporter of culture with popular Korean music, dramas and webtoons gaining popularity in western markets.

Signs of a bottoming of the downcycle in the chip industry has led the South Korean market to outperform its emerging and developed market counterparts in the past year. In dollar terms, the MSCI Korea Index returned 27% in the 12-month period ended September 2023, versus a 12% return in the MSCI Emerging Markets Index and 23% increase in the MSCI World Index.

South Korea’s valuations also remain attractive, with the MSCI Korea Index trading at a forward price-to-earnings (P/E) ratio of 11.4x vs 11.6x for MSCI EM and 16.1x for MSCI World.

Looking ahead we think there is continued scope for performance in Korean equities, particularly in export-oriented sectors such as semiconductors, where the technology cycle is bottoming, and structural trends continue to drive the shift to higher value-add products.

Demand for semiconductors is forecast to grow in the coming years driven by demand for processing power to drive artificial intelligence (AI) applications and the internet-of-things. Continued technological development has led to higher silicon content per device, as well as the expansion of new end-applications (autonomous driving, generative AI), which drives continuous growth in semiconductor content. Technology companies will drive semiconductor demand as they accelerate investments in AI.

Demand for ever more powerful semiconductors could increase dramatically in the years ahead as companies outside the technology industry also invest in customised large language models (LLM) for their own use.

As an export-orientated economy, South Korean exporters have benefited from a weaker won. A weak won (along with high oil prices), however, has also made energy imports more expensive for South Korea given it imports most of its energy needs.

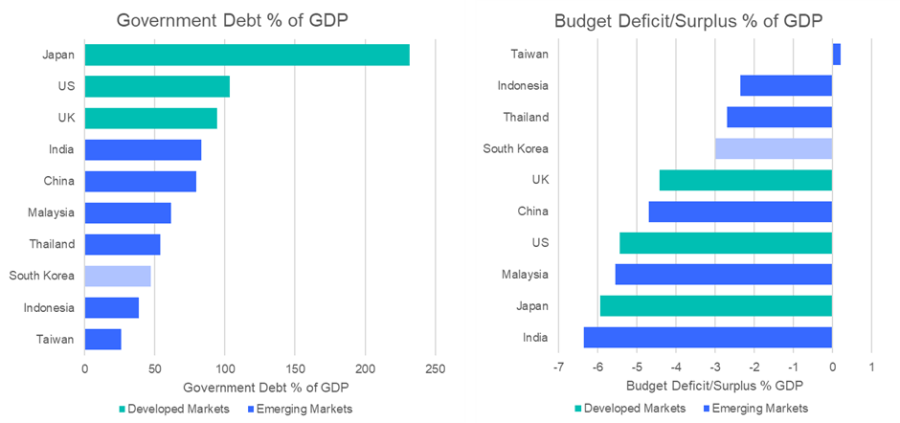

South Korea has for many years pursued prudent economic policies, resulting in relatively lower government debt and budget deficit levels, in comparison to most developed markets. The country also has significant foreign reserves, leading us to believe that it remains well positioned to withstand any major external financial shocks or a global economic downturn.

South Korea: Prudent Policymaking Positions Country Well

Source: Bank for International Settlements, Economic Intelligence Unit

However, like any emerging country, South Korea does have some challenges to overcome. Demographic trends are unfavourable, with the country facing an aging and shrinking population and one of the lowest birth rates in the world.

As such, the size of the working age population is also expected to decline, which would impact economic growth in the longer term. Geopolitical tension with North Korea also remains a cause of concern, however, we expect to see the current status-quo remain for the foreseeable future.

One area currently undergoing vast improvements is corporate governance, which has been a key challenge of investing in South Korea for a long time. Various instances of engagement with companies are increasingly yielding results, evidenced by improving shareholder returns including higher dividends, public apologies, and restructurings.

Overall, we believe there is a strong investment case for South Korea which can provide investors with superior earnings growth of globally competitive sustainable companies at appealing valuations.

Chetan Sehgal is lead Portfolio Manager of Templeton Emerging Markets Investment Trust. The views expressed above should not be taken as investment advice.