One of the many dilemmas investors face these days is deciding what’s more attractive between a guaranteed income of approximately 5% for the next one to two years, which they can still get from a few cash savings accounts, and an income fund or trust with a yield that isn’t guaranteed but has the additional benefit of capital appreciation.

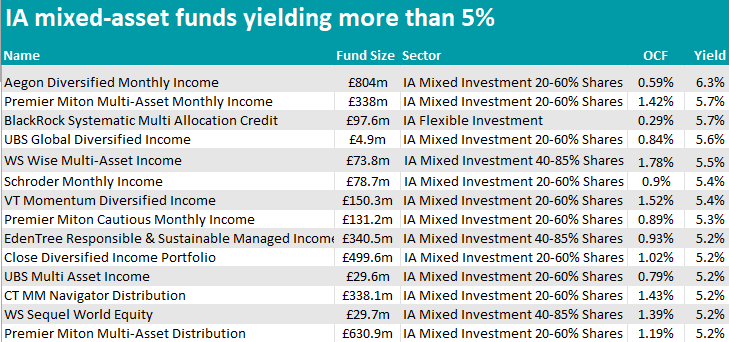

For those whose attention might be shifting from cash and other liquid instruments such as money-market funds towards income vehicles, below Trustnet lists the multi-asset funds on the market that today are offering yields above 5%. Previously, we covered global equity and UK equity income.

The vast majority of the funds below come from the IA Mixed Investment 20-60% Shares sector. Topping them with its 6.3% yield and a good track record of meeting its 4-6% income target, is Aegon Diversified Monthly Income.

Source: FE Analytics

When yields on income-generating assets are low, managers Jacob Vijverberg and Vincent McEntegart may have to take on higher levels of risk in order to meet their target. Square Mile analysts have conviction in the multi-asset team despite the recent departures of senior members of the fixed-income team.

“We like the collaborative approach and the way they work with the underlying specialist teams to ensure security selection is in line with their investment themes,” they said.

“While our knowledge and conviction in the fixed income team is not as high as it previously was following departures, we believe the group is appropriately resourced and can continue to successfully run the mandate.”

Sharing the third position on the podium at 5.7% are Premier Miton Multi-Asset Monthly Income and, from the IA Flexible Investment sector, BlackRock Systematic Multi Allocation Credit.

The former is co-led by the “experienced” David Hambidge, who works in a “focused and stable” team, according to Square Mile researchers.

“They have an excellent appreciation of the outcomes that investors seek and this diversified, incomeseeking fund has a strong record of meeting its income objective since the team took responsibility,” the analysts said.

“Over the years, the team has demonstrated a good track record when selecting managers that have complementary investment styles and who can deliver superior risk-adjusted returns.”

On a par with it, the actively managed BlackRock Systematic Multi Allocation Credit fund invests in fixed-income assets from a composite benchmark of global equally-weighted sterling-hedged indices.

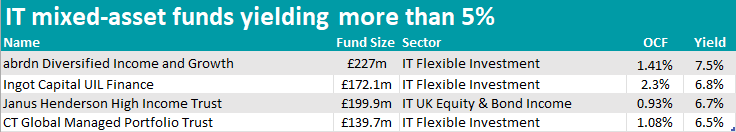

In the investment trusts universe, fewer vehicles made the list, but the four that did offer higher yields than most mutual funds.

The highest payer, with a yield of 7.5% is abrdn Diversified Income and Growth, a strategy which is “stuck between a rock and a hard place”, according to Numis analysts.

The trust has had “many years and incarnations that have failed to produce an attractive return profile” and will face a continuation vote in February 2024, a tender offer will be held at a 15% discount to NAV.

“The changes in 2020 to move into less liquid investments has limited the company’s options, with any changes to the portfolio and strategy being like turning around a supertanker,” they said.

“As a result, we expect that the portfolio was not a particularly attractive merger target for other listed funds, whilst options for returning capital on an ongoing basis are limited. A wind-down would be hard to achieve given the long-term nature of the assets.”

Source: FE Analytics

In second position, Ingot Capital Management’s UIL Finance pays out 6.8% and invests 43.2% of its portfolio in the financial services sector, followed by technology (22.5%) and resources (13.7%). Its total return was -2.6% in October, outperforming the FTSE All Share total return Index which was down 4.1% over the month.

Finally, at 6.7%, the Janus Henderson High Income Trust was in third position. The trust has undergone corporate action, with the board agreeing to merge the fund with Henderson Diversified Income, which Numis analysts were “not surprised to see” due to “unexpected market conditions” and “concerns over the scale of the fund”.

The merger was announced on 4 October and “avoids some of the issues that others are struggling with, because its relatively liquid portfolio enables it to offer investors a full cash exit.”

There will be “a reasonably significant shift in underlying asset exposure” from debt to equities; however, investors not wishing to make this change will have the option of a full cash exit at a 1% discount, they noted.