It has been around three years since the infamous vaccine Monday, when the world was filled with optimism that the end of the Covid pandemic was in sight. A booming recovery was expected, with consumers unleashing a year of pent up savings, but the reality has been far more muted.

No-one was expecting the events of the past three years, with conflicts in Ukraine and more recently Israel, as well as a ramp up in the trade war between China and the US, shifting the geopolitical landscape.

From an economic standpoint, rampant inflation led to one of the most aggressive interest rate hiking cycles in history, in part due to supply chain disruption, which remained for far longer than expected following the pandemic.

Globalisation appears to be coming to an abrupt end – which is also inflationary – while a mini banking crisis in the US and Europe threatened a potential financial crisis, although this was contained.

But it has not all been bad news for investors. Indeed there have been pockets where those savvy enough to back the right investment could have made sensational returns.

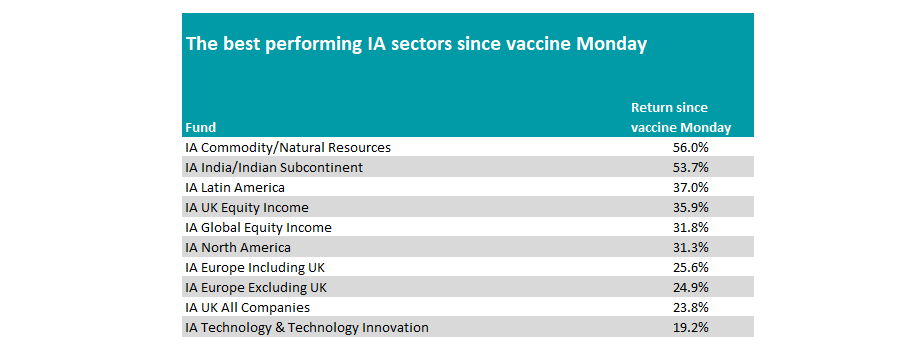

The top performing sector over the three years has been the IA Commodity/Natural Resources, up 56% since the creation of the Covid vaccine.

Supply chain woes bolstered commodity prices across the board, with some suggesting we are in a ‘super cycle’. War between Ukraine and Russia meanwhile prompted a spike in the oil price, as Western countries placed sanctions on Russian exports, including its vast oil and gas industry.

For a similar reason, the commodity-heavy IA Latin America sector took third position with the average fund up 37% over the past three years.

Source: FE Analytics. Data from 08/11/2020 to 28/11/2023

Splitting the two is the IA India/Indian Subcontinent sector, where the average fund recorded a 53.7% gain despite the country being a net importer of oil.

Nilang Mehta, co-manager of the HSBC GIF Indian Equity fund, told Trustnet last month that the country has now become too big to ignore.

“India is the fifth largest economy in the world today and is set to become the third-largest over the next five to six years,” he said. “How is that to be considered a niche market to allocate to?”

Income strategies have performed well, with financials boosted by interest rates, oil majors and mining titans boosted by commodity prices and some retailers benefiting from consumer spending in pockets of the market.

Both IA UK Equity Income and IA Global Equity Income made the top five sectors over three years.

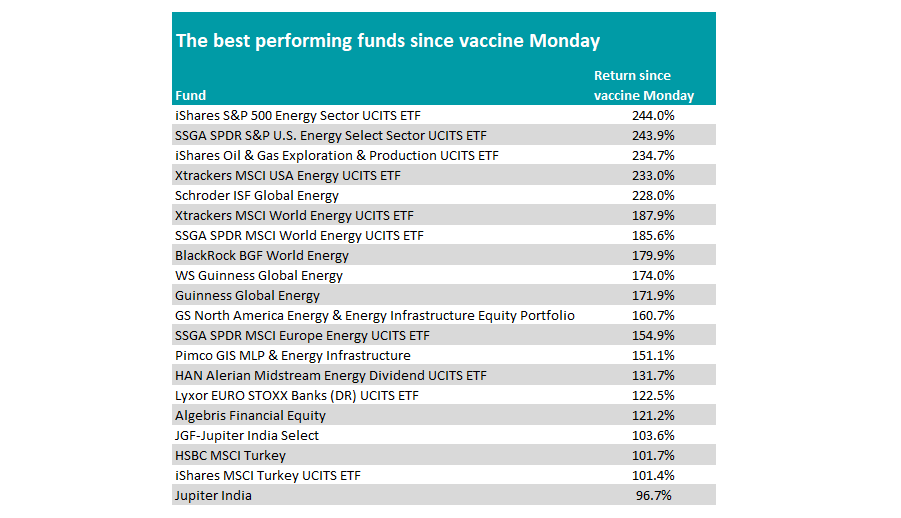

Turning to individual funds, 14 of the top 20 funds over the three years since vaccine Monday all specialise in energy, with iShares S&P 500 Energy Sector UCITS ETF and SSGA SPDR S&P U.S. Energy Select Sector UCITS ETF topping the charts, having generated a return of 244% each.

In terms of active strategies, Schroder ISF Global Energy made the highest return of 228%, while BlackRock BGF World Energy and WS Guinness Global Energy were also among the top 10.

Source: FE Analytics. Data from 08/11/2020 to 28/11/2023

Lyxor EURO STOXX Banks (DR) UCITS ETF (122.5%) is the first non-energy fund on the list. Another low-cost passive option, it tracks a European banking index. Financials, and in particular banks, have benefited from the high interest rate environment of the past three years as their profits are directly linked to the Bank rate. Algebris Financial Equity also cracked the list in a similar vein.

Two tracker funds investing in Turkey appeared towards the end of the top 25, both doubling investors’ money over the three years as the volatile index has rallied, while JGF-Jupiter India Select and Jupiter India were the top performers from the IA India/Indian Subcontinent sector.