Climate resilience, financing for emerging markets and policy are the three main themes the BlackRock Investment Institute is watching for at the UN climate conference in Dubai (COP28).

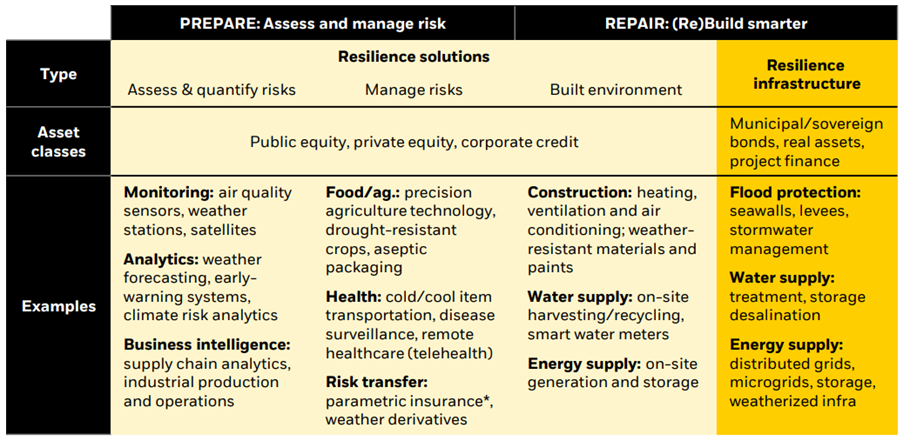

Christopher Kaminker, head of sustainable research and analytics, said climate resilience is an emerging (although underappreciated) investment theme. Companies with products and services that help society prepare for, adapt to and withstand climate hazards are an attractive investment opportunity, he explained.

“Solutions such as early monitoring systems to predict floods or retrofitting buildings to better withstand extreme weather make the technology and industrial sectors standout to us,” he said.

As the cost of damages from climate-related disasters increases, demand for climate resilience solutions will increase. “Case in point: demand for home air-filtration appliances in the northeastern US spiked during the Canadian wildfires in early 2023,” Kaminker said.

“We see investment opportunities in resilience solutions spanning sectors, including some subsectors underrepresented in typical transition exposures – such as healthcare, water utilities and professional services. We believe there are opportunities to invest in climate resilience solutions across public and private equity and debt,” he explained.

A further element of climate resilience involves rebuilding physical infrastructure after climate-related damages, as the table below shows.

Investing in climate resilience

Source: BlackRock Investment Institute, Aladdin Sustainability Analytics

Emerging markets are bearing the brunt of extreme weather events so have greater need of climate resilience, but have struggled to raise money both to adapt to the impact of climate change and to finance the low carbon transition. Investment is lower than in developed markets due to higher perceived risk and thus a higher cost of capital.

“We think closing the financing gap would require significant public sector reforms and private sector innovation, resulting in greater ‘blending’ of public and private capital,” Kaminker explained.

BlackRock estimates that emerging markets will account for over half of energy demand and carbon emissions by 2050. “We think successful reforms could see low-carbon investment in emerging markets rise on average by a further $200bn a year – or $4trn overall – above our base view of a major increase in investment between 2030-2050,” he said.

Kaminker expects policy to drive demand for renewable energy in developed markets as well. “Countries at COP28 look poised to agree to a goal to triple renewable energy capacity by 2030. We think further policy support may make the goal achievable,” he concluded.