Investors should be positioned for a hard recession, as a lot of the enthusiasm currently found in the market is based on unsustainable, transitory trends that will reverse soon, according to Mike Riddell, manager of the Allianz Strategic Bond fund.

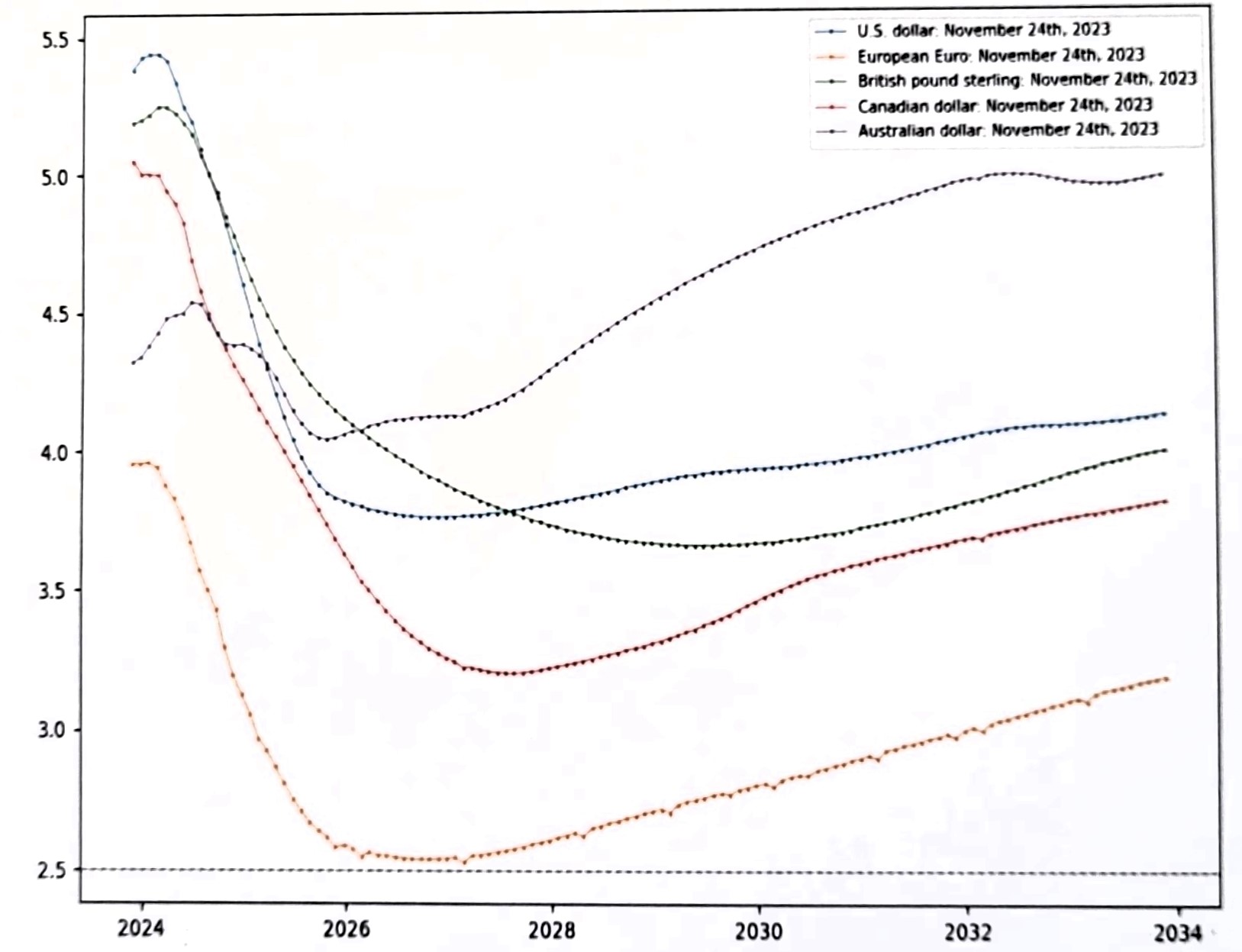

Today, the most subscribed-to monetary policy narrative for the year ahead is “higher-for-longer”, whereby interest rates should remain elevated for a long time. Markets expect interest rates to never go below 4% in the US and the UK, as shown in the chart below.

Market-implied forward overnight rates, monthly for the next 10 years

Source: Allianz, Bloomberg

At the same time, however – and this is where the contradictions begin – markets are expecting lower inflation rates.

“These two things can only be consistent if global economic growth accelerates, which is what is priced in by risk assets right now,” said Riddell.

“I was looking yesterday in horror at the S&P 500 index. It is about 3% off the all-time high right now. Which just seems wrong, taking recession risk into account. No one is expecting a hard landing or worse as a base case, and that is definitely our view.”

Google searches for ‘no landing’ or ‘soft landing’ are “just going crazy”, as everyone is assuming there will not be a recession, whether it's a no landing or soft landing.

But what people keep forgetting is that it takes 12 to 18 months before the impact of interest-rate hikes is felt by the economy, said Riddell, who added: “If interest rates are slightly lower than what is priced in, that's extremely positive for bonds”.

“Soft landings don't really exist. It's either no landing or a hard landing, there's not normally anything in the middle.”

So why are we going through a high-growth patch and why are people expecting this to continue? Riddell mainly attributes this to commodity prices.

“Nothing has structurally changed to sustain high growth, not the labour market, not corporate investment nor artificial intelligence (AI). Commodity prices are a really big part of this story,” he said.

“European gas prices are currently 75% to 80% lower than where they were in August of last year. This is one of the biggest positive economic shocks we have ever seen. The Bank of England earlier this year upgraded its GDP growth forecast by the most in its history, just because gas prices collapsed.”

This is “an enormous positive growth tailwind”, as commodity prices tend to be good lead indicators for economic growth about six months in advance. But looking forward, gas and commodity prices are basically flat.

“It's not yet a headwind, but it definitely isn't good news,” the Allianz Strategic Bond fund noted.

Under closer scrutiny, global growth doesn’t look as strong as people think either.

“The US consumer has gone completely bonkers between the beginning of July and about September. Their disposable income's gone lower but consumption has soared. This is not sustainable in any way and will reverse,” he said.

“This side of the pond, the UK economy today has felt about a quarter of the tightening cycle which started in December 2021. People look at the growth in the past nine months and assume that interest rates don't matter anymore because growth is okay and the global economy is immune to rate hikes. I could not disagree with that more.”

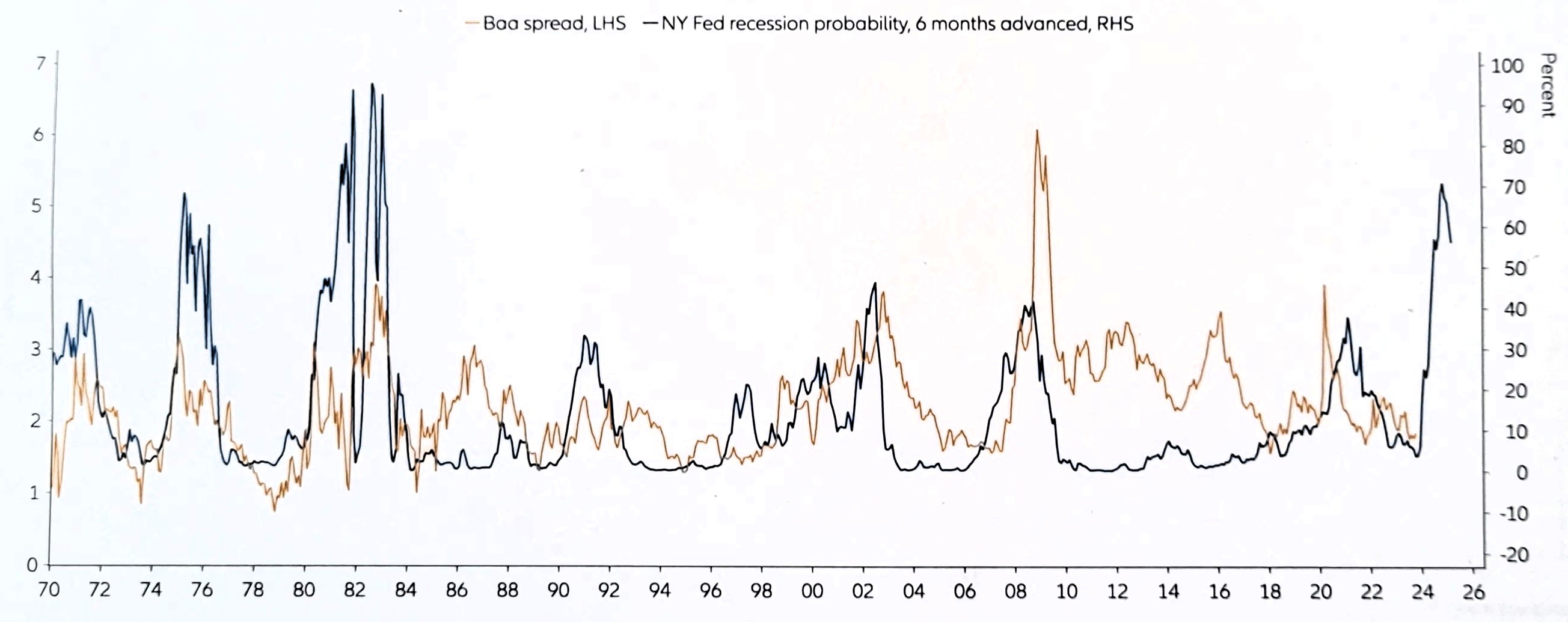

The cherry on top of the pessimism cake is the New York Federal Reserve’s recession probability model shown below, where the blue line indicates the probability of a recession 12 months ahead and the yellow line credit spreads.

Credit spreads versus New York Federal Reserve recession probability Source: Allianz, Bloomberg, Moody’s.

Source: Allianz, Bloomberg, Moody’s.

“The model is based entirely on the shape of the yield curve, which has been one of the most successful indicators of recession that we've ever seen. There's only been one false positive in the late 60s, when the yield curve inverted and there wasn't recession. Otherwise every single recession has been preceded by an inverted curve,” explained Riddell.

“The US yield curve has been inverted for the longest period in history, so this seems entirely the wrong time to be pricing in a no landing narrative into markets, given what is likely to happen in the next six months.”

In terms of how this should translate into portfolios, Riddell “adores” government bonds, where he has maximised his exposure, and takes as long-duration positions as he can within the Allianz fixed-income mandates.

He is also “outright short” on credit because “spreads will widen, potentially aggressively, and we can actually make money out of that”.