Asia Dragon Trust effectively absorbed its now former stablemate New Dawn last month, with the combination of the two abrdn Asian portfolios forming the second largest portfolio in the IT Asia Pacific sector. After the merger, Asia Dragon Trust has been promoted to the FTSE 250 and boasts a market capitalisation of £568.4m.

Perhaps more importantly for investors, the merger means that the trust has now more flexibility with its investment mandate and can now take non-benchmark positions up to 30% of the portfolio.

As a result, it has built positions in the Netherlands, with semiconductor companies ASM International and ASML.

Pruksa Iamthongthong, senior investment director at Asia Dragon Trust, said: “That was really because of the valuation opportunity, but the mandate of the trust remains the same. To be eligible for the portfolio, the contribution from Asia to a company’s revenue has to be more than 50%.”

Asia Dragon Trust also retained some Australian holdings from New Dawn, such as healthcare businesses CSL and Cochlear, energy company Woodside and mining firm BHP, with Iamthongthong highlighting that the exposure to Australian commodities is an indirect China play.

A byproduct of the merger is that the trust’s allocation to India has moved from slightly overweight to slightly underweight relative to the MSCI AC Asia ex Japan index, although Indian equities have performed well this year across different sectors.

Among Asia Dragon Trust’s Indian holdings, Power Grid Corporation of India has been the top performing name this year.

Iamthongthong explained: “You might think that utility companies have no growth, but that's not the case for this one. The theory behind it is quite simple: as the ‘Make in India’ initiative is finally taking off, India needs more power, more energy and a better mix of renewable energy.

“That means there is a need for more investment into the grid. That's a simple thesis and that has done quite well for us this year.”

Iamthongthong also mentioned SBI Life Insurance, Maruti Suzuki and Larsen & Toubro as other Indian holdings that have done well this year.

Unlike India, China has been a disappointment for Asia Dragon Trust. In fact, Iamthongthong was hopeful that Chinese equities would rebound in the second half of 2023 or early 2024, but the economic environment in China has worsened since then with further upheavals in the property sector among others.

This has been detrimental to the trust’s performance as China is the biggest geographical exposure in the portfolio.

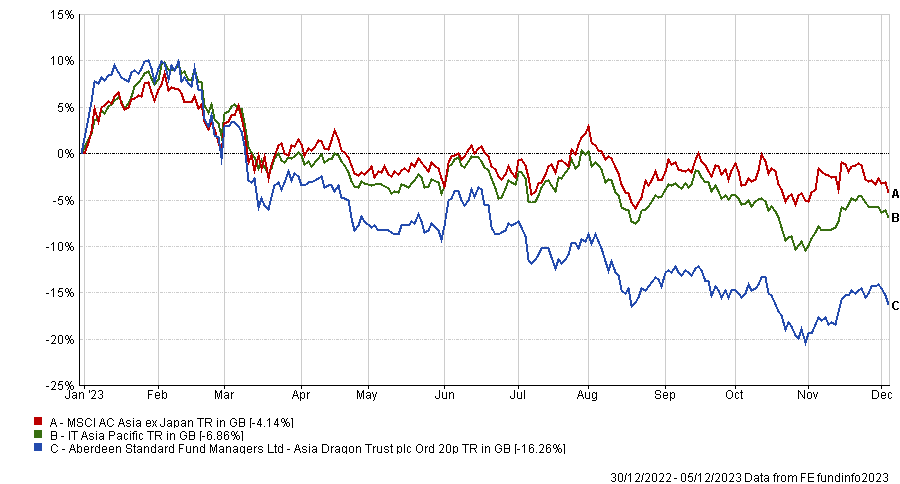

Performance of the trust YTD vs sector and benchmark

Source: FE Analytics

Iamthongthong said: “It has been disappointing because the savings that have been accumulated throughout Covid did not get spent like in developed markets. Broadly speaking, consumer confidence remains weak, but the government has been more active in putting through some measures to support economic growth and stabilise the property market since the summer.

“The market is disappointed that we have not seen any big bank stimulus from the government. We are not expecting this to happen, but we are waiting for the cumulative effects of the various policies that have been implemented since August to start to come through.”

While she remains confident on China’s fundamentals and considers that things are moving in the right direction, Iamthongthong conceded, nonetheless, that it is hard to assess how long it will take for consumer confidence to improve.

Therefore, the trust has concentrated its China exposure towards names with the highest earnings visibility. Conversely, it has exited companies that are going through cyclical weaknesses or changes that might impact the investment team’s long-term thesis.

Iamthongthong concluded: “The long-term fundamental growth opportunity in China remains the same. Even though the much expected consumer recovery hasn’t come through this year, we do think that is a cyclical and not a structural change.

“Structural growth drivers such as long-term consumption upgrade and the growth of the middle class remain intact.”