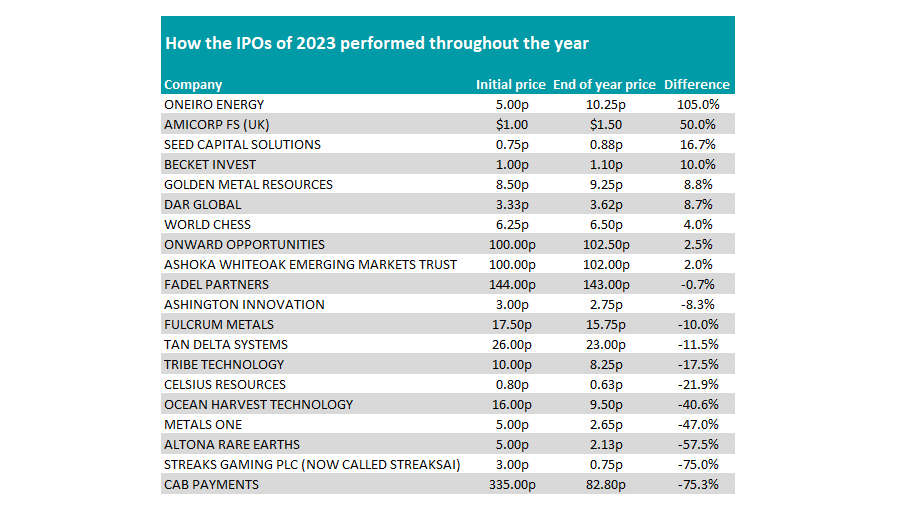

Investors who backed newly listed stocks in 2023 would have lost money as a tough backdrop meant there were few success stories among initial public offerings (IPOs), according to data from AJ Bell.

It follows on from a disappointing 2022, when 42 new names were added to the London markets, although last year was even softer, with just 20 companies braving listing.

Of the stocks to list on the UK main market and AIM last year, just nine made a positive return, while the average return among the group was an 8% loss.

Dan Coatsworth, investment analyst at AJ Bell, said: “Market conditions were not conducive to IPOs in 2023. Risk appetite was weak amid the sharp rise in interest rates and high inflation so companies hoping to float needed to offer something special to win support from new investors.

“In more difficult market conditions, the promise of generous dividends might have done the trick, but that strategy didn’t work last year as investors could easily find 5% to 6% interest on cash savings accounts.”

The top performer was Oneiro Energy, which doubled investors’ money based on the difference between the original listing price and the closing price at the end of 2023.

“It is looking to do deals in the energy sector. It is quite common to see investors bid up cash shells – also known as SPACs or Special Purpose Acquisition Companies – in anticipation they might find a great deal. This euphoria oftens dies down when a deal is struck,” Coatsworth said.

Source: AJ Bell

Meanwhile, at the foot of the table, CAB Payments was the joint worst performing London IPO in 2023 following a major profit warning soon after floating.

“Advisers often tell companies it is vital they under-promise and over-deliver in the first year of being a listed entity otherwise their reputation will be in shatters. CAB Payments clearly didn’t get the memo,” he noted.

There were two investment trusts launched in 2023, with Ashoka WhiteOak Emerging Markets Trust listing on the London Stock Exchange and raising £30.5m and Onward Opportunities listing on AIM in March and raising £12.8m. They made 3% and 3% respectively by the end of the year.

Some have written that many companies thinking of a UK listing are looking overseas instead. Part of the reason for this is the performance of the UK market, which has lagged international peers since the Brexit referendum in 2016.

By choosing to list abroad, companies can get premium share prices and a much easier route to capital, while the home market is a tougher sell, particularly with international investors.

In March last year, Simon Gergel, manager of the Merchants Trust, told Trustnet many were considering the US, as the payout upon listing was much more attractive, while some incumbent FTSE name were also considering a switch as “many businesses want to get a higher valuation”.

However, not all see this as an issue. Fidelity’s Alex Wright told Trustnet in November he was not concerned by the phenomenon: “There is a gnashing of teeth about this, with people asking why those companies are relisting in the US. It's incredibly clear why they are doing this. That’s because the US market is fundamentally overvalued. Why wouldn't you want your company to get the wrong share price on the upside?”